Key Takeaways

-

Index-level (headline) valuation levels across asset classes may be modestly ahead of themselves at this juncture due to their reliance on rate cuts coming to fruition in late 2023.

-

The shift away from artificially low interest rates and liquidity-flushed markets will affect certain segments of the economy more than others, making this a credit-pickers market once again.

-

We believe our active trading style and prudent positioning can help us achieve our funds’ target returns in an attractive risk-adjusted manner. If volatility were to persist, our strategies are well-positioned to capture alpha through our highly active trading strategy that thrives during dispersed markets.

For most investors, 2022 felt much like walking a tightrope between mountaintops. In stark contrast, January 2023 has provided real hope that we might finally be nearing the other side of the mountain. Bond yields rallied, and credit spreads tightened notably, leading to higher bond prices across the fixed income spectrum. Equity returns were even stronger as the hope for an economic soft landing increased in the eyes of market participants.

With strong market technicals as a tailwind, we believe that bonds are a very attractive asset class with clear fundamental support. A setup that makes us think corporate credit can add significant risk-adjusted returns in 2023 while being more resilient

and predictable than equities.

Markets May be Getting Ahead of Themselves as Rate Hikes Near an End

The Bank of Canada and the Federal Reserve raised their respective overnight rates by 25bps over the past few weeks, which, combined with softer language on future hikes and recognition of disinflationary pressures, led to notable declines in bond yields across maturities. However, this move quickly retraced following robust labour data out of the US, which continues to pose a risk against policymakers’ inflation-fighting efforts. Contrarily, a robust labour market, coupled with encouraging developments like increasing labour participation and cooling wage growth, could be a silver lining by providing the resiliency needed for a soft landing.

Source: Bloomberg. FOMC Summary of Economic Projections. Data as of February 6, 2023.

Mixed data has resulted in a divergence between monetary policy expectations and broad risk markets. While market estimates of the terminal rate (the highest overnight rate in a given hiking cycle) have caught up to Fed officials’ projection of 5.0-5.25%, markets still anticipate that central banks will begin cutting rates as soon as Q3 2023 despite the Fed’s “higher-for-longer” ideology.

We currently side with policymakers considering their commitment to not repeating the same mistakes made during the 1970s inflation spiral. Consequently, we believe index-level (headline) valuation levels across asset classes are modestly ahead of themselves due to their reliance on rate cuts coming to fruition in late 2023.

Valuations in Focus

We believe that narratives around interest rate volatility will subside, and the effect of higher-for-longer borrowing costs on real corporate fundamentals will take their place as the defining story of 2023 for both equities and bonds.

As mentioned, we do not believe that headline corporate credit spreads (the additional yield we receive for buying a corporate bond instead of a risk-free government bond) necessarily compensate investors fairly at these valuation levels. This is particularly true in lower-quality credit segments, which tend to experience greater earnings volatility in a recessionary environment. In general, the shift away from artificially low interest rates and liquidity-flushed markets will affect certain segments of the economy more than others, making this a credit-pickers market once again.

This is why we plan to focus on areas of the bond market where we can extract attractive yields without exposing ourselves to unattractive valuations more broadly. We believe flexibility will be critical in this environment as the narrative unfolds, and our game plan needs to be selective and targeted.

Q1 2023 Gameplan: Aim to Capture Attractive Yields Without Taking Undue Valuation Risk

To take advantage of the current market backdrop, we are positioning our portfolios in the following ways:

- Managing credit risk actively to take advantage of spread dispersion without being overly exposed to broad market (beta) risk

- Favouring the shorter end of the credit curve, the portion that we believe is the most attractive given the inverted yield curve

- Buying floating rate bonds that are more attractive than fixed-rate bonds of the same credit quality and tenor

- Taking a more selective approach to high yield exposure – in the portfolios that can buy high yield – because headline spreads are too tight to provide sufficient compensation

We believe this positioning can help us achieve the target returns we set in our funds in the first half of the year. If volatility were to persist, our strategies are well-positioned to capture alpha through our highly active trading strategy that thrives during dispersed markets.

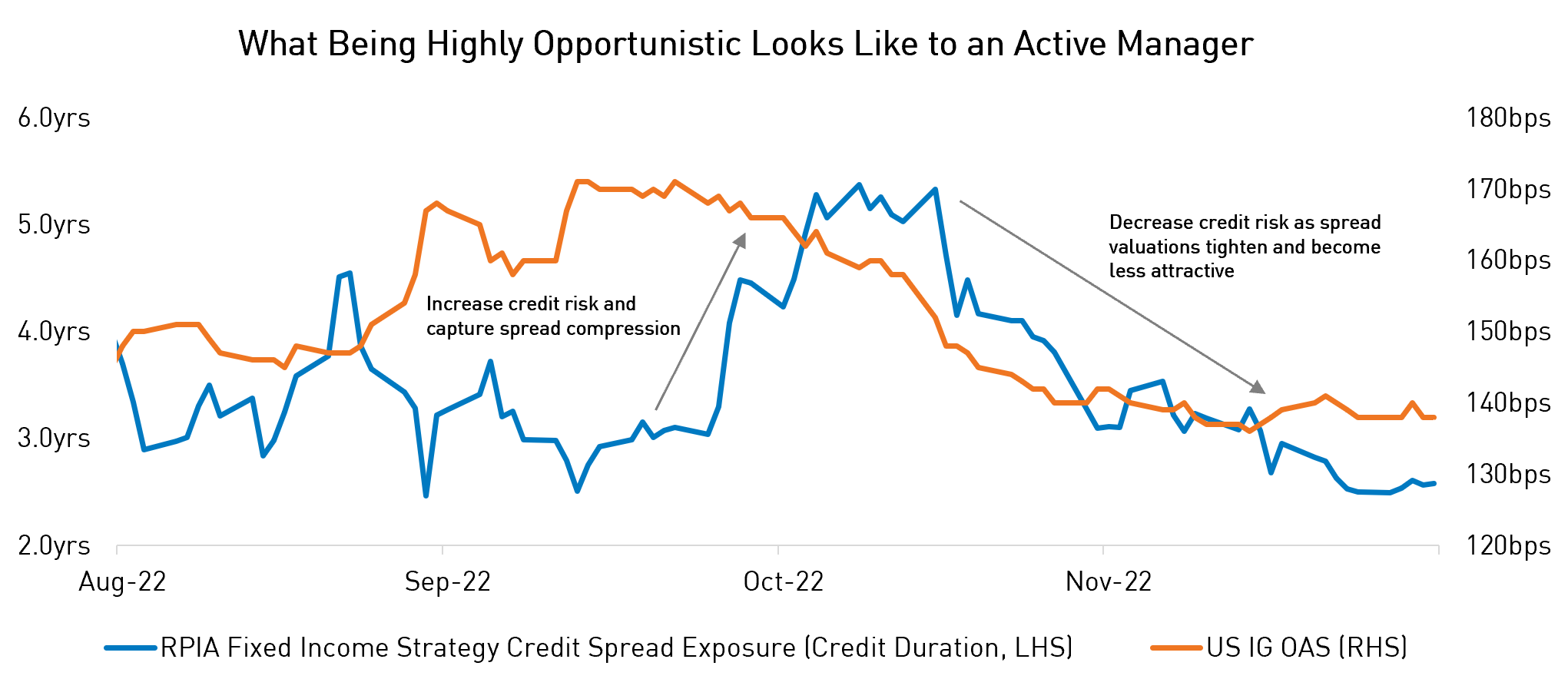

What Being Highly Opportunistic Looks Like to Us

Investors often ask us to explain what an opportunistic approach to bond investing looks like, so we thought we would take this opportunity to highlight an example from the previous quarter.

We screened investment grade credit spreads (orange line) as attractive after reaching year-to-date wides in October 2022. To express this view, we significantly increased credit exposure to take advantage of this favourable setup in our highest conviction credits.

As spreads tightened (rallied), we reduced our exposure and realized gains from this move. We believe 2023 will provide us with multiple opportunities for actively trading in this manner. We plan on opportunistically participating in the market to generate strong returns throughout the year.

Source: RPIA, ICE BofA. Data as of 02/06/2023. RPIA Fixed Income Strategy = RP Alternative Global Bond Fund. US IG OAS = ICE BofA US Corporate Master Option Adjusted Spread.

Opportunity in Floating Rate Bonds

Recently, investment grade rated floating rate notes (“FRNs”) have been an opportunity of interest across our portfolios. FRNs pay a coupon that fluctuates based on a reference rate that is tied to the overnight rate set by central banks. These coupon rates typically reset periodically, unlike a fixed bond where the coupon is set at issuance.

We believe short-maturity FRNs are attractive because they currently provide greater yields with less term and interest rate risk relative to fixed-rate bonds. The primary driver of this phenomenon is the inverted yield curve, which is simply a fancy way of saying that shorter-term bonds are paying higher yields than longer-term bonds. Additionally, FRN coupons are elevated because they move higher with the central bank's overnight rate, whereas fixed bond yields are more subject to market expectations of future yields. As we noted earlier, the markets expect rate cuts in 2023 and 2024, which is driving many of these fixed market rates lower.

Bottom line – we think FRNs are an excellent opportunity to generate attractive yields. If rates increase again due to continued inflation volatility during 2023, FRNs enable us to keep dry powder for new opportunities to arise without getting caught with our hand in the cookie jar.

Last Word

Looking ahead, our best advice to investors is to stay invested. Use a highly active manager in your bond portfolio to capture the unique opportunities that will likely arise in 2023, and don’t look back. We think this will be a great year to generate compelling risk-adjusted returns in corporate credit.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should

not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing

it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated,

the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully

offered and to investors who qualify under the applicable regulation. RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. “Forward-Looking” statements

are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future

events and as a result RPIA’s views, the success of RPIA’s intended strategies, and its actual course of conduct.