Explore Our Funds

Strategy Performance

An overview of all our strategies including their performance, portfolio characteristics, and any relevant documents all in one place.

RP Strategic Income Plus Fund

RP Strategic Income Plus Fund seeks to generate stable risk-adjusted absolute returns consisting of dividends, interest income and capital gains by investing primarily in investment grade corporate debt and debt-like securities, with a focus on capital preservation.

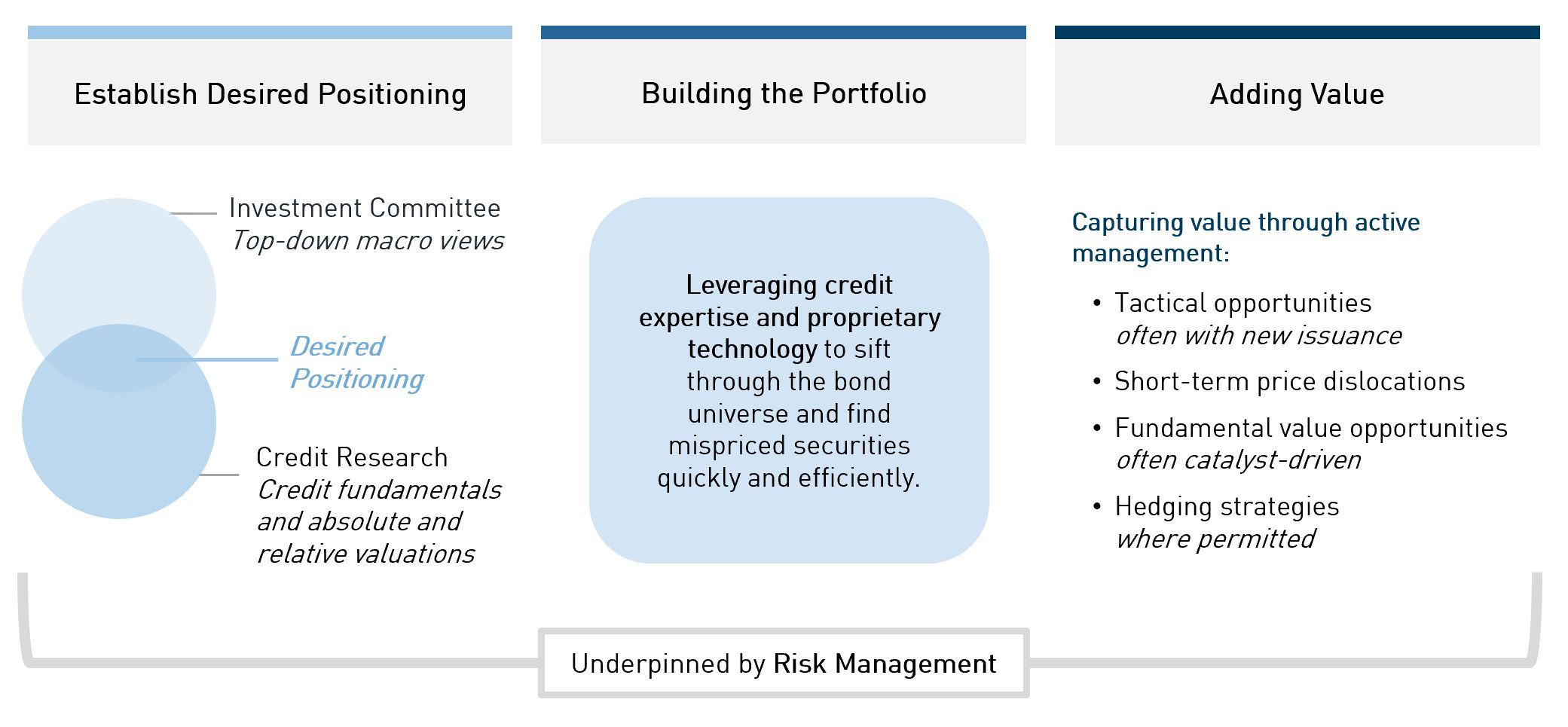

RP Alternative Global Bond Fund

RP Alternative Global Bond Fund seeks to generate attractive risk-adjusted returns with an emphasis on capital preservation. The Fund will invest primarily in investment grade debt and debt-like securities of corporations and financial institutions.

Credit Market Themes in 5 Charts

Out With a Whisper, In With a Bang

2025 in Review and What to Watch in 2026

Default Stories from Private Lenders

The Power of a Global Opportunistic Credit Strategy During Uncertain Times

Investor Education: Our Products

RP Select Opportunities (RP SOF) combines our carefully selected investment ideas with a highly active and flexible approach, delivering positive calendar returns for investors every year for almost a decade. In this video, Kripa Kapadia highlights how an unconstrained credit strategy like RP SOF can potentially enhance performance while increasing diversification and downside protection for an investment portfolio.

Calibrating Interest Rate Exposure

Investor Education: Bonds 101

Interest rates are the common factor used to discount an investment's expected future cash flows, and, therefore, they are the backbone of all asset class valuations. Consequently, a traditional investment portfolio is inherently exposed to interest rate risk in several explicit and implicit ways. In this video, Brendon provides an overview on interest rate exposures and how utilizing strategies that manage interest rate risk can provide potential benefits.

Uncovering Hidden Risks: Reinvestment Risk

Investor Education: Bonds 101

Given the rise in risk-free rates over the past few years, investors can now capture yields through high-quality bonds, GICs, or money market funds. However, although opting for shorter-term options is appealing, it's crucial to assess reinvestment risk and its long-term impact on the portfolio. In this video, Carly discusses two primary ways investors can combat reinvestment risk using an actively managed fixed income solution.

UPCOMING EVENTS

There are currently no upcoming events.