Explore Our Funds

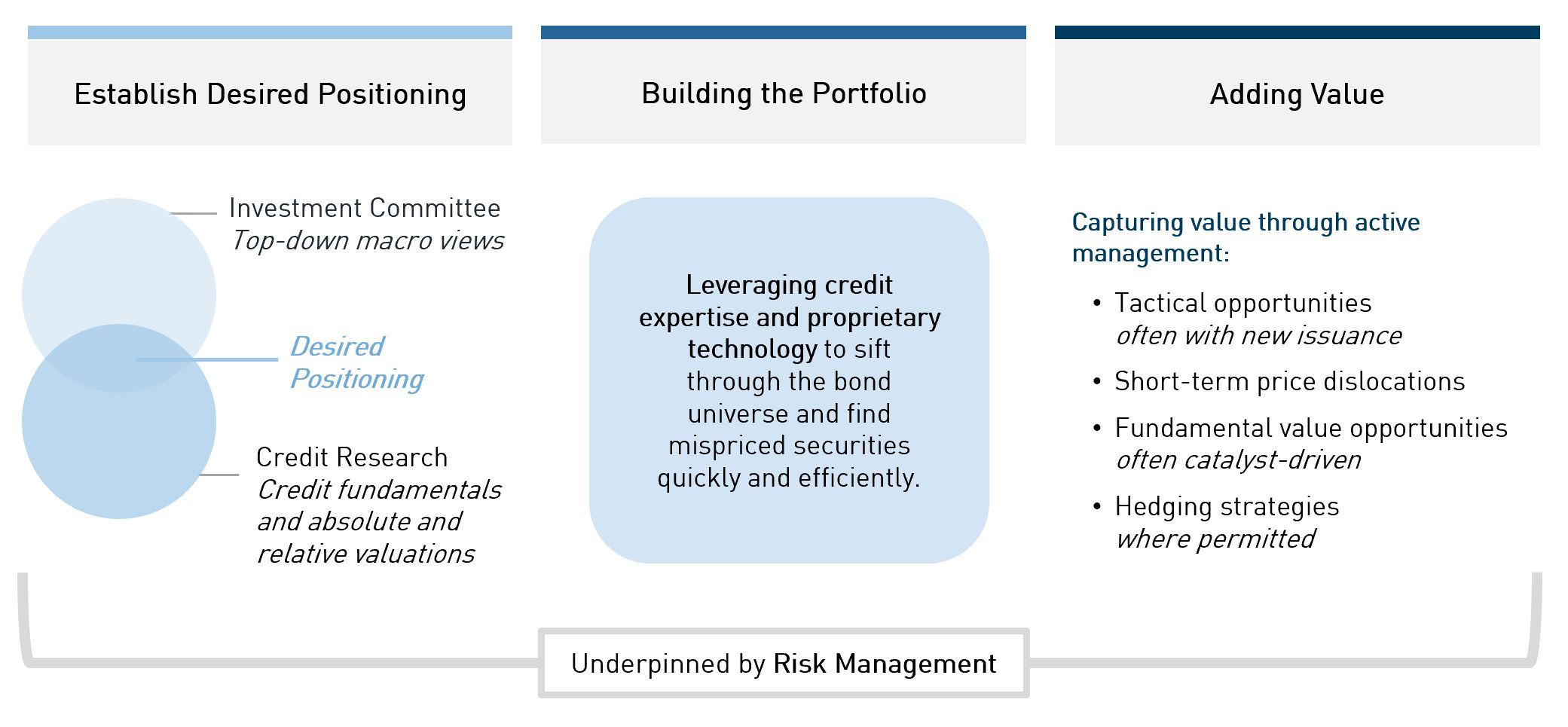

RP Broad Corporate Bond

This actively managed credit strategy's primary objective is to outperform the FTSE Canada All Corporate Bond Index net of fees in a risk-controlled manner. The strategy aims to add value through superior credit selection across global credit markets and avoid uncompensated interest rate risk by remaining duration-neutral versus the benchmark.

RP Broad Corporate Bond (Fossil Fuel Exclusion)

An actively managed credit strategy with the primary objective of outperforming the FTSE Canada All Corporate Ex Fossil Fuels Enhanced Bond Index by 100 bps (net of fees) on an annualized basis. The strategy merges our long-standing investment process with a transparent, rules-based approach to screening fossil fuel exposure out of the portfolio.

RP Fixed Income Plus

This strategy aims to generate a stable return and low volatility by investing in a portfolio of investment grade money market instruments, government bonds, and high-quality corporate bonds primarily on a long basis but with the ability to use cash-covered short positions to hedge interest rate risk. The strategy’s investment portfolio is actively managed with low sensitivity to the direction of interest rates.