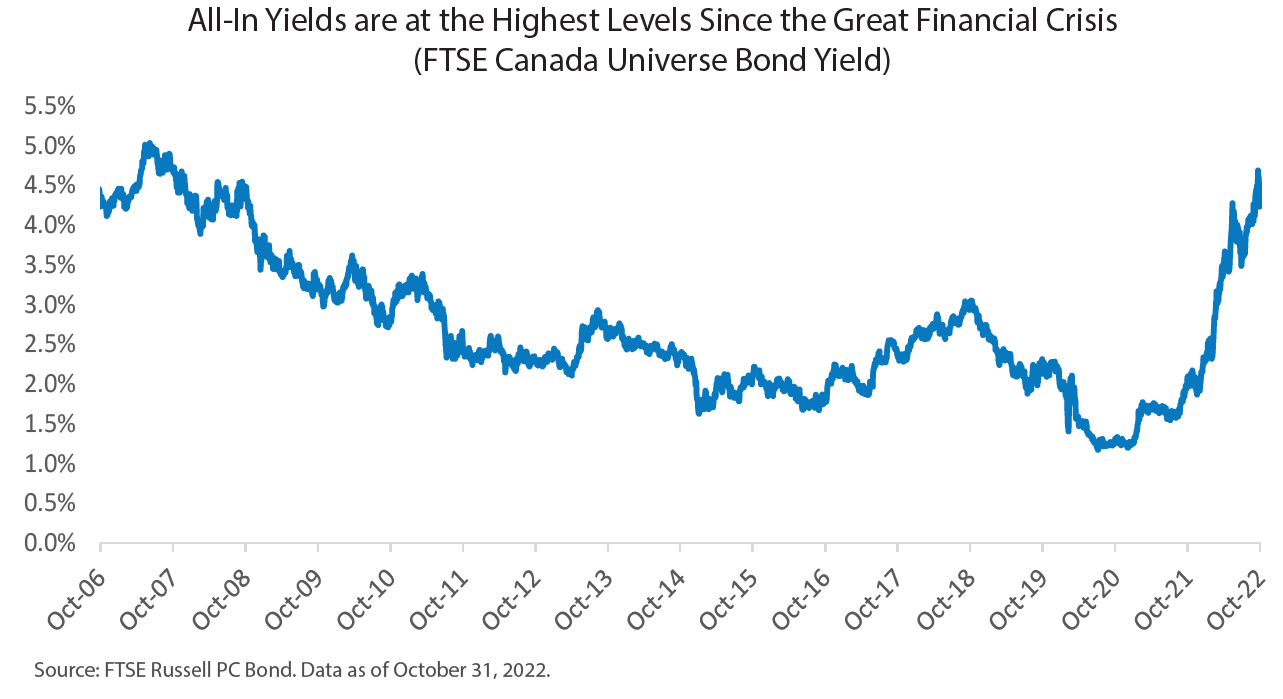

We believe it is the right time for investors who are underweight in a core bond position to increase their allocation and take advantage of this opportunity with RP Strategic Income Plus Fund (“RP STIP”).

Positioning RP STIP for an Optimal Offense Moving Forward

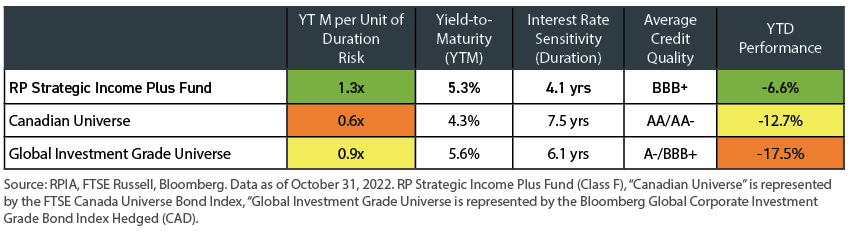

The recent dislocations in credit spreads across the investment grade universe, and the continued volatility in rates has allowed us to put our offense back onto the field. But this doesn’t mean we are blindly buying the highest-yielding bonds. Instead, we are aiming to optimize our portfolios and capture higher yields per unit of risk while taking advantage of what we view as the subtle mispricings in the market.

The table below illustrates what this looks like versus the broader bond universe:

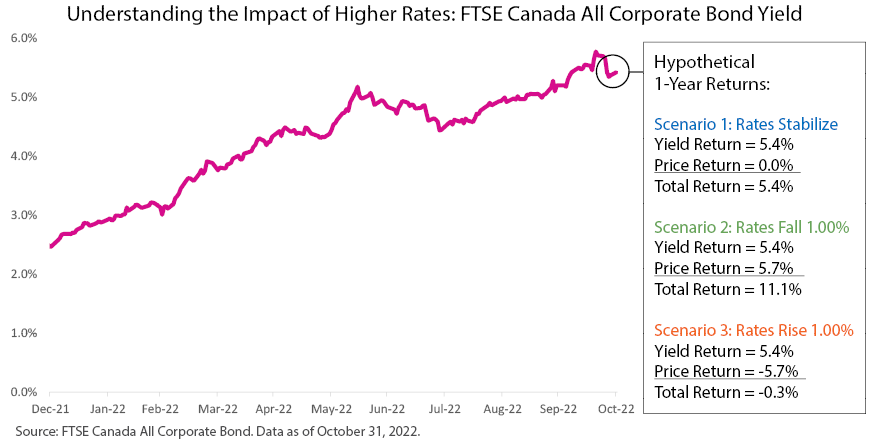

Forward Outcomes are Skewed to the Upside

Our long-short credit strategies can hedge and mitigate sharp moves from broad changes in rates and credit spreads, which has been the downfall of most traditional bond strategies during this period. Simultaneously, our highly active nature allows us to be tactical and gain returns from the opportunities we see in credit markets. We believe that these strategies can deliver diversification and positive returns to investors in this challenging environment. Please do not hesitate to get in touch with our team if you want to discuss how long-short credit strategies could benefit your portfolio.

In our base case analysis, we view investment grade bond yields as largely being range-bound for the next 2-3 quarters and representing excellent value at current levels. Let’s look at a few simple scenarios to illustrate why this is the case:

- Rates Stabilize

The yield to maturity of a fixed income portfolio could provide a return more attractive than GICs/cash deposits while allowing for additional return opportunities from credit selection. - Rates Fall If yields move lower as the chance of recession risk increases or it materializes and causes an easing in hawkish language from central banks, a fund could rally notably. In such a scenario, the combination of coupons and lower market yields could lead to capital gains and approach double-digit returns over the next 12 months, depending, of course, on the path of credit spreads.

- Rates Rise

A further rise in rates would be less ideal, but our belief is that current yields are high enough to provide a substantial cushion for investors. For example, a current 2-year investment grade portfolio that yields 6% per year, or 0.5% per month, would need to see a combination of bond yields and credit spreads rise by over 3% before it endures a loss over the next 12 months. We think that scenario is unlikely at this point in the cycle.

This Same Flexibility Can Enable Us to Protect Capital

Our highly active investment team has the tools necessary to effectively implement high conviction views agnostic of any benchmark.

Year-to-date, we have taken a commonsense approach to reduce risk and conservatively positioned ourselves to protect capital.

First, we reduced our interest rate exposure across the portfolio and accepted a lower yield and fewer return opportunities. This turned out to be very prudent and allowed us to protect against higher bond yields that caused lower bond prices.

Second, we conservatively managed credit risk within the portfolio and elected to grind out incremental returns through active credit selection and relative value opportunities. This allowed us to be less correlated to broad credit markets and helped protect capital when credit spreads widened.

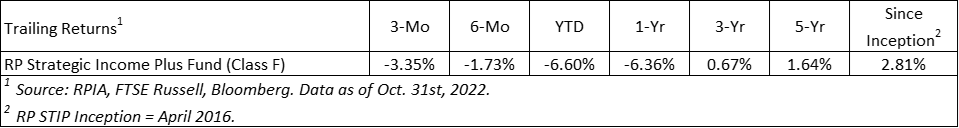

The ability to manage rate risk and credit risk separately allowed us to outperform broad Canadian bonds by +6.1% and global investment grade bonds by +10.9% YTD (net of fees).

We believe investors who have been sitting on the sidelines or are underweight a core bond position could benefit significantly from increasing their allocation at this point in the tightening cycle.

RP STIP is a highly active strategy that invests in developed market investment grade credit, and we believe it can take advantage of the recent market volatility to capture attractive all-in yields and provide compelling returns moving forward.

Important Information

Last Updated: November 2nd, 2022

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. RP Strategic Income Plus Fund is a mutual fund offered pursuant to a simplified prospectus in all applicable Canadian jurisdictions and is subject to applicable securities law and regulations. “Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct. RPIA-managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. Guaranteed Investment Certificates (“GICs”) and other term deposits generally earn a fixed or guaranteed return. Unless indicated otherwise, all fund and index returns presented herein is as of the last business day of the stated month, and returns presented for periods greater than one year are annualized. Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Indicated rates of return include changes in share or unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The performance presented for RP Strategic Income Plus Fund is for Class F of the respective fund. Class F units do not include embedded sales commissions, which results in higher performance relative to Class A units of the fund. The index performance comparisons presented are intended to illustrate the historical performance of the indicated fund with that of the specified market indices over the indicated period. The comparison is for illustrative purposes only and does not imply future performance. There are various differences between the fund and indices that could affect the performance and risk characteristics of each. Market indices are not directly investable and index performance does not account for fees, expense, and taxes that might be applicable to an investment fund.