Key Takeaways

- Encouraging inflation data, dovish central bank rhetoric, and an economy that is no longer showing signs of overheating bolstered the market's belief in a soft/no landing.

- Favourable dynamics led to lower government bond yields and tighter credit spreads as market consensus shifted toward the belief that central bank rate hikes are done in developed markets.

- Our strategies captured the upside well, but the swift move could be an overshoot in sentiment and valuations, leading us to taper our positioning and proceed more cautiously.

A Pivot in Expectations

Traditional fixed income investors were preparing for a third consecutive year of negative total returns as fears of a higher-for-longer interest rate environment gained traction in October. But November provided some much-welcomed relief.

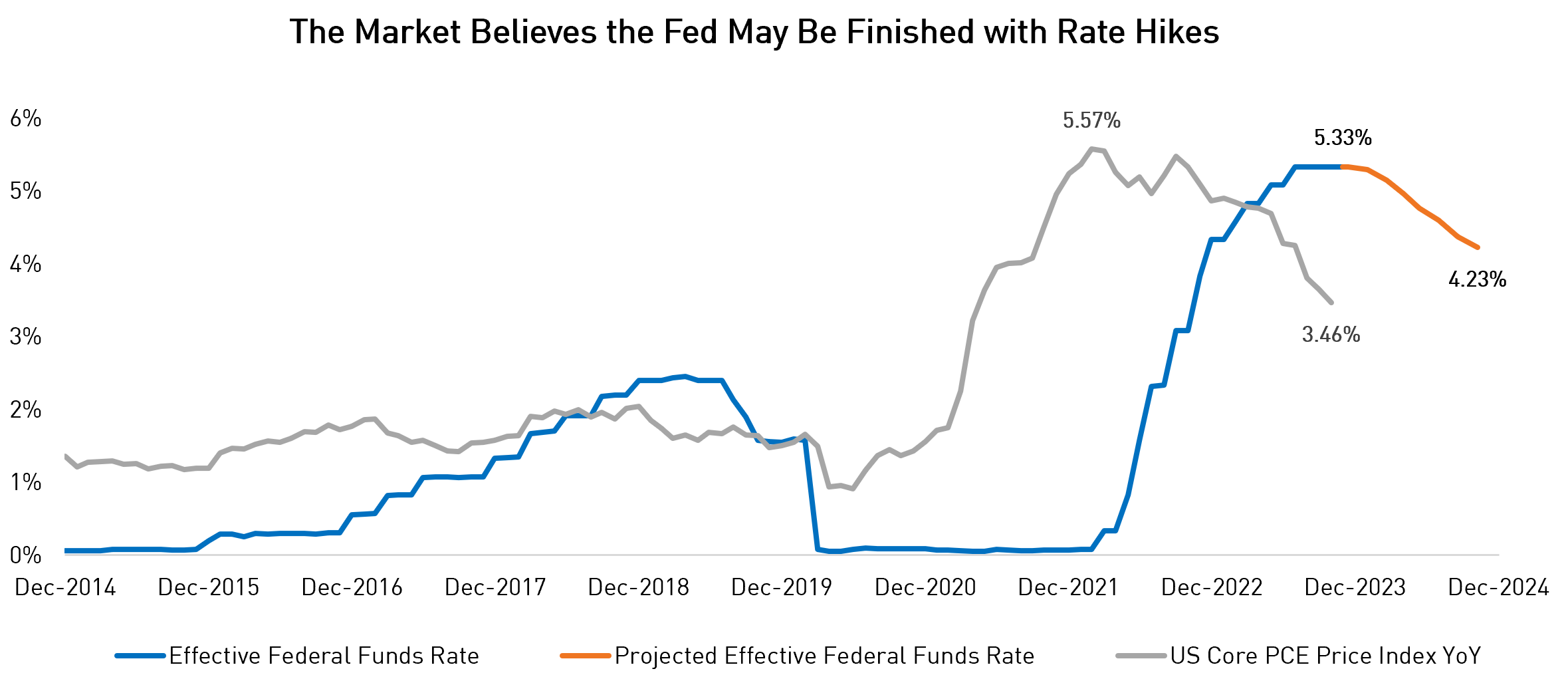

The tide shift began with encouraging US inflation data and continued as the market absorbed evidence of a relatively controlled decline in economic activity. Central bank rhetoric also took on a more dovish tone, causing market consensus to shift toward the belief that developed market central bank rate hikes are done. These dynamics spurred a sharp rally in risk-free yields, and markets now expect ~125 basis points of rate cuts in 2024 beginning as early as March.1

Source: Bloomberg. Data as of December 7, 2023.

Revitalized market sentiment unleashed animal spirits, with assets across the risk spectrum rallying in unison. The rally drove a significant easing in financial conditions and bolstered the market's belief that central banks were achieving a historically elusive soft/no landing. 2

Caution is Required

Uncertainty in the path of interest rates and the economy more broadly has led to large swings in sentiment and valuations. As a recap, sentiment has shifted drastically this year from recession concerns, to fears of a higher-for-longer interest rate environment, to a fiscal crisis, and now back to a soft landing scenario.

We have suggested for some time that US and Canadian central bankers are on hold, a view we maintain because we believe that administered rates have been in restrictive territory for some time.3 While this dynamic is promising, we believe the market may be somewhat ahead of itself by embracing a soft/no landing outcome and simultaneously pricing in early (i.e., March 2024) and aggressive (i.e., 5-6) rate cuts in 2024. In our opinion, it is too early to declare victory over taming rising prices, and the substantial easing of financial conditions should worry policymakers, given inflation is still above target.

Tighter Valuations

Excess optimism around a soft/no landing and global central bank rate cuts also contributed to a significant rally in credit spreads. Index-level credit spreads of both investment grade (“IG”) and high yield (“HY”) credit now sit at or near year-to-date tights and are well within their historical averages.

While we are not calling for a meaningful credit spread widening event, we have taken the opportunity to realize profits in less liquid, beta-driven long positions to reduce overall exposure and rotate capital into more liquid credit structures from issuers with fortified balance sheets.

One of the benefits of active management is the ability to tactically control a portfolio's exposure to beta risk. This allows us to focus on our team's core strength – identifying overlooked areas of the market to capitalize on idiosyncratic credit opportunities. We believe the volatile backdrop this year enhances our advantage as we can capitalize on the dispersion in credit valuations and dynamically allocate to what we view as the most promising risk-adjusted opportunities.

For instance, longer-dated corporate bonds have notably outperformed their short-term counterparts during the recent rally due to a greater decrease in long-end risk-free yields and credit spreads.

-by-maturity-bucket.png?sfvrsn=f7d0f53e_4)

Source: ICE BofA. Data as of December 5, 2023.

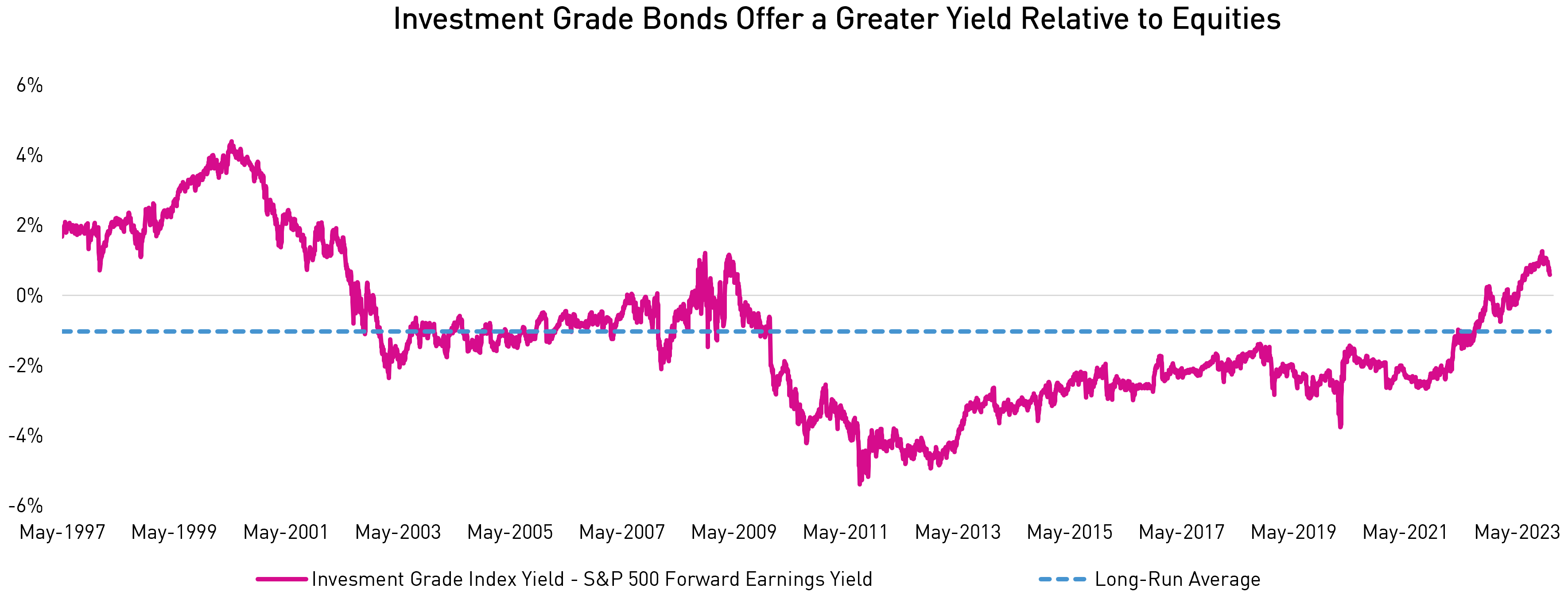

Similarly, HY credit spreads have rallied more than their higher-quality IG counterparts. More specifically, the BBB-rated segment of the IG market, which we believe still contains many alpha-generating opportunities, has lagged the broader rally. We believe this repricing amplifies the value potential of front-end (≤5 years) investment grade credit on a relative basis compared to other fixed income segments, and especially relative to equities.

Source: Bloomberg, ICE BofA. Investment Grade Index Yield = ICE BofA US Corporate Effective Yield.

Re-positioning and Value Moving Forward

While our strategies have participated well in the rally, we remain committed to being nimble and not growing complacent in the event the consensus soft/no landing scenario does not materialize. Barring any material downside economic data, we do not expect central bankers to willingly underwrite the market’s current expectations of early and aggressive rate cuts. Instead, we expect policymakers to retain a hawkish tone in the short-run as they look to regain credibility and control still elevated inflation expectations.

Accordingly, we continue to employ an active and common-sense approach in terms of managing our mandates’ interest rate exposure (duration). We remain constructive on duration in the longer term, but at present, we have tactically lowered our duration position in our active mandates, with an intent to extend again if rates revert higher.

From a credit perspective, we look to de-risk exposures in stretched areas of the market. As mentioned, we maintain a bullish stance on front-end (≤5 years) IG credit, but we remain selective in our positioning and conservative in our use of leverage. Moreover, we remain steadfast in our preference for IG > HY credit, given (1) the greater vulnerability of lower-quality issuers in an economic slowdown, and (2) the recent outperformance of HY vs. BBB IG.

In terms of geographic exposure, relative value continues to oscillate between the US, Canadian, and European markets as their economies moderate at different speeds. Nonetheless, the US continues to offer better opportunities in tax-effective yields via discounted bonds in the ≤3 years maturity bucket.

Sector-wise, the Research Team is diligently assessing our outlook for 2024. As a preview, we are concerned about the strength of the consumer, particularly in Canada, and we remain cautious on cyclical sectors that are most exposed if a soft/no landing is not achieved. Lastly, we see an opportunity to layer back into downside protection at attractive prices following the recent reduction in volatility.

Final Thoughts

Although we feel the market may have gotten ahead of itself, we reaffirm that we believe corporate credit in developed markets will be among the best risk-return opportunities over the coming quarters, especially as cash balances are redeployed in the market.

If you would like to discuss how our fixed income strategies can fit in a broader portfolio in the current environment, please reach out to our team at any time.

1 Source: CME FedWatch Tool – https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?redirect=/trading/interest-rates/countdown-to-fomc.html.

2 Source: Goldman Sachs US Financial Conditions Index (FCI). US FCI eased in November by more than any month in the last forty years.

3 Source: Federal Reserve Bank of St. Louis – https://www.stlouisfed.org/publications/regional-economist/2023/june/is-monetary-policy-sufficiently-restrictive#authorbox . In June 2023, James Bullard, former President and CEO of the Federal Reserve Bank of St. Louis, noted that “monetary policy is now at the low end of what is arguably sufficiently restrictive given current macroeconomic conditions”. Since his statement, monetary policy as arguably become more restrictive given cooling inflation and economic growth data.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice.

The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA.

The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.