The ongoing conflict in Ukraine, a worrisome global inflation picture, bond yields rising at the fastest pace in decades, and flatter yield curves led key bond markets to lose between -5% to -8% during the quarter. Toward the end of March, credit spreads

partially recovered their post-Ukraine invasion losses. Equity market barometers such as the S&P 500 and Nasdaq also retraced some of the year-to-date losses and finished the quarter down -5% and -9%, respectively.

Our focus remains on the significant near-term risk catalysts, including a further escalation in the European conflict, more economic disruptions from COVID-19, or a move away from globalization. Moreover, these same issues are increasingly leading to

longer fused and potentially persistent inflation risks from further supply chain disruptions, higher energy prices, and a permanently fragmented world economy.

Bond Yields Surging on Anticipated Central Bank Hikes

To combat longer-term risks, Canadian and U.S. central banks continue to telegraph their plan to aggressively raise rates and utilize other monetary policy measures to rein in inflation expectations. In addition to rate hikes, the U.S. Federal Reserve

will begin reducing its nearly $9 trillion balance sheet by $95 million per month to draw liquidity out of capital markets and expedite the fight against inflationary forces.

As a result, borrowing costs and bond yields have moved higher in anticipation. For example, one year ago, the yield on Canadian and U.S. 2-year notes was 0.22% and 0.16%; by the end of Q1, these yields had risen to nearly 2.27% and 2.28%, respectively.

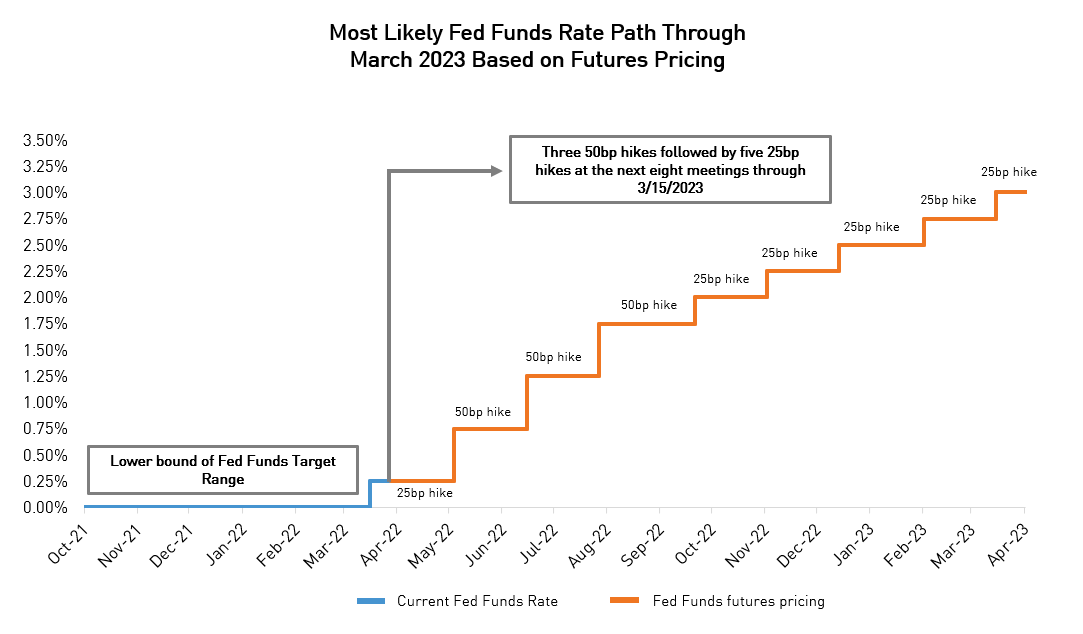

The market continues to price in and adjust its expectations of rate hikes on a daily basis. Currently, the terminal Fed Funds Rate by March 2023 is expected to be 3.0%. On the path to this rate, the market has begun indicating that we could see two or three consecutive +50bp rate hikes in the upcoming May, June, and July meetings this year. But the question remains – will the Federal Reserve have the resolve to carry out so many rate hikes, and if it does, can it avoid triggering a recession

Ultimately, the answer will not be apparent until the cards are played. Still, many market strategists believe that a mild and short-lived recession could be an acceptable scenario, especially if it allows for inflation to be brought under control and

sets the stage for a longer, more stable growth cycle.

Corporate Fundamentals Remain Strong

Two years after pandemic-induced volatility led to a surge in corporate debt issuance, the balance sheets of many issuers we follow remain strong. How cash sitting on corporate balance sheets is ultimately utilized has important implications for credit

investors, making company-specific analysis and forecasting more critical than ever. Today we favour Financial, Energy Infrastructure, and Communication-related sectors, while most other industries remain neutral. The upcoming earnings season will

be very important for determining the confidence that CEOs have in the forward-looking guidance and strength of their businesses.

On the other hand, relative value opportunities have emerged from the recent market volatility and dispersion, which allows us to generate returns from more idiosyncratic market opportunities.

Rogers Communications - Capturing Relative Value Opportunities

To illustrate a new issue transaction we recently participated in, we can highlight a much-anticipated debt deal by Rogers Communications at the beginning of March. The deal came to market with approximately US$7.05bn of bonds in the USD market while

concurrently issuing C$4.25bn in its domestic market. This deal represented the largest Canadian corporate bond offering ever completed in Canada as the issuer financed its proposed acquisition of Shaw Communications. We were able to extract value

from this issue in three primary ways:

- New Issue Concession: The bonds issued came to market at a discount to other existing Rogers bonds and comparable companies within the sector after accounting for differences in term and market supply. We were able to benefit from

acquiring them at a cheaper price and in greater size versus where we would have been able to buy Rogers bonds in the secondary market.

- Relative Value Across Denominations: We initially participated in the new issue by taking a position in all CAD-denominated bonds but quickly capitalized on relative value dynamics between markets as post-deal bond performance varied

across jurisdictions as well as tenors. Following material outperformance in the CAD bonds, we took profits in the CAD 10-year position, which saw price appreciation immediately after the issue, and rotated into its USD-denominated bonds (currency

hedged), which had not yet appreciated from new issue pricing.

- Relative Value Within Issuer Term Structure: The new issue did not include any bonds with a 5-year term in CAD; however, it did include newly issued 5-year USD-denominated bonds. We added to our 5-year CAD position (post-deal) as

we saw a relative gap between the existing 5-year CAD and USD bonds after hedging for currency costs. 5-year CAD bonds appreciated after the issue (as we had hoped) and allowed us to profit from this technical market factor.

Keeping our Eye on the Future Prize

Bond markets have suffered across the board, but there is an important silver lining to this scenario. The fall in bond prices over Q1 also means it is considerably more attractive from a total return perspective going forward.

Our focus is and always has been on making money when the risk is worth taking, and our team thoroughly debates where we are on that spectrum every single day. The time for taking a more aggressive stance on rates and credit may be approaching, but in

the meantime, we are having success in targeted trades with catalysts less correlated to broad markets and protecting investors’ capital as best we can.