As many have come to realize, traditional bond strategies can be heavily reliant on falling or stable interest rates, a tailwind that has eluded markets in recent years. Consequently, many fixed income investors have been frustrated with consistently negative returns that have detracted from their portfolios. On the flip side, the turmoil in bond markets has highlighted the value proposition of alternative credit strategies that can navigate volatile markets and generate positive returns irrespective of interest rate movements.

1. Global Relative Value

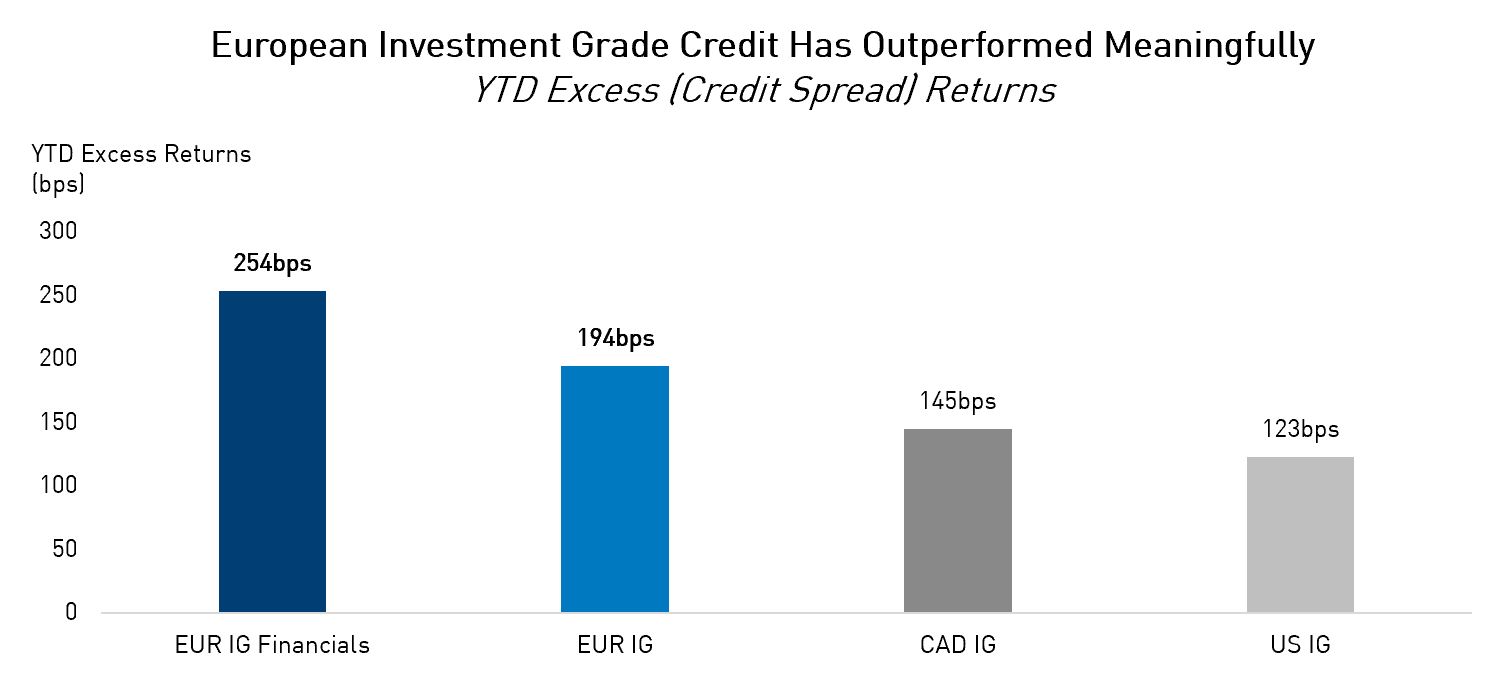

The credit spreads of European firms and US companies issuing in €EUR (i.e., Reverse Yankees) have screened very attractive even after accounting for currency hedging. Moreover, the European Central Bank initiating their rate-cutting cycle has made the macro-environment in Europe much more supportive relative to the US. This has calmed uncertainty and fueled credit demand in the region.

Capitalizing on Opportunities Across the Pond

Our Investment Committee identified this opportunity and quickly relayed it to our Research and Execution teams earlier this year. Our team leveraged their expertise and relationships with European bond desks to execute countless trade ideas under this theme. These trades have driven returns across our mandates year-to-date as European corporate spreads have notably outperformed their Canadian and US counterparts.

Source: Bloomberg. Data as of June 5, 2024. Excess return is a metric used to quantify the duration-neutral return of an index by comparing the total return of a spread index to that of a duration-matched risk-free treasury asset. EUR IG Financials = Bloomberg Euro-Aggregate Corporate Financials, EUR IG = Bloomberg Euro-Aggregate Corporate, CAD IG = Bloomberg Canada Corporate, US IG = Bloomberg US Corporate.

2. A Weakening Consumer Backdrop

Lower and middle-income consumers have been showing signs of strain, with household excess savings tapping out and borrowing rates hovering at two-decade highs. Additionally, leading indicators suggest a recession is still possible this year despite the continued optimism for a soft landing. The performance of consumer discretionary versus consumer staple stocks indicates that much of the consumer weakness has been priced in, but equities do not necessarily speak for credit markets.

Hitting Singles with Single-Name Short Opportunities

Consumer discretionary credit spreads have also underperformed, but our Research team has identified several high-conviction single-name short candidates (reserved for our long/short mandates) within the sector. These candidates share common characteristics such as vulnerable balance sheets, a deteriorating consumer base, and upcoming refinancing needs. While our portfolios are always long-biased, we believe that sensibly sized short positions in vulnerable consumer-related credits can provide incremental returns for our investors.

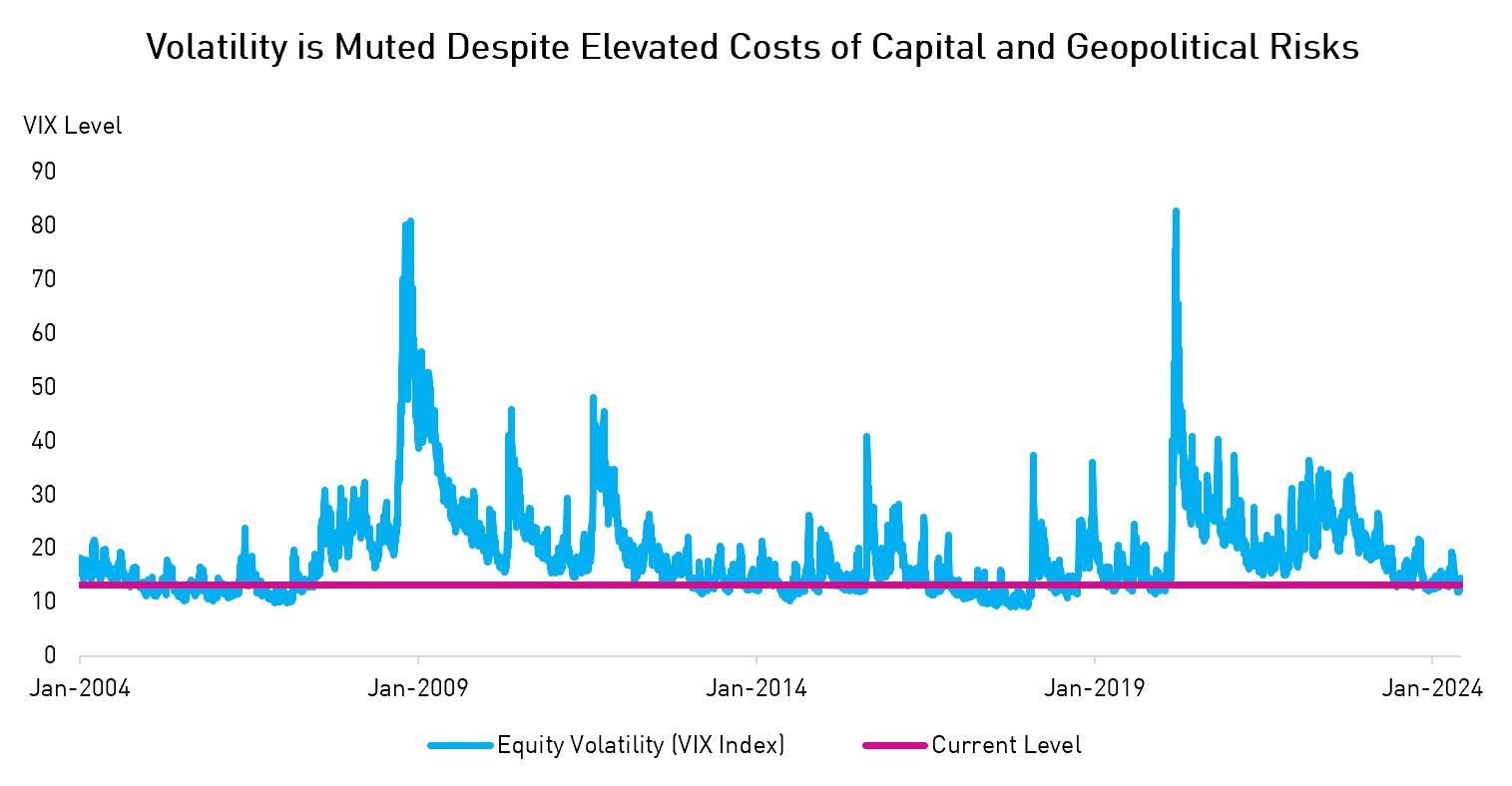

3. The Volatility Masquerade

Volatility across asset classes has been muted on average despite elevated costs of capital and geopolitical risks. But whatever the rationale for suppressed volatility may be, the tide could be turning as growth forecasts and labour market metrics begin to trend downwards. As we know, higher volatility tends to be episodic rather than steady, meaning spikes often catch market participants by surprise.

Source: CBOE S&P500 Volatility Index. Data as of June 5, 2024.

Embedding Downside Protection

Today’s combination of high carry (income earned via interest) and low volatility makes it cheap to layer downside protection into portfolios. Given these conditions, we believe it is prudent to sacrifice some yield for capital preservation. Essentially, we give up a portion of the attractive yield we’re earning in our portfolios to embed convex protection, which simply means our macro-oriented hedges pay off in an increasing manner as markets sell-off. With stocks at or near all-time highs and subdued volatility, we believe options on equity index ETFs and volatility products are the best vehicles to provide this type of defense.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice.

The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA.

The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.