Executive Summary

- Financial markets continued to recover with strong performance in corporate bonds.

- We continue to focus on a conservative core positioning with selective exposure to areas of the market where the Federal Reserve is not an active participant

Our portfolios posted positive returns in July as financial markets continued to recover. Central bank policy has clearly been instrumental in market performance since March. However, the strong performance of credit was also bolstered by improving economic data as global economies continued to re-open and pent-up demand was unleashed. The performance of the financial markets since March has been remarkable but we must remember it will take longer for the “real economy” to fully recover. We cannot discount how deep the shocks were to the global economy due to pandemic lock-downs. One of the starkest indicators of the severity of the shutdowns was April’s job number in the US. The number of jobs lost during that month was 20.8 million (as per US Bureau of Labor Statistics) – basically wiping out the previous decade’s job gains. Thus, while we are encouraged by improving economic data, we need to remind ourselves that the recovery will be long and uneven.

Despite continued strong performance we still believe corporate bond valuations are attractive. Credit spreads have retraced a significant amount since March, when valuations were pushed to extraordinary levels owing to a temporary liquidity vacuum. In that environment prices were detached from fundamentals. Since that time, central bank intervention and better economic data has caused investment grade bonds to retrace 85% of their initial widening and high yield by 77%.1 However, we still see value in credit, especially relative to other asset classes. Government yields are at all-time lows and equity valuations looks relatively high for their risk. Conversely, current investment grade credit spread levels are pricing in an approximately 7% default rate in US and Canadian markets over the next 5 years. Going back to the 1980’s the highest 5-year cumulative default rate experienced in the US was 2%. 2 Although the impact of COVID-19 and future shutdowns is significant, we believe there is still value left in the asset class.

We are employing a selective approach focusing on the pockets of the market where there is most value. Dispersion in credit markets remains elevated. Credit spreads for certain companies are now narrower than pre-pandemic levels. Examples include AT&T, Bank of America and Apple. Other corporate bonds still come with credit spreads well above long-term averages in hard-hit sectors such as retail, leisure and airlines. This dispersion across markets is an opportunity for relative value and selective positioning. The Federal Reserve’s buying program in the US has led to significant compression of credit spreads in USD corporate bonds with 5 years or less to maturity. Thus, alongside core defensive positions we are also searching for opportunities outside of this segment of the market for opportunities that are being overlooked by those investors who are simply “following the Fed”.

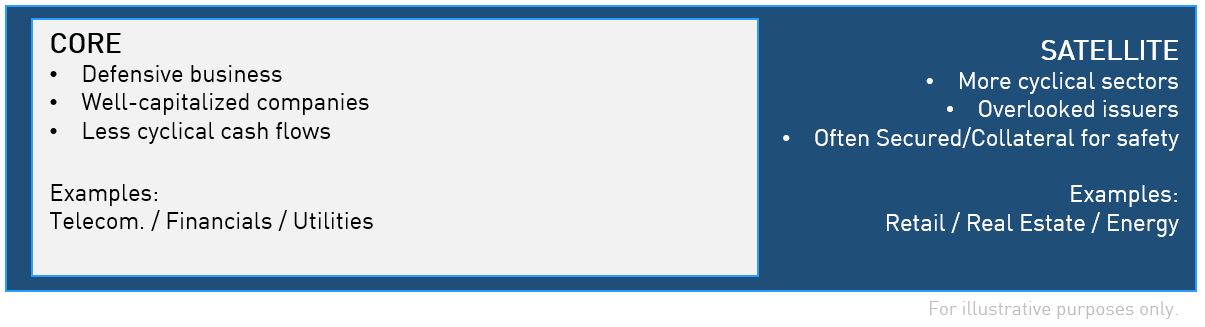

We continue to focus on “core” high quality sectors and businesses and are using a highly selective approach with cyclically sensitive companies. Because of dispersion many of our portfolios are positioned with high quality “cores” focused on defensive positioning. We continue to view Financials as part of this core as they are well-positioned at this point in the cycle. Although there will be earnings headwinds for banks, they are well-capitalized companies which gives us comfort as bondholders. In the portfolios we have been rotating some exposures from US bank’s home currency issues to the same bank's issuance in currencies outside of the US dollar which offer relative value without taking more credit risk. Certain mandates also added select subordinated securities in global diversified banks where valuations were attractive versus senior bonds. We have also found attractive opportunities in the short-term bonds of leasing companies who recently increased their balance sheet liquidity. Alongside these opportunities within the core part of our portfolio, some of our mandates have established highly selective satellite positions in more cyclically sensitive issuers. Many of these companies have issued bonds over the last quarter at attractive yields despite being secured by high-quality assets. With many unknowns ahead we believe this approach strikes the right balance between risk and reward.

Thank you for your support and please contact us should you have any questions.