Typically, equity and bond prices move in opposite directions. However, 2022 has begun with both assets moving lower together. This recent behaviour stems from changing expectations around monetary policy and is driven by changes in the pace of inflation, higher probabilities of interest rate hikes, and other policies that could drive bond yields higher (and prices lower).

The latest US CPI reading released today showed a year-over-year inflation increase of 7.5%, leading US markets to now expect a 50bps increase in rates in March and approximately 6 to 7 rate hikes in 2022 in total.

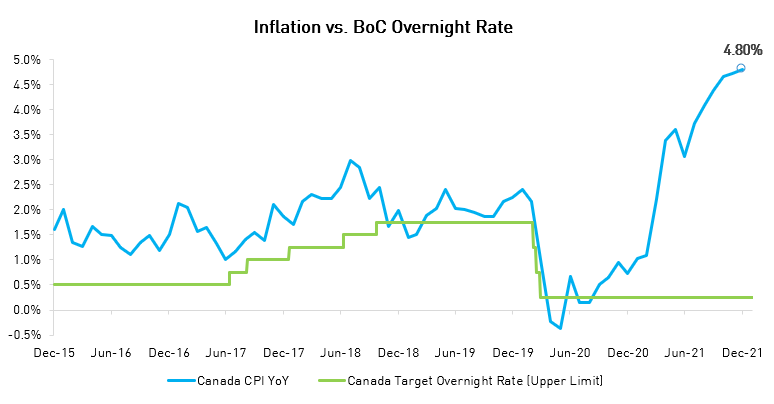

Closer to home, the Bank of Canada decided not to raise rates during its meeting in January, which was a surprise to markets. Notwithstanding its decision, inflation in Canada continues to rise and recently peaked at 4.8%, causing a gap between this measure and the overnight rate.

Source: Bank of Canada, Statistics Canada

We have reduced the interest rate risk in our strategies over the past 6 months during this volatile period, which has led to meaningful amounts of capital preservation relative to traditional bond indices. We are not trying to time the bottom of the rates cycle, but rather patiently waiting and keeping risk levels at or near their lows.

We have begun using the volatility and dispersion in credit markets to extend our highest conviction themes, including:

1. Banks and financials that benefit from higher rates and have strong regulatory frameworks,

2. Companies with solid funding profiles and a high chance of a ratings upgrade, and

3. Improving credits that are still benefiting from re-opening exposure globally.

Geographically, we have reduced our exposure to EUR-denominated credit markets given the expectation that the European Central Bank would need to become more focused on withdrawing stimulus and increasing rates later this year.

This is an exciting time for us as bond investors, and the coming months should give us the opportunity to demonstrate our focus on capital preservation and allow us to search for compelling return opportunities for our investors.