Executive Summary

- Q2 began the great retrace whereby financial assets have rallied significantly.

- Unprecedented monetary support is clearly buoying asset prices as the Federal Reserve began to put its balance sheet to work in corporate bond markets.

- Re-opening in the U.S. has led to some data surprises to the upside in Q2, albeit from devastating lows in Q1 – it remains to be seen if these data points are an aberration or signal a positive trend.

- We discuss two sectors where we believe there are interesting relative value opportunities - aircraft leasing and real estate.

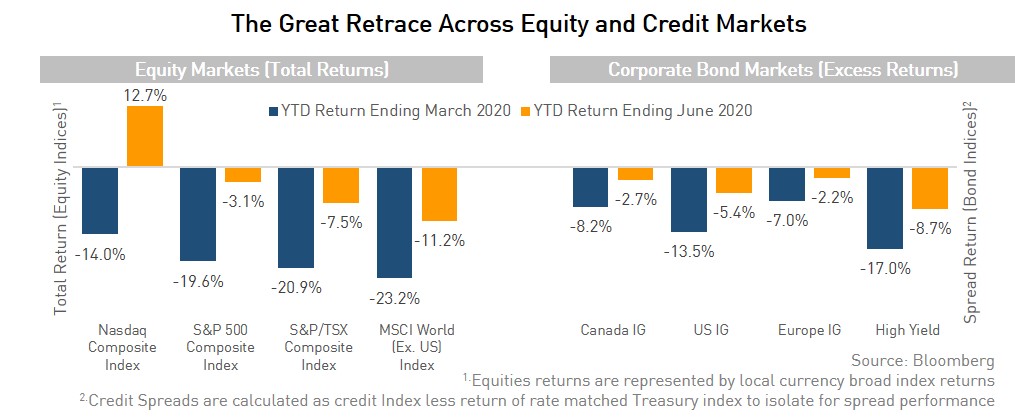

Markets posted a strong rebound in Q2 thanks to unprecedented fiscal and monetary support and the early re-opening of many U.S. states. As anticipated, the widespread lockdowns of Q1 brought financial markets and the real economy to a near standstill with record drops in economic activity. Following unprecedented central bank stimulus, financial markets rebounded strongly in Q2. Equity markets rallied ending the quarter down only marginally for the year (with the NASDAQ up an amazing 12%). Credit markets also posted strong returns with credit spreads retracing from their widest levels and are now sitting at “normal” recessionary levels. However, the question remains as to whether financial assets are too far ahead of the real economy in terms of recovery expectations.

Beyond just central bank and fiscal support, there were some glimmers of hope in the macroeconomic data which also helped fuel the quick recovery narrative. Examples included Non-Farm Payroll data in the US which went from a record setting negative reading to positive numbers that beat even the rosiest economists' expectations. Small business revenues also recovered in the quarter as U.S. small businesses re-opened, although nowhere near pre-crisis levels. The jury is still out on whether these upside surprises are signs of a sustained recovery, especially given the alarming increase in virus cases we are seeing south of the border. Rightly or wrongly, these surprises provided additional fuel to a fire that was already being stoked by promises of unlimited central bank support.

This was also the quarter that central banks began putting their balance sheets to work in corporate bond markets. This included the Federal Reserve’s (“Fed”) first foray into investment grade markets with purchases of corporate bond ETFs. The Fed’s holdings in ETFs (part of the Secondary Market Corporate Credit Facility [SMCCF]) reached $6.8B by mid-June. More importantly, the Fed revised their terms for directly purchasing secondary market corporate bonds, opting for a broad market approach rather than having individual issuers self-identify as needing Fed support. These changes now make it easier for the central bank to support wide swaths of investment grade credit markets if we were ever to revisit the illiquidity experienced in March. With the Fed’s changes, onus is no longer on individual companies to raise their hands for financial support - a requirement of the old policy that we believed would limit corporations’ willingness to use the facility. We believe this was a hurdle the Fed needed to address and the newest iteration of the SMCCF is an elegant way to solve for this problem. While not a panacea for all the unknowns that lie ahead, we believe the Fed’s latest iteration will help reduce tail-risk and has lowered the probability of revisiting the dysfunction we saw in Q1 – even if the worst economic/pandemic predictions become reality.

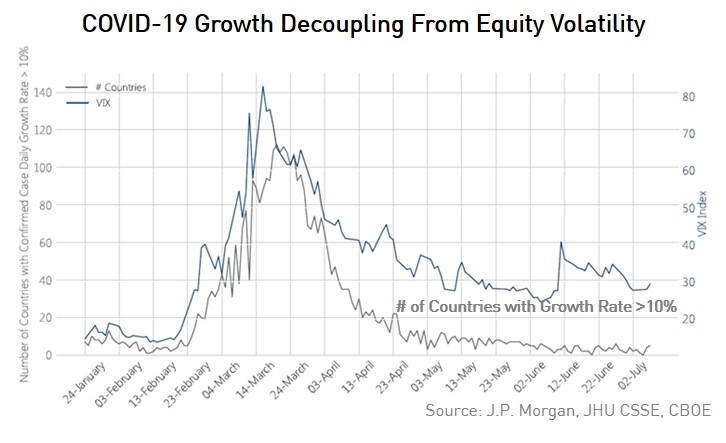

Different views around COVID-19 continue to underpin market volatility globally. While we continue to monitor expert epidemiologists’ research on future trajectories for the pandemic, we believe new cases taken alone is a misleading indicator of the potential severity of the disease. Instead, investors should focus on hospitalization rates relative to new cases, deaths to hospitalizations and, critically, using the progression of infection rates and deaths globally to infer likely trajectories for the U.S. and North America. Taken together, what is clear is that death rates relative to infection rates have reduced meaningfully (by a factor of more than 5). While the increase in new cases in the southern U.S. is certainly alarming, the burden it will put on the health system relative to the initial North Eastern hot spots of New York City and New Jersey could be materially less. There are two primary reason for this – treatments are improving, and new cases are in part due to increased testing. The proportion of new cases and hospitalizations made up of 18 to 45-year old's is increasing meaningfully. Thus, we may be experiencing better outcomes from hospitalizations – both shorter stays and lower fatalities which may have different knock-on effects for risk assets. We are reassured by the relative consensus forming around this view by financial media, statisticians and recognized epidemiologists.

There is no doubt economic activity will be curbed as “hot spots” are met with increased restrictions and this will slow the economic rebound, but we do not foresee a full nationwide lockdown like we had in the first wave.

In Q2 we quickly pivoted our exposures to sectors that would benefit from central bank support and whose business models were well positioned for the “work-from-home/social distancing” economy. This included holdings in well-capitalized Financial issuers and corporations in the Technology, Media and Telecommunication space. While we reduced Energy holdings in certain issuers which faced longer-term structural headwinds, we also saw significant retracement in the issuers we held throughout the crisis – mostly utility-like, stable credit profiles which were disproportionately hurt by the general selling pressure experienced in Q1. Looking forward, we prefer the higher liquidity of U.S. markets over Canada especially considering the normal drop in liquidity experienced during the summer months. We continue to look for businesses that benefit from central bank support and businesses that have the ability to pivot to meet COVID-style demand and in businesses that offer essential services. This includes attractive opportunities in sectors such as Financials and Telecommunications while also finding idiosyncratic opportunities in industries which have been labelled as “challenged” but whose sub-sectors offer interesting opportunities to invest in high quality issuers whose yields are clearly mispriced.

Despite the broad strength experienced across markets in Q2 we continue to find idiosyncratic opportunities within sectors that are considered “challenged” including Aircraft Leasing and Real Estate. When the pandemic hit, the airline industry faced one of the most challenging situations in their history. This reality was not lost on investors, who sold any-and-all types of bonds related to the airline industry, including aircraft leasing companies. Although we are cautious on the airline sector itself, we believe aircraft leasing companies should be analyzed like financial institutions given their lending/leasing business models. Because the market was unwilling to discern these different types of risk we found opportunity in Q2 to deploy capital into attractive investment opportunities.

Following our analysis and speaking with company management some of our strategies began to invest in the short-dated bonds of issuers such as AerCap (AER), Air Lease Corp. (AL) and Air Castle (AYR) which were offering yields of around 9%. All three issuers are BBB rated companies with USD debt and collectively represent the largest aircraft leasing companies globally. Our conclusion was that these selected issuers had enough cash to repay those short-term maturities while also retaining solid ratings in the near term. Our thesis was supported by positive activities in the new issue market with AER issuing a 5-year bond in June which was well received. This was followed by additional issuance from AL, the success of which reflected each company’s financial strength and funding flexibility despite pressures from the pandemic.

Another sector in which we have uncovered selective opportunities is real estate.Like airlines, real estate has been one of the more challenged sectors during this time – and like airlines there are sub-sectors of the real estate market that are being punished for their sector label rather than their fundamental credit strength. Our credit team screened for selective issuers with property portfolios which were focused on sub-sections of the market less impacted by the pandemic. Again, our team focused on issuers that maintained/increased defensiveness within their capital structures over the past years, positioning them well to weather the current environment. This meant avoiding challenged areas such as office-space, retail and senior residences. However, we found opportunities in certain U.S. REIT issuers who had some of the lowest leverage amongst global peers, strong balance sheets and the financial flexibility to maintain their credit strength throughout a prolonged economic slowdown.

From our research we uncovered clear beneficiaries of the secular changes that have been accelerated by COVID-19. For example, there has been an increase in demand for warehouse space from industrial companies due to the acceleration in ecommerce. We found many technology companies looking for datacenters to accommodate the increase in cloud adoption as businesses shift to work-from-home models. We have also seen consistent demand for life science facilities, medical offices and multifamily residential units.

Overall, while credit markets have experienced a significant retracement over Q2 we are still finding pockets of value through which we can both capture additional yield and returns. More importantly, we are finding such opportunities while also ensuring these businesses are sufficiently prepared for changes in the pandemic’s evolution and positioned to weather continued headwinds in the quarters to come rather than requiring a straight-line recovery from this point forward. Considering how far credit spreads have retraced, especially in investment grade markets, we continue to ensure our exposures are very selective in nature and represent a higher concentration in sub-sectors and companies which we believe are well positioned to benefit from a recovery or maintain quality if lockdowns are reintroduced. For applicable portfolios we are also maintaining hedges and other short positions to benefit if volatility in credit re-escalates. Overall, we believe our portfolios have struck the right balance going forward between these two factors.

If you have any questions or would like more information on our funds and the opportunities we see in Corporate Bonds, please reach out to our Client Portfolio Management Team at any time.