If 2019 was the year of unfettered risk appetite the start of 2020 has reintroduced volatility back into the market. Several exogenous shocks have put the brakes on the otherwise uninterrupted rise in risk assets. January was a battle

between relatively constructive macroeconomic sentiment (Phase-One trade optimism, improving macro data) and exogenous shocks such as a flare-up in Iranian-U.S. conflict and the novel Coronavirus outbreak. Markets rebounded quickly from the former

and are showing surprising strength in the face of the latter (equities gave up gains in late January but rallied in early February). Coronavirus fears had the largest impact on emerging markets and economies closely tied to Chinese GDP growth

while U.S., Canadian and European spreads widened (EM corporate sold off by ~25 bps in hard currency terms versus 7 bps for U.S. credit) but generally re-tightened in the first few trading days of February.

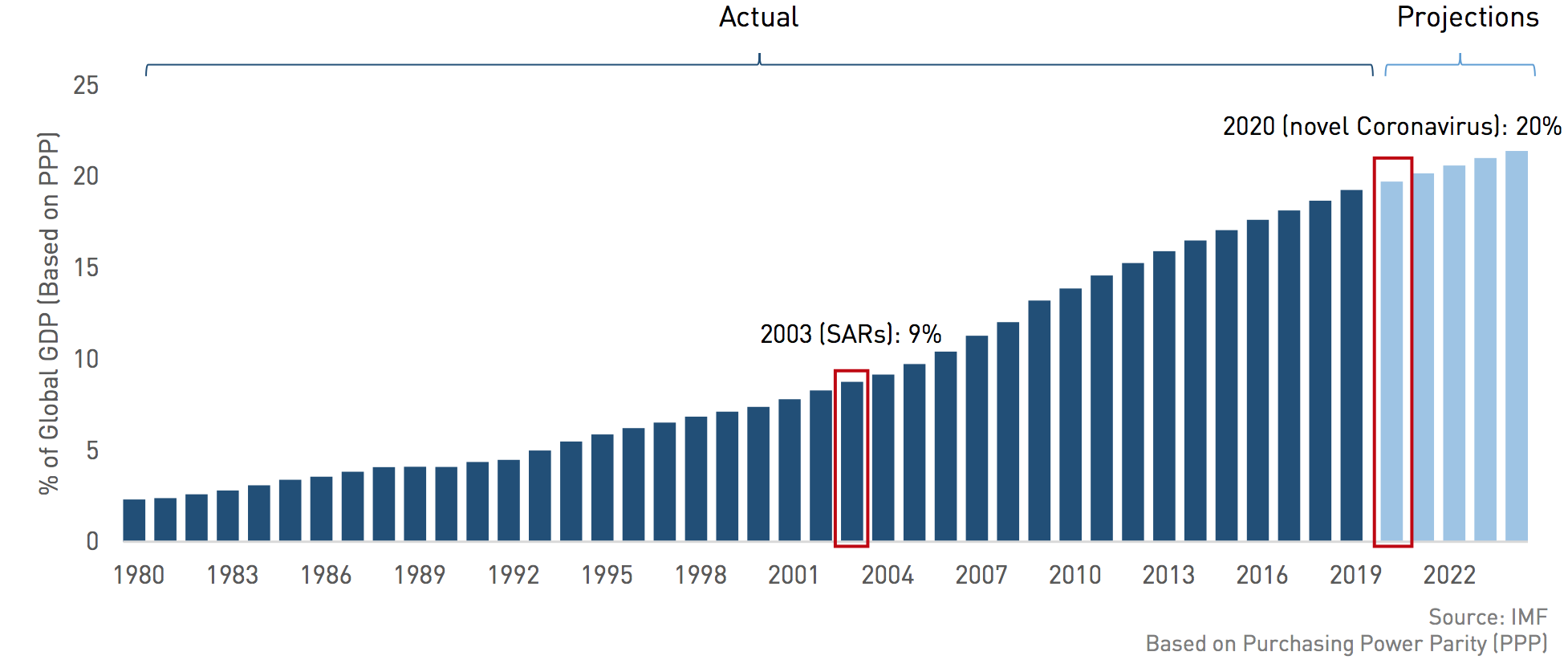

We are monitoring the situation closely, recognizing the key similarities and differences between today’s situation and past outbreaks. Most importantly, we are cognizant that China represents a larger percentage of global GDP

versus prior periods (such as SARs in 2003). Therefore, even an identical repeat of past outbreaks may have larger knock-on effects in the U.S., Europe and Canada. For our Credit Analysts and Portfolio Managers these events mean re-assessing risk

in light of our exposure to Chinese-based supply chains and sensitivity to Chinese growth going forward. We do not invest in emerging markets and China directly but will continue to monitor flow-through effects from any disruption in Chinese output as it impacts the developed markets and economies that we do invest in.

While Applying Past Scenarios to Monitor This Outbreak, We Are Also Conscious of China's Larger Role in the Global Economy.

Outside of the macroeconomic backdrop we continue to see bond market trends that lead to “technical” opportunities to extract value. “Technicals” in this context refers to supply/demand dynamics which make

certain subsets of the corporate bond market look attractive despite overall low yields and tight spread levels. One technical factor that continues to drive corporate bond performance, despite relatively lofty valuations, is lower “organic”

net issuance expected in 2020. Organic issuance takes into account new bonds issued against those which mature (or are redeemed) and those bonds which enter or drop out of certain segments of the market due to ratings changes. This more wholesome

picture of the supply side of corporate bond markets suggests 2020 investment grade issuance could come in lower than previous years. With lower supply and continued demand, this technical factor suggests that spreads could remain range bound/move

tighter despite starting at tight levels in January. This trend gives us further confidence in sizing our positions in high conviction issuers knowing that the technical of demand versus supply remains in our favour.

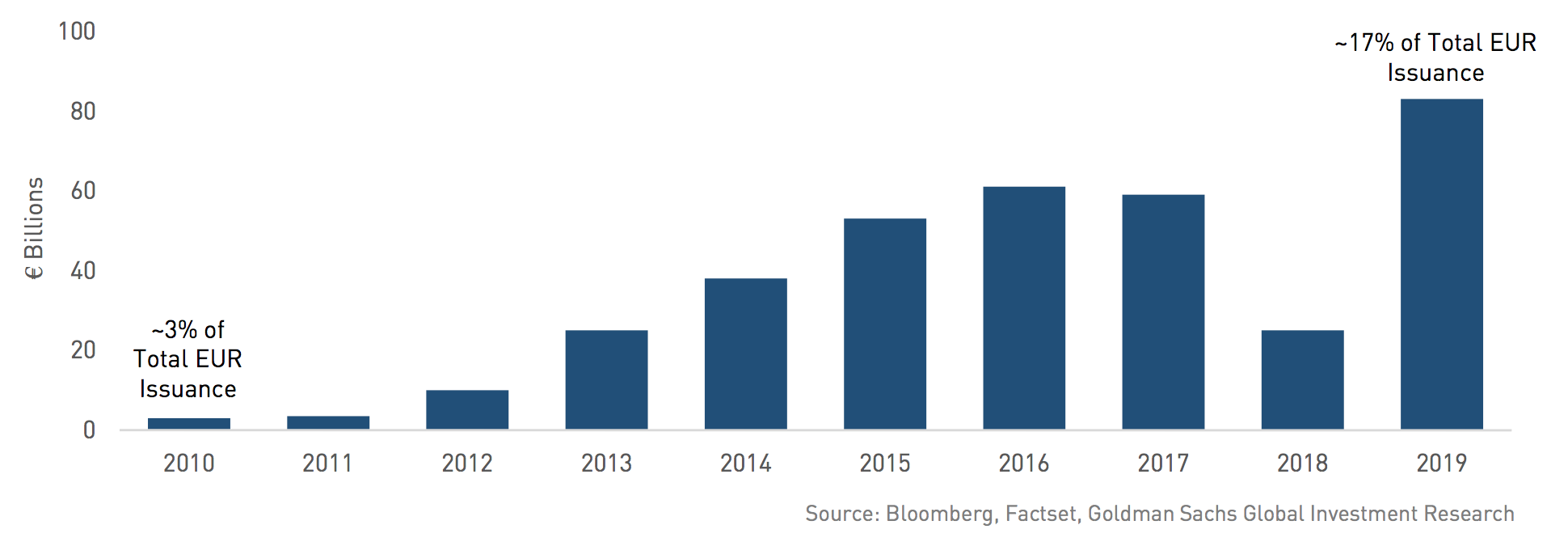

Another example of a “technical” in 2020 that we have used to our advantage is the changing composition of markets – in this case the growth of the Reverse Yankee market. Reverse Yankee issuance is simply “bond-

speak” for U.S. corporations issuing bonds denominated in Euros. In 2019 and into 2020 we have seen a considerable uptick in Reverse Yankee activity as U.S. corporations chase the low funding costs to be found in Europe. In 2019 Reverse

Yankee bonds represented a substantial 17% of European bond market new issuance - a level we have not seen since 2016 and far above the 3% of total issuance these bonds represented back in 2010. This ties into our previous comment on lower issuance

in the U.S.-dollar market with more U.S. issuers turning to finance some of their balance sheet in the Eurozone, bringing down the relative supply in the USD issues. A similar trend has occurred in Canada with Canadian banks turning to European

markets for funding.

Issuance of Euro Denominated Bonds by U.S. Corporations Grew Substantially in 2019.

This trend has provided opportunities for all our strategies as we aim to express our view on issuers through the best value available in the market at any given time. In this case we have been able to buy U.S. and Canadian issuers’

bonds in the Reverse Yankee market capturing the additional yield that comes when hedging those holdings back to CAD. This includes the likes of large, investment grade corporations such as Comcast, Dow Chemical, Citi Group, RBC, New York Life,

Coca-Cola, Colgate and IBM. Not only can we can add value/protect capital by identifying issuers that have strong fundamentals, but we can also earn an additional yield by expressing our views through the best relative value – in this case

the EUR-issued version of these bonds.

With corporate bond spreads sitting at relatively tight levels going into 2020 we think following the “technicals” will differentiate us from more traditional strategies to extract added value in areas often overlooked by others. Given high valuations and increased volatility, keeping it technical could be the key to success.

Important Information