Executive Summary

- Markets rebounded strongly in April as investors digested the willingness of central banks to backstop credit markets through extraordinary measures.

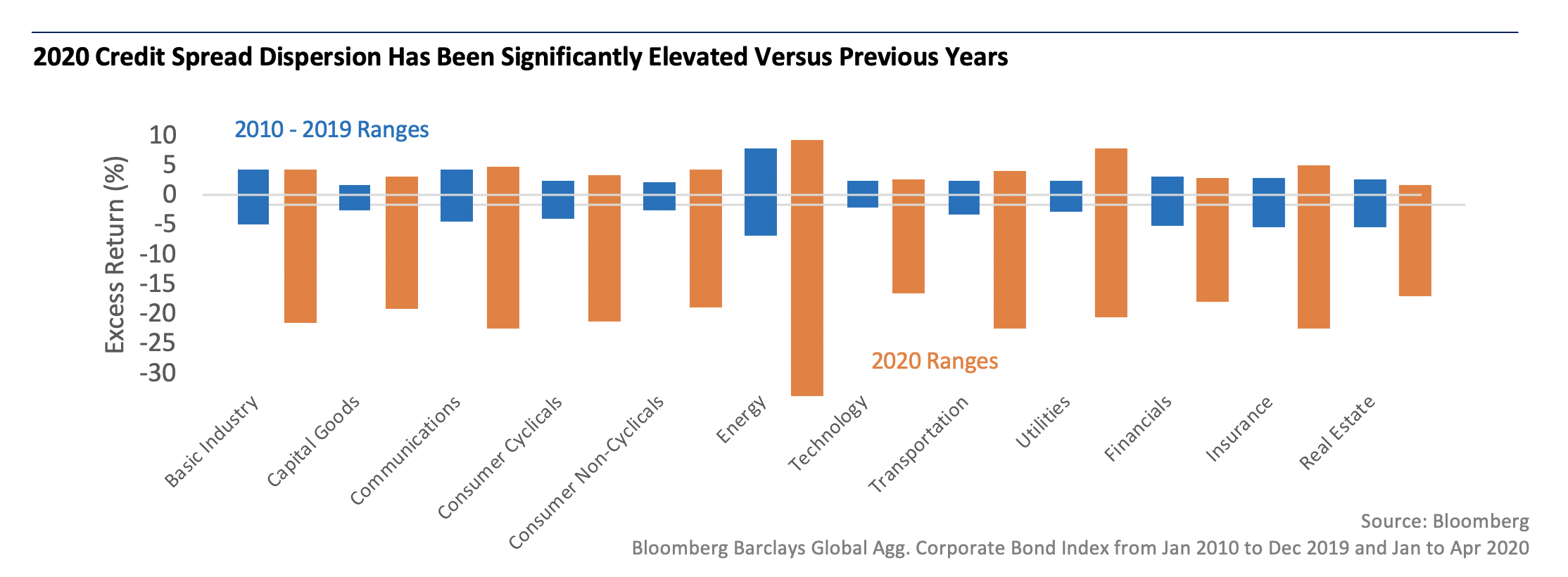

- Although credit spreads have (on average) retraced a significant portion of March’s moves, there is significant dispersion in performance across sectors and companies, presenting interesting opportunities.

- Given the uncertain outlook, we continue to believe the return outlook for credit is attractive – both on an outright basis and on a risk-adjusted basis versus government bonds and equities.

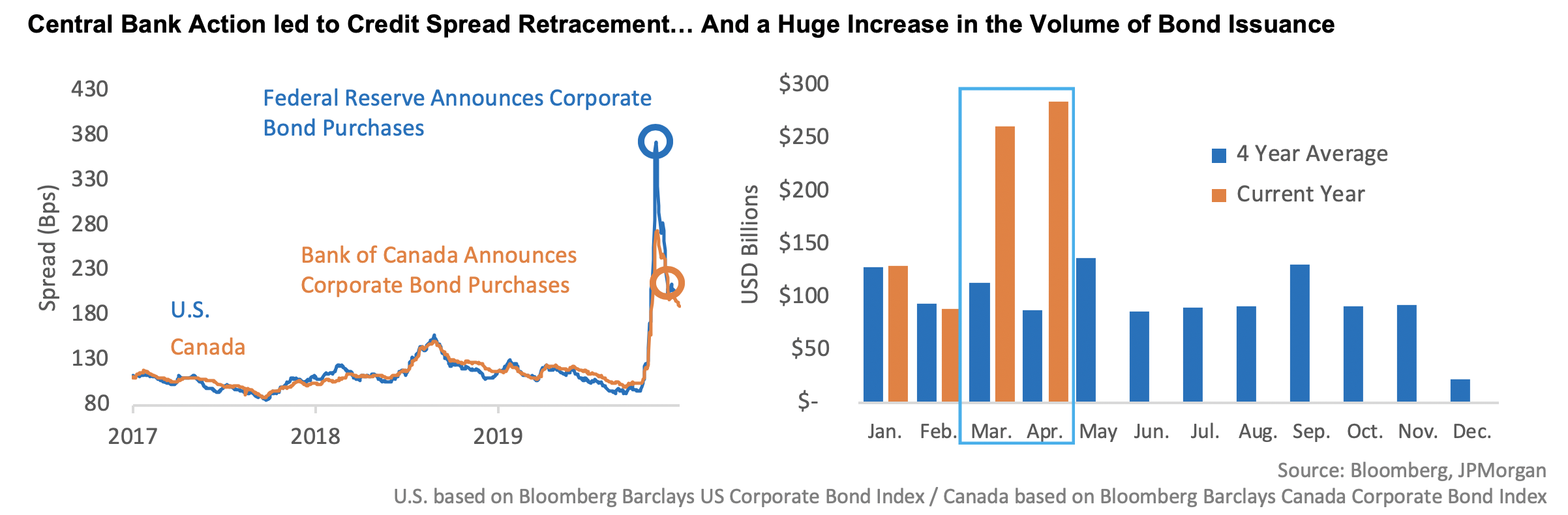

During April, financial markets rebounded strongly, with equities posting their best month since 1987. Corporate bond markets also posted positive returns as credit spreads retraced a significant portion of their March moves. While many countries seem to have succeeded in “flattening the COVID curve” the economic impact of the pandemic has been severe and remains somewhat unclear. Discussion of a “V” shaped recovery has evolved into talk of a “U” shaped recovery or even a “checkmark” shaped recovery. In spite of this uncertain outlook, financial markets rebounded significantly as investors digested the willingness of central banks to backstop credit markets through extraordinary measures. It is impressive that the Federal Reserve (“Fed”) was able to achieve this material change in credit conditions without actually having to buy a single corporate bond. The expectation is that the Fed program will ramp up in the coming weeks and months – starting with bond ETFs and then moving onto individual securities.

The Federal Reserve “backstop” has meant companies are able to issue debt in the market again – and they have definitely been active in doing that! April was a record-breaking month in the US with issuance up 85% year-over-year and the trend has continued in May to date. There was also a significant volume of issuance in the Canadian market. In recent weeks, details have emerged that the Fed’s bond-buying program will be more selective on an issuer-specific basis than that implemented in the Eurozone – where the European Central Bank targets eligible issuers on a more pro-rata basis based on debt outstanding. In the US, corporations will have to certify that they are eligible for the plans. What’s more, many companies may be concerned that there may be a stigma attached to requesting assistance, either now or at some point in the political future. As a result, companies that can issue directly in the market are doing just that. At the start of the month, new issue concessions were significant, with companies willing to pay a healthy premium to raise money. As the month wore on, new issue concessions returned to more normalized levels.

In recent weeks, we have seen credit rating agencies aggressively move ratings and/or outlooks down in response to the twin shock of oil and COVID-19. In the US market, nearly $164 billion of “fallen angel” debt has transitioned from Investment Grade into High Yield territory so far this year. The recent downgrades in the USD market have also been quite concentrated, with just three issuers out of eighteen - Occidental Petroleum, Kraft Heinz, and Ford - accounting for roughly 70% of the year-to-date fallen angel activity. Given the macro backdrop, we expect continued fallen angel situations in the coming quarters. That being said, at this point a significant amount of fallen angel activity has already been priced into BBB spreads. In some cases, BBB-rated companies are trading at cheaper levels than comparable companies that are already rated BB. In addition, the migration of companies to HY could mean investors in IG are therefore required to reallocate that money to remaining IG companies, which is another medium-term positive technical for that market. We are focused on leveraging our expertise in analyzing credit to best position our portfolios given this backdrop, and to take advantage of opportunities where we believe securities are mispriced.

From a fundamental perspective, this has been a very active earnings season so far. Many companies accessed the bond markets even before their full results were published by pre-announcing weakness toward the end of March when the lockdowns were put into place. The sentiment around the shape of the recovery in many developed countries has changed in recent weeks, with the initial positive outlook tempered by data from Asia where some countries have seen second waves of the virus and still haven’t been able to fully restart their economies. Nevertheless, we have been focusing on simplifying the portfolio, increasing exposure to sectors that are more resistant to a longer-tailed recovery in case that should prove to be the case. However, following the programs put in place by central banks to support the Investment Grade (and in some cases, High Yield) bond markets, many more companies than originally expected have been able to raise liquidity by issuing secured or unsecured debt to investors globally, reducing concerns about near-term defaults.

In spite of pressure on ratings, we have selectively increased exposure to telecom and the systemically important, large cap banking sector. The former have strong balance sheets, have been relatively unscathed by the virus, and have raised liquidity in recent weeks at very advantageous yields. The banking sector is clearly part of the solution of this crisis, and have not only been active in issuing a lot of debt to reopen the markets for other issuers, but have benefited from relaxed liquidity and capital rules by regulators for the foreseeable future as well as central bank facilities on very attractive terms, particularly in North America. Even though capital levels will deteriorate across the banking sector as companies and consumers begin to default on loans in the coming months post the debt deferral periods, the banks entered this period with the lowest levels of non-performing assets in decades and multiples of capital levels seen in the last crisis. Outside of the large US banks, we have also added to some risk in UK banks but are being very selective in European banks. While the liquidity and capital of the European banks still look solid, the headline risk around the politics and the weaker profitability metrics lead us to be more cautious in the near term, preferring to stay higher in the capital structure for the most part and extremely selective by issuer.

Elsewhere, we are monitoring the outlook given by many companies to be able to identify value if there are signs of recovery in a particular sector or company profile. Some bonds in the most badly-hit sectors such as Real Estate, Oil & Gas, Entertainment and non-bank financial sectors (among others) have rebounded somewhat from the low levels seen in mid-March, but still reflect high levels of uncertainty around the timing and length of any recovery. But it is important to acknowledge that all companies are not equal within these sectors and some have much better liquidity and earnings profiles than others – so we will continue to be vigilant around stress testing future cash flow and ability of management teams to come through this crisis in a solid way for bondholders, and make sound sector and company investments where appropriate.

Despite some credit spread tightening, from an asset allocation perspective we still believe it makes sense to allocate to credit. It is true that during April, investment grade credit spreads on average retraced around half of the move wider in March, with high yield more like 30-40%. Despite this, we believe credit spreads in general are still quite attractive – spreads are still 200 bps wide of average in IG and 750 bps wide in high yield.

As a result of these elevated credit spreads, coupons on senior debt are in many cases bigger than dividends – and are much higher than long-term averages. This is a market where we continue to think it makes sense to be senior in the capital structure. Note that the Price-to-Earnings ratio on the S&P 500 index is back to 23x which is where the index was back in October last year. With continued uncertainty about earnings and the path of COVID-recovery, we anticipate that the equity market will remain volatile, but as liquidity is replenished at many companies, credit should be the more stable asset class overall.

There has been significant dispersion in performance within credit – meaning plenty of opportunity still exists.During April, higher-rated issuers (A and above) performed significantly better than BBB-rated companies, which in turn significantly outperformed lower-rated companies. In general, larger issuers with many securities outstanding outperformed issuers with a smaller capital markets footprint. There has been significant dispersion even across sectors as investors re-assess how business models will fare in the world after (or the world with) COVID-19. Taken together, there has been elevated volatility and abundant opportunity from a security selection perspective.

Taking note of this dispersion, on average the credit spreads in our portfolios moved less than the overall market in April. This is not entirely a surprise to us – in general, we don’t focus exclusively on the biggest companies that are the most widely followed – preferring to look for underappreciated securities and companies. In our alternative funds, some of our highest conviction positions are in companies or securities where there is some complexity. This is complexity we are comfortable with, but it means these securities tend to lag somewhat in a sharp rally. As a result of this, we believe there is still significant embedded value in our portfolios. As the market stabilizes, we expect further positive performance in a number of these positions.

There are a number of positions in our portfolios that have lagged the broader move – there are even positions in the portfolio that widened in April. For example, in RP Debt Opportunities there are around 40 positions that actually saw spread widening in April. Most of these positions are in the industrials, financials or real estate sectors and the average term of such positions is just over 3yrs to maturity. We have undertaken extensive credit analysis on every credit exposure in the portfolio and have conviction in these positions. For the financial positions we own, we take confidence from central bank policy initiatives, which are in place to offset the near-term earnings headwinds from revolver drawdowns and government lending schemes as well as higher volumes in the capital markets trading arena. We also believe that some of the challenged sectors from a near-term operating perspective – such as real estate - are likely to recover as economies get moving again globally and that even a minor change for the positive in activity - coupled with government support mechanisms - could drive these spreads tighter again.

Looking forward, we believe there will continue to be uncertainty and that markets will continue to be volatile. Notwithstanding this, we still believe that the forward-looking outlook for our strategies is attractive. Thank you for your ongoing support and please don’t hesitate to reach out if you have any questions.