The unprecedented volatility in bond markets over the past two years has resulted in many bonds trading at discounts to their par values. These bonds can offer a tax-efficient approach to generating returns for investors over the coming years.

Bonds that are trading below their par value are referred to as “discount bonds,” and they can be very attractive to investors for two reasons:

- The yield to maturity, or return over the remaining lifetime of the bond, is higher than when it was first issued at par.

- The tax treatment of the return is more efficient because a portion of that bond’s return is now treated as capital gains and taxed at a much lower level than interest income.

Discount Bonds in Action

Let’s look at a hypothetical $100 bond with an initial return expectation of 4% and a 2-year term issued in January of 2023. A month later, due to a market adjustment (ex., a rate hike), the required return increases to 6%.

The increase in return to 6% is derived from now having the opportunity to buy the bond at $96.6 (instead of the original $100). Then investors can see that price move to $100 over the remaining 23 months of the bond.

This additional 2% in return is treated as a capital gain and not interest income for new holders of this hypothetical bond and is in addition to the coupon payments of 4% that investors will continue to receive.

Implications on the After-Tax Return

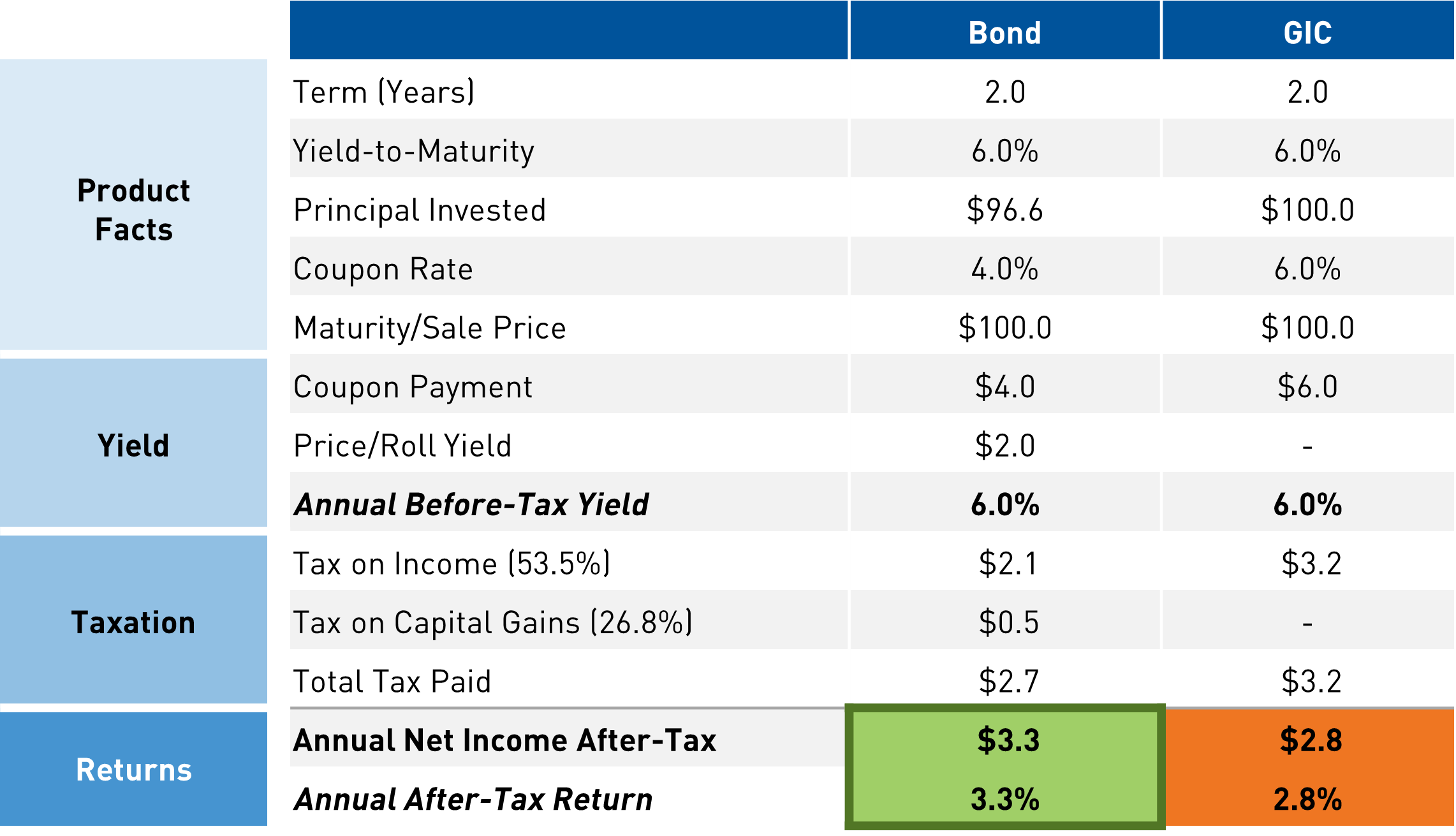

One way to understand the impact of this is by looking at the after-tax returns of a GIC relative to a discounted bond with the same term to maturity.

Buying bonds with similar maturities to a locked-in GIC can provide notably higher after-tax yields for investors who are in high tax margin brackets. This is simply because the return earned on GICs is taxed entirely as interest income, whereas a portion of the total return generated from discounted bonds is taxed at the lower capital gains tax rate.

Additionally, most fixed income mutual funds that purchase discount bonds can readily provide daily liquidity, unlike locked-in GICs, whose term typically can not be broken without incurring significant penalties.

If you have any questions about discount bonds and the tax treatment differences between bonds and GICs, please feel free to reach out to a member of the Client Team.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RP Investment Advisors LP (“RPIA”) assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct. RPIA managed funds and strategies carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. Trade examples presented or discussed are for informational purposes only and does not necessarily reflect a trade or current holding in any particular RPIA strategy or fund.