In the earlier stages of the ESG-linked bond market, we saw issuers given a significant advantage when issuing a Green, Social or Sustainable bond compared to their conventional corporate bonds. Essentially, these ESG-labeled bonds are issued at higher prices than traditional bonds and have lower yields, simply because of the ESG label on the bond. This lower spread at issuance was attributed mainly to low supply and high demand as new ESG-dedicated fixed income funds competed for a finite, albeit growing, number of ESG-labeled instruments while also building their dedicated fund offerings.

In 2019 and 2020, an issuer could save 10 or more basis points (bps) in interest cost by issuing an ESG-labeled bond instead of conventional debt (a large discount on $500M to $1B in borrowing). This cost advantage became known as a "greenium." Some investors (including ourselves) were concerned about whether the size of the discount was warranted relative to how impactful the use of proceeds would be on actual ESG issues. Green and Social bonds often have long lookback periods, allowing issuers to finance past projects that were already part of the businesses' plans even before the advent of ESG-labeled debt. While we applauded the increasing focus on Environmental and Social projects, we questioned whether some issuers were simply funding business as usual activities but gaining a cost advantage simply through a label.

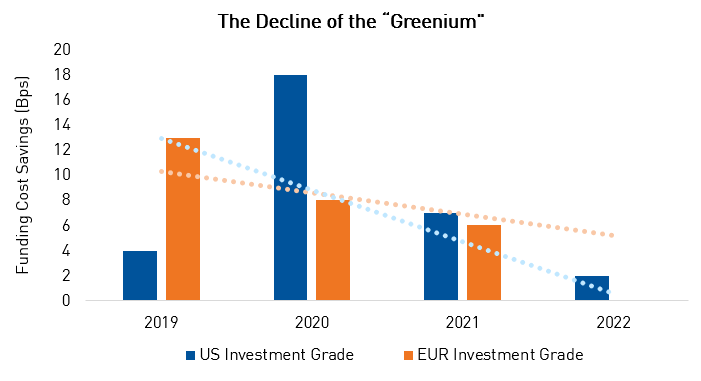

As the ESG bond market has grown, we have seen the "greenium" evaporate in many deals, thus eliminating the funding advantage borrowers have had in previous years, receiving favourable treatment by the markets with better pricing and lower rates. As highlighted below, we have seen US investment grade issuers go from a nearly 20 bps funding advantage in 2020 to an under 5 bps funding advantage this year. European ESG bond markets are more mature and actually posted zero cost savings in 2022, a far cry from the over 10 bps advantage seen in 2019.

The diminishing "greenium" is a welcome trend in our view! We believe this trend represents the maturing nature of the ESG labeled bond market, where issuers only gain a cost advantage on the ambition of their ESG bond issuance rather than the label. We believe this is a key development in ensuring the longevity and credibility of ESG bond markets, allowing managers to express views on issuers either through conventional or ESG debt without causing large pricing discrepancies. This can also be a case for Sustainability Linked Bonds (SLBs), which incentivize improvements in a company's ESG profile, bringing the focus back to ambition over labeling.

The structuring of ESG bonds is also maturing thanks to ongoing feedback and collaboration from investors. Issuers are now actively addressing "greenwashing" claims by embedding incrementality into their ESG bond issuance. This ensures that proceeds are used to fund new projects/activities rather than financing "business-as-usual" operations. For example, to avoid the lookback periods mentioned above, we have seen new issues from the likes of Bank of America and Honda whose use of proceeds will be 100% dedicated to new projects rather than financing preexisting projects.

As the ESG debt market matures, we look forward to increasing credibility within the marketplace where issuers utilize these structures to target true impact. Only then can the dialogue move from "greenwashing-or-not" to "how can we allocate investment dollars to the most impactful ESG bonds."

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under the applicable regulation. RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. “Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.

RPIA aims to consider ESG factors as part of our overall investment process, but the weight and importance of it can vary across the investment funds we manage. Always refer to the relevant fund offering documents for important information on the investment objectives, strategies and associated risks of a particular fund. The consideration of ESG factors in the investment process for RP Strategic Income Plus Fund and RP Alternative Global Bond Fund plays a limited role and is weighted less than the core financial and credit analysis employed in the management of these funds.

For more information, visit www.rpia.ca/esg.