RPIA Business Continuity Note

We wish to reassure our clients that we have a robust Business Continuity Plan (“BCP”) that provides for many scenarios, including the current potential threat posed by COVID-19. This BCP is tested regularly for exactly this situation. We have implemented a rotating “work from home” protocol for all teams within the organization. We plan to continue this protocol for the foreseeable future. Our approach has been designed to strike the optimal balance between maintaining the cohesiveness of the firm with ensuring business continuity. We continue to monitor the threat posed by COVID-19 and will respond accordingly as circumstances change. We are confident in our ability to continue operations in a seamless fashion should our BCP need to be rolled out on a broader basis. Please don’t hesitate to contact us if you require more detail or would like to discuss this further.

Coming into February, COVID-19 was a mounting concern, but market reactions were muted as the epidemic remained relatively localized within China. While supply chain shocks weighed on investors’ minds, equity and rates markets were not pricing in a substantial economic slowdown. However, by mid-February, all of this changed as we began to see COVID-19 spread faster in countries outside of China. Market participants quickly realized that countries facing quarantines and travel bans could see significant drops in economic output and consumption. We have written in previous letters about the consumer’s key role in extending the current economic cycle. The spread of COVID-19 across the globe now threatens the consumer’s vital role in global economies. If populations curtail normal activities due to lock-downs (or simply out of fear) then one of the largest pillars of developed market economies, may no longer be able to carry GDP on their shoulders.

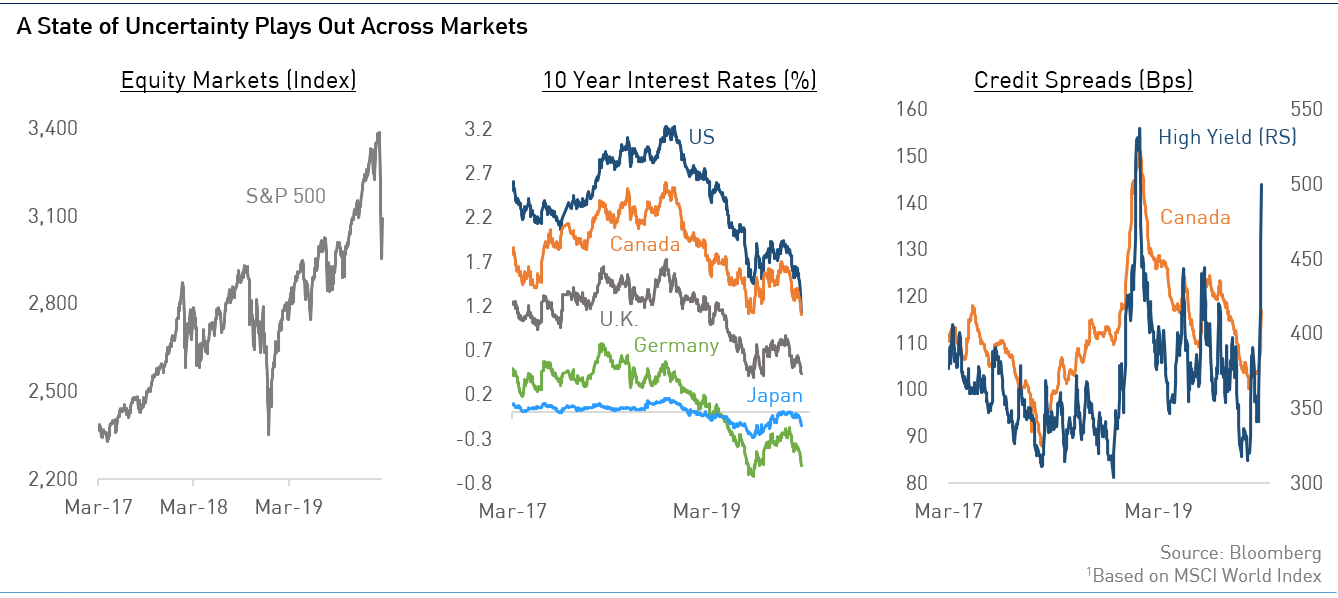

Pricing in a higher probability of consumer-led economic slowdown had material impacts on capital markets. Developed market equities1 ended the month down over 8% and commodities saw continued weakness. Bond markets began to price aggressive central bank easing with the 10-year U.S. Treasury hitting a low of 1.1% (with further extension below 1% early March – unseen territory in terms of interest rates). Analysts are now revisiting whether interest rates could go negative in North America. Corporate bonds were not immune to this sell-off with spreads moving considerably wider regardless of sector or credit quality. Overall, February was a classic “risk-off ” market with indiscriminate selling and fear driving performance of all assets.

We are cognizant of the uncertainty that the COVID -19 virus poses for markets. Unlike past financial-based crises the current situation presents many unknowns in terms of global spread, length of time before the virus subsides and the short-and-long-term economic impacts to a highly interconnected global economy. In this state of uncertainty it is not prudent to take outsized risk and we believe conservative positioning is still the right posture for all of our portfolios. This means maintaining hedges where applicable and rotating up in quality. We have done

this within many of our positions, selling subordinated debt in favour of senior debt and focusing on shorter-term holdings. We also continue to focus on owning higher liquidity bonds which will allow us to quickly change positioning as situations

develop.

From a fundamental standpoint we have taken the time to re-assess all positions across all the portfolios. We have revisited our original investment thesis and re-tested our beliefs based on future stressed scenarios. We do this to ensure

the companies we own have necessary balance sheet liquidity to weather both a short-and-longer-term economic slowdown.

We want to remind you that periods of volatility also present opportunities. Despite the extent of this month’s moves we are still finding areas where opportunities exist. While we are not adding considerable risk in the portfolios,

we are finding selective compelling opportunities to put capital to work in a highly risk-controlled fashion. These instances of mis-pricing of risk have occurred because many market participants have been forced to de-risk considerably and raise

cash. These inefficiencies present an opportunity for us as we maintain our dynamic investment style.

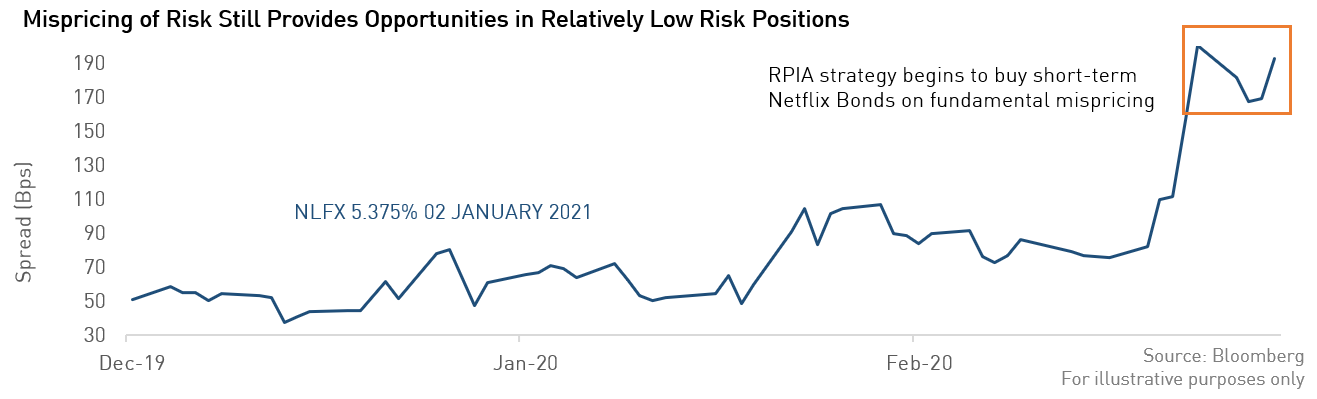

A case in point is Netflix 2021 bonds which saw increased selling pressure from high yield ETF’s and mutual funds who were forced to raise cash and were quick to sell anything which had high liquidity. The Netflix 2021 bonds saw

spreads move out to 280 bps (from ~50 bps) at the time of writing despite having only 10 months to maturity, a $165 billion equity market cap and nearly $5 billion of cash on the balance sheet. Versus the weakness in the bonds, Netflix equity has

performed well through the most recent volatility, reflecting the company’s relative insulation from the current virus impact (because a fearful population staying home would benefit the company). Despite the short-term nature of the bond, Netflix’s

BB rating has limited the amount of “natural buyers” available to absorb the selling from high yield funds. Constrained investment grade and money market managers who cannot buy anything rated below BBB cannot capitalize on such an opportunity.

However, we have the credit analysis capabilities available to assess risk independent of the rating agencies, the highly active style to identify such an opportunity and the focus on liquidity to quickly put capital to work, even in volatile markets.

We have added this position in the Select Opportunities strategy.

In our view, the market environment remains highly uncertain. As volatility persists, we will continue to focus on preserving capital. The core team at the firm have managed risk through volatile periods in the past and will use their skill and judgement to ensure we are putting our clients’ interests first. We understand that today’s state of uncertainty raises many questions about where markets are heading and how we are positioned for that outlook. We encourage you to reach out to your RPIA representative if you have any questions. We would welcome the opportunity to discuss any concerns that you may have.