Since the beginning of 2021, bond holdings have posted double-digit losses and weighed down portfolio performance.1 However, as is often the case in markets, with pain comes opportunity. Despite the potential for continued short-term volatility, we believe the time to increase bond allocations for intermediate and long-term investors is now.

Anticipated Rate Increases are Largely Priced into Higher Yields

Suggesting that fixed income looks attractive is wildly unpopular today, but it should be recognized that the market has already priced in an additional 2.25% increase in rates from the US Federal Reserve, even after their most recent 50bps hike last week – that is equivalent to 9 quarter-point hikes from now until May 2023.2 Under this assumption, the “terminal rate” (the rate at which markets believe the Federal Funds Rate will peak in this hiking cycle) will approach 3.25% in the US.

It is a similar story in Canada. The overnight rate sits at 1.0% after the latest 50bps rate hike in April, while the yield on the 2-year government bond sits at approximately 2.7%.3 This means that an investor can effectively buy bonds and “lock in” a good amount of the anticipated increases in rates today, even though they may not fully come to fruition.

Active Management: Building a Base of Attractive Bonds

The Federal Reserve’s asset holdings are primarily made up of Treasuries and mortgage bonds backed by government agencies. These assets were more than doubled during the pandemic from $4.2 trillion to $8.9 trillion until March 2022, when the Fed officially stopped adding to its balance sheet.4

Just as Quantitative Easing drove interest rates down, Quantitative Tightening can be expected to put pressure on them to rise. The expectation for an increasing trajectory of interest-rate hikes alongside a contracting Fed balance sheet has been the key reason treasury yields soared in the first quarter of 2022.

If markets have underappreciated the potential impact of quantitative tightening, it could be the driver of more short-term volatility in bond markets. But again, given the anticipated terminal rate, we think there is enough cushion for investors to begin picking up bonds now, with a chance for capital gains if these measures turn out less aggressive than anticipated in the next 12 months.

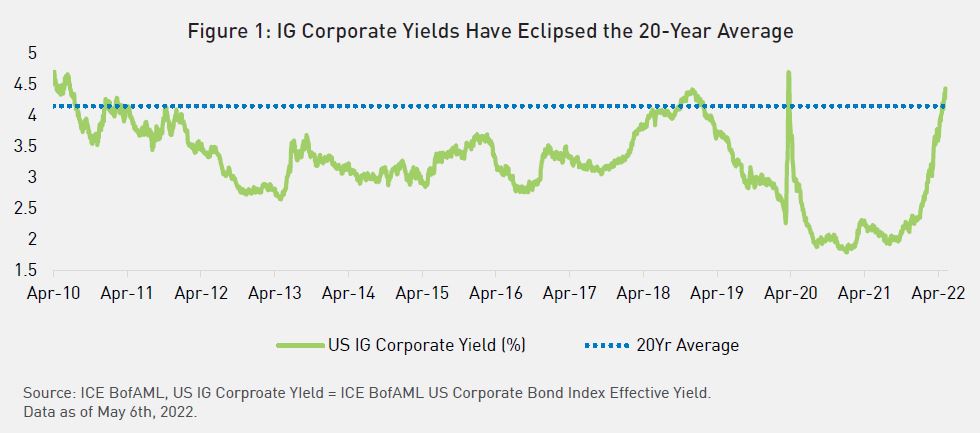

Corporate Bonds Trading at Attractive Levels

In addition to higher risk-free rates, investors can further increase their yield pick-up by taking a modest amount of credit exposure. The investment grade bond market offers a nearly 4.4% all-in yield today, a level that has eclipsed the 20-year average yield and is approaching pandemic levels.

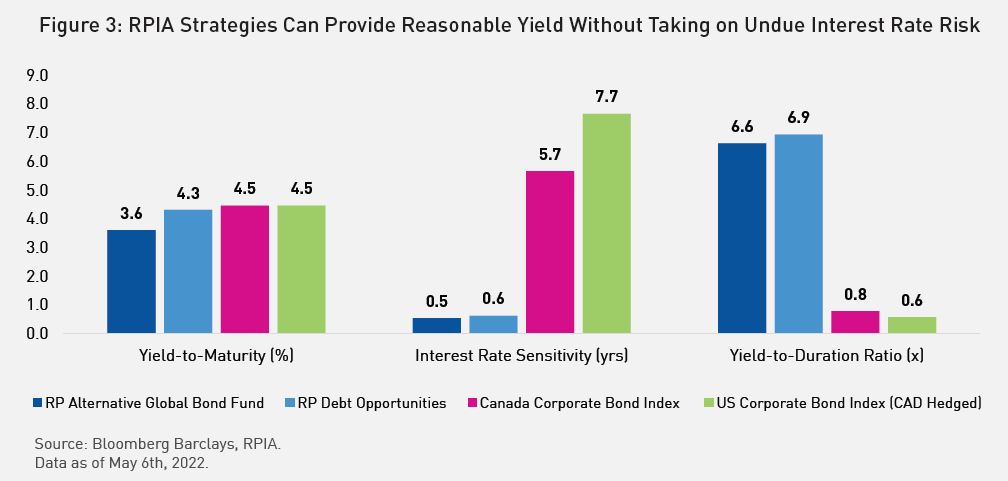

But this doesn’t mean that investors should blindly lock in the highest yield possible – as many of the highest yielding bonds can also come with uncompensated interest rate risk and/or credit risk.

Against this backdrop of wider spreads and the sharp sell-off in rates, the level of yield support has notably improved across a variety of fixed income markets. We believe yields at these levels can provide critical upside if the Fed decides to re-evaluate and slow down over the next 12-months or inflation begins to crest and surprise us on the way down.

Buy the Dip Mentality for Bonds

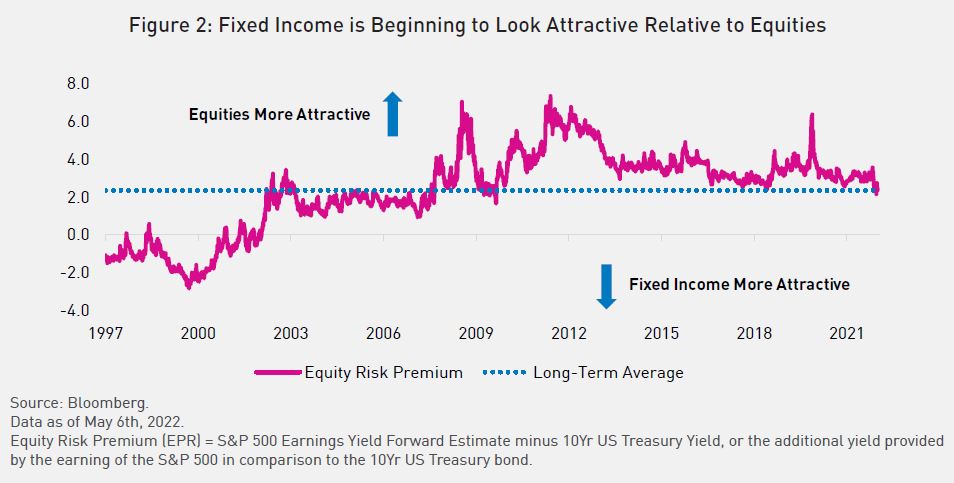

Investors hold bonds because no other asset class has consistently done what they historically have – preserve capital if held to maturity (defaults are very rare for investment grade bonds) and generate modest returns.

The proverbial “buy the dip” methodology has worked wonders for equity investors over the past decade. We think investors can use a similar strategy with bonds at these levels to help insulate their portfolios prudently and keep them aligned with their risk profiles better than other income-oriented asset classes.5 As an aside, bonds are also beginning to look attractive relative to beloved equities.

Active Management: Building a Base of Attractive Bonds

We believe you need to pick away in stages to take advantage of the opportunity right now. We recognize that each new data point and headline could spawn further volatility, but we are advocating for a gradual re-entry without trying to pick the proverbial “bottom of the market.”

For example, we want to buy bonds today that will give us a predictable downside scenario over the next 2-3 years, but that has upside capital gains optionality if spreads tighten from here due to an improving economy or avoiding a recession, idiosyncratic fundamental improvements, and/or other technical market catalysts that offer relative value.

To illustrate, the table below shows how our strategies are taking advantage of yield opportunities in the market without taking on nearly as much interest rate risk as Canadian and US Corporate Bond indices.

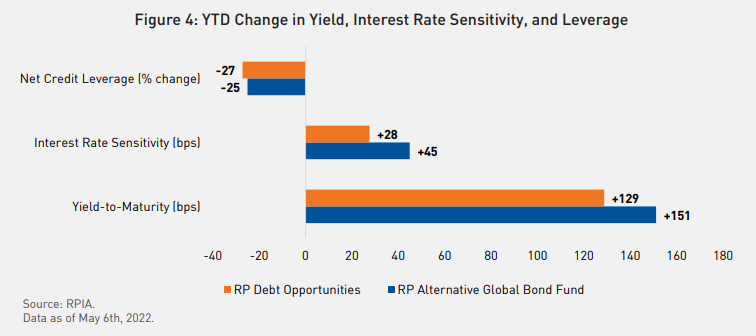

Year-to-date, the market volatility has allowed us to increase all-in yields while limiting interest rate exposure and reducing credit risk metrics. For example, RP Alternative Global Bond Fund’s yield has increased +151bps while its rate sensitivity has only increased +45bps, all while its credit leverage has been reduced by -25%. This helps highlight how we pursue attractive risk-adjusted yields and not focus solely on absolute yields, which can come with uncompensated amounts of risk.

1 As of May 6th, 2022, the Bloomberg Barclays Global Aggregate Bond Index has suffered a drawdown of -16.7% since January 2021.

2 Source: CME FedWatch Tool, CME Group Inc. (www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html). Data retrieved May 6th, 2022.

3 Source: Bank of Canada. Data retrieved May 6th, 2022.

4 Source: Federal Reserve. Data as of May 4th, 2022. US Total Assets Held By All Federal Reserve Banks.

5 For example, cash might protect your capital, but you’ll lose purchasing power over time, thanks to inflation. Treasury Inflation-Protected Securities (TIPS) and floating-rate loans can have negative yields if deflation comes to pass over the coming year. Granted, commodities, cryptocurrency, and gold can diversify your equity holdings. Still, all of these bring new risks to the table and do not come with any guarantees or maturities backed by a business or its cash flows.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation. “Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.

RP Debt Opportunities is offered pursuant to available prospectus exemptions to eligible Canadian investors through units of RP Debt Opportunities Fund Trust respectively. Investor level fund performance may differ from the strategy level performance presented. RP Alternative Global Bond Fund is a mutual fund offered pursuant to a simplified prospectus in all applicable Canadian jurisdictions and are subject to applicable securities law and regulations.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Indicated rates of return include changes in share or unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Returns for time periods of more than one year are historical annual compounded total returns while returns for time periods of one year or less are cumulative figures and are not annualized. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The compound growth chart is used only to illustrate the effects of a compound growth rate and is not intended to reflect future values or returns of the Fund. Performance presented for RP Alternative Global Bond Fund is for Class F of the fund. Class F units does not include embedded sales commissions, which results in higher performance relative to Class A units of the fund. Performance data for RP Alternative Global Bond Fund is calculated in accordance with NI 81-102.

The index performance comparisons presented are intended to illustrate the historical performance of the indicated strategies compared with that of the specified market index over the indicated period. The comparison is for illustrative purposes only and does not imply future performance. There are various differences between an index and an investment strategy or fund that could affect the performance and risk characteristics of each. Market indices are not directly investable and index performance does not account for fees, expense and taxes that might be applicable to an investment strategy or fund.