Key Takeaways

- Monetary policy, inflation concerns, and virus variants

could challenge bond returns in 2022.

- Four rate hikes are now expected in 2022, which could

put upward pressure on bond yields.

- We are entering 2022 with very low interest rate exposure (duration)

and identifying thematic opportunities related to M&A,

new issuance, COVID-impacted sectors, as well as upgrade and

downgrade candidates.

2021 was an unpredictable but also transformative year in

financial markets. We saw concerns around inflation for

the first time in decades, the emergence of new variants

of the virus, and policies from governments and central

banks that changed as often as the wind.

Nevertheless, investments in riskier asset classes such as equities and commodities were rewarded despite the

market confusion and volatility, while traditional “risk-free”

investments in government bonds were largely

negative.

2021 re-enforced the idea that investors might want to adapt their bond portfolios and highlighted how active

credit strategies could provide diversification, capital

protection and improve total return potential in this

environment.

Déjà Vu in 2022

The backdrop for 2022 is beginning to look as challenging as it was in 2021. Monetary policy and inflation concerns could again be the crucial driver of returns with the pace of economic growth and employment dictated by the path and implications of the

virus. We believe inflation will be elevated over this next year, but we do not see it getting out of control.

However, it is yet to be seen if the US Federal Reserve ("Fed") can manage inflation that is meaningfully higher than its target rate without evoking even higher inflation expectations and creating a vicious

cycle upwards of actual inflation. We are equally concerned that the Fed could increase rates too quickly in the face of inflation that turns out to be less persistent than anticipated and unintentionally

slows the economy and its recovery prospects.

Ultimately, RPIA's goal in 2022 remains familiar – limiting or minimizing undue interest rate risk for investors and focusing on providing reasonable returns through credit selection and active trading in companies and sectors that offer attractive

risk-reward characteristics.

Monetary Policy at the Forefront

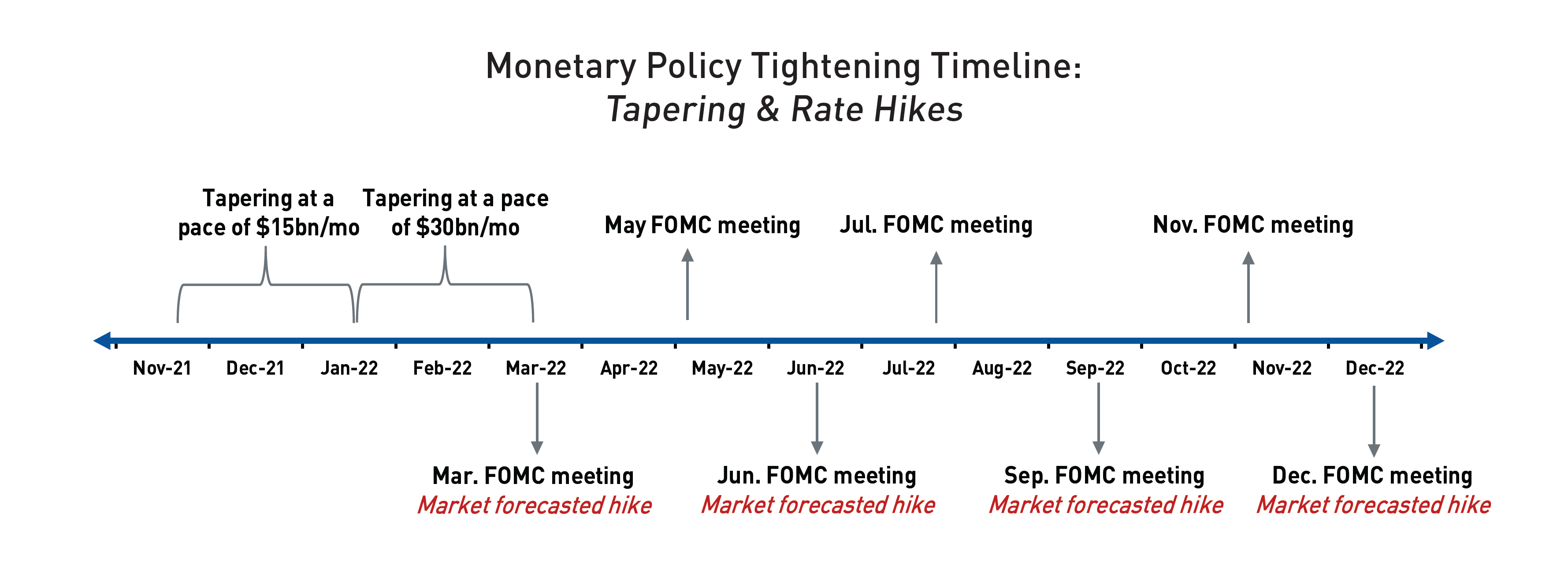

In mid-December, the Fed announced that it would slow its quantitative easing (QE) program faster than previously indicated and move forward its target to end that process to March 2022. To accomplish this goal, the Fed will double the reduction of its

asset purchases, citing elevated inflation pressures and a strengthening labor market for why the economy no longer needs increasing policy support.

One implication of a quicker end to tapering asset purchases is that markets believe it will clear the way for the beginning of rate hikes. Post-meeting, the bond futures market responded by raising its rate hike expectations in 2022 from two 25bp hikes

to three. As of writing, the market has priced in a fourth rate hike in 2022

Interestingly, the announcement did not result in increased bond yields immediately, but rather after the release of the Federal Open Market Committee meeting minutes in January. This illustrates a point we make with clients often – bond

market yields reflect a constantly moving set of probabilities and assumptions that are very difficult to predict and can be irrationally volatile.

This is a key reason we generally kept low interest-rate exposures across our funds and strategies in 2021. We will continue this course until we believe the risk-reward opportunity in rates becomes attractive again.

Currently, real bond yields (adjusted for inflation) continue to be sharply negative, and the extended term premium is not well compensated. We are fortunate to have flexibility built into many of our strategies which allows us to hedge rate risk

today. But we can also see an environment later this year after a rise in rates, where locking in higher yields could be beneficial for our investors, especially if we can minimize the downside from yields moving higher along the way.

A Selective Approach to Credit

While credit spreads rallied into the year-end and are at close to historically tight levels, we believe that there will be plenty of opportunities in the investment grade and high yield markets over the course of the year. Even though bond strategies

that rely on coupon clipping and more traditional capital appreciation may be challenged in some sectors or companies, we see attractive opportunities to trade companies that can continue to improve fundamentally in the coming months.

We believe the value of a highly active approach combined with a strategy that is less reliant on yield generation and broad spread tightening is crucial to succeeding in this environment.

Our Portfolio Management Team has been focused on identifying thematic opportunities around topics such as mergers and acquisitions (M&A), new issuance, COVID-impacted sectors, as well as upgrade and downgrade candidates, among others.

We continue to think that the environment for financial institutions is positive, especially as rates begin to rise and the quality of the loan books remains strong. We particularly like specialty finance companies such as Aercap (aircraft leasing), which

recently took part in an M&A deal that could be a catalyst for price appreciation, and some US and European banks with diversified exposures such as Standard Chartered and Société Générale. We have seen a strong start

to new issuance from financials in January, and we believe that rating improvements in companies will materialize in the coming months.

We are also re-balancing our exposures to covid-sensitive sectors that we do not think are

appropriately priced and adding companies that are not as impacted by Covid but whose spreads have moved in sympathy. For instance, the volatility during and after the US Thanksgiving allowed us to pick up defensive names such as Netflix (streaming

entertainment) at a substantial discount while lowering our exposure to mobility-linked credits like Heathrow (Airport).

With volatility comes opportunity, and we continue to do our work ahead of time to make sure we are ready to benefit from compelling valuations in covered companies during what is sure to be another unpredictable year.