Key Takeaways

- The US Federal Reserve raised interest rates by 25 basis points (bps) on March 24th to continue its fight against inflation, but recent turmoil in both US and European financials have bond markets feeling less certain about future economic growth and have caused them to price in rate cuts as soon as Summer 2023.

- Credit spreads widened for a second month in a row, specifically in issues with shorter maturities and those that operate within the financial sector.

- Equity markets remain resilient despite the gloomy economic headlines and an elevated chance of financial accidents that could become more likely if rates stay higher for longer than expected.

Uncertainty rises in credit markets but lower bond yields come to the rescue

Credit spreads were wider during the quarter due to uncertainty from the bank liquidity crisis in March. Though the circumstances of the Silicon Valley Bank and Signature Bank failures may have been unique, we must admit the speed of the fall of a global systematically important bank such as Credit Suisse was alarming.

Financial instability ignited further volatility in bond yields in the first quarter of the year. In March alone, yields on 2-year Canadian and US government bonds fell 90bps and 129bps, respectively, as markets priced in rate cuts, expecting them as soon as this summer. Overall, the move lower in risk-free yields buoyed investment grade bond indices by offsetting losses from wider credit spreads.

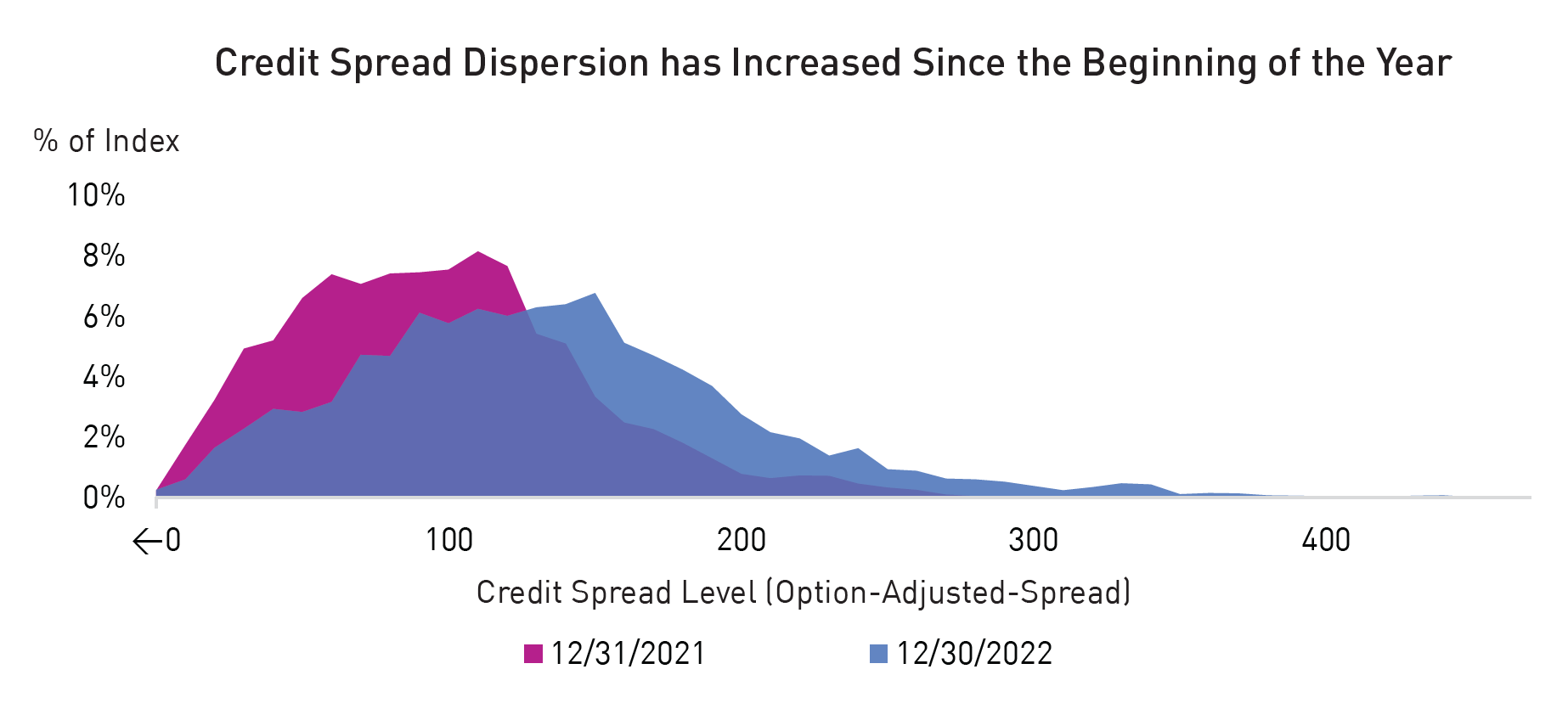

The implications of the recent events on growth and markets continue to be assessed and may be far reaching given the integral role that financial institutions play in the functioning of the real economy. Underneath the surface, credit dispersion has increased, and in some cases, the challenges facing regional banks have spilled into non-financial issuers with near-term liquidity needs. There is a risk that the market will continue to punish issuers with reliance on wholesale funding, and we plan to remain vigilant in our liquidity assessments in a rapidly-evolving market.

Credit risk repriced amidst the uncertainty and created opportunities

The credit spread repricing in March was negative for investors broadly, but much of the pain was felt by those holding shorter-term bonds. Investors sold short-maturity bonds amidst the turmoil to generate liquidity, which caused credit curves to flatten, or in some cases, invert, meaning yields on short-term bonds exceed their long-term counterparts.

The credit spread widening was unevenly distributed among sectors, with financials/banks experiencing the deepest repricing as both regional and large banks sold off. Interestingly, there was also an element of “throwing away the baby with the bath water” as credits in defensive sectors repriced wider in sympathy. In response, we embraced an up-in-quality trade in select credits that were repriced to attractive levels during the height of the volatility. For example, we added non-financial risk in traditionally less volatile segments of the market, such as healthcare, pharmaceuticals, and consumer staples.

Within financials, we believe certain short-end (≤3 years) US and Canadian paper looks attractive. We are also re-evaluating the senior parts of the capital structure in select European financials.

Catching the baby as it's thrown out with the bathwater

As mentioned previously, the credit selloff created significant dispersion across and within sectors. As the chart illustrates, credit spread-level dispersion within investment grade credit is bountiful (gray shaded area) relative to the previous years (blue shaded area).

Source: Bloomberg. Data as of 31/03/2023. Index = Bloomberg US Corporate Total Return Value Unhedged USD.

We used this action to rotate into selected financials of the highest quality – i.e., global systemically important banks (GSIBs) – and increase our portfolio yield and credit quality, while reducing term risk in many cases. However, for the most part, we were selective about adding financial exposure as we feel these wider spreads fairly accurately reflect the uncertainty embedded and thus are not yet offering value.

Non-financial corporates were a different story, however, and we felt many issuers in defensive sectors incurred mark-to-market losses driven largely by negative risk sentiment. One example of an issuer we added to was HCA Inc., which is one of the largest healthcare service companies (hospital and outpatient center operator) in the United States. It is important to note that our global reach allows us to identify these types of opportunities, given that healthcare issuers are essentially non-existent in the Canadian credit market.

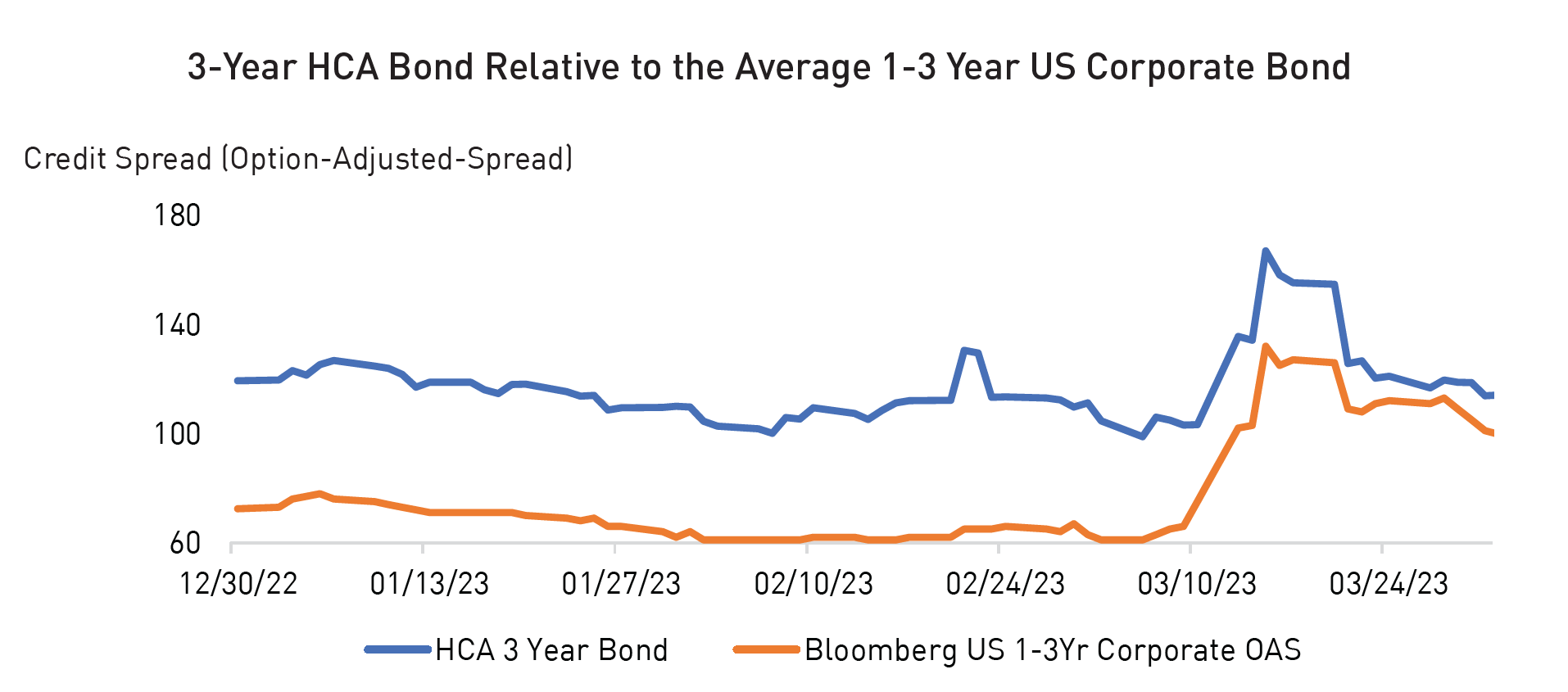

Prior to the market spread widening, a 3-year HCA bond was trading at consistently wider spread levels relative to the average 1- to 3-year US corporate bond. The pronounced selloff in short-dated bonds in March led the bond’s credit spread to widen ~70bps. Index level spreads widened a similar amount, but it is essential to highlight that the index has a 46% weighting towards financial issuers. Therefore, we thought a relatively unlevered healthcare bond represented compelling value as it was “thrown out with the bathwater.”

Source: Bloomberg. Data as of 31/03/2023. 3-Year HCA Bond = HCA 5.875 02/15/2026.

We took advantage of this opportunity and added to the name at what we believe to be attractive absolute and relative levels. Subsequently, the bond’s credit spreads rallied ~53bps and repriced closer to index levels. We hope these opportunities, some short-fused, some longer, can provide our investors with attractive risk-adjusted returns.

Final Thoughts

Corporate bond prices rebounded into quarter-end due to diminishing fears of broader contagion from the banking turmoil and a growing narrative that the Federal Reserve will soon pause its rate hikes and begin a cutting cycle. While banking stress has receded for the time being, there are still many challenges facing market participants, including an increased probability of recession due to constrained bank lending and mounting geopolitical risk. As a result, the path of interest rates and risk markets remains uncertain as the tradeoff between inflation fighting and recession or financial accident risk is still front and center.

Given the uncertainties, we believe that the case for fixed income relative to equities is a strong one. However, unlike the post-Covid rebound where everything rallied in unison, we believe the move away from liquidity-flushed markets has made this cycle a bond picker’s environment. Accordingly, we think investors should not rely on passive bond strategies and should instead employ an active manager who can ensure they are being selective about the opportunities available to them.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation. RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated.

RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. Internal calculations represent unofficial RPIA calculations and should not be relied upon as official reporting. Security and trade examples are presented for illustrative purposes and do not necessarily reflect a trade or current holding in any particular RPIA strategy or fund.

The index performance comparisons presented are intended to illustrate the historical performance of the indicated strategies compared with that of the specified market index over the indicated period. The comparison is for illustrative purposes only and does not imply future performance. There are various differences between an index and an investment strategy or fund that could affect the performance and risk characteristics of each. Market indices are not directly investable and index performance does not account for fees, expense and taxes that might be applicable to an investment strategy or fund.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.