September has bid farewell to relaxing summer weekends and white pants and ushered in morning drop-offs and the beginnings of sweater weather. As this month marks many transitions in our personal lives, we wanted to share what it will mean for credit markets in the months ahead – the key themes and opportunities we anticipate during the final quarter of this year. As always, questions and comments are welcome.

Volatility will likely persist heading into the fall

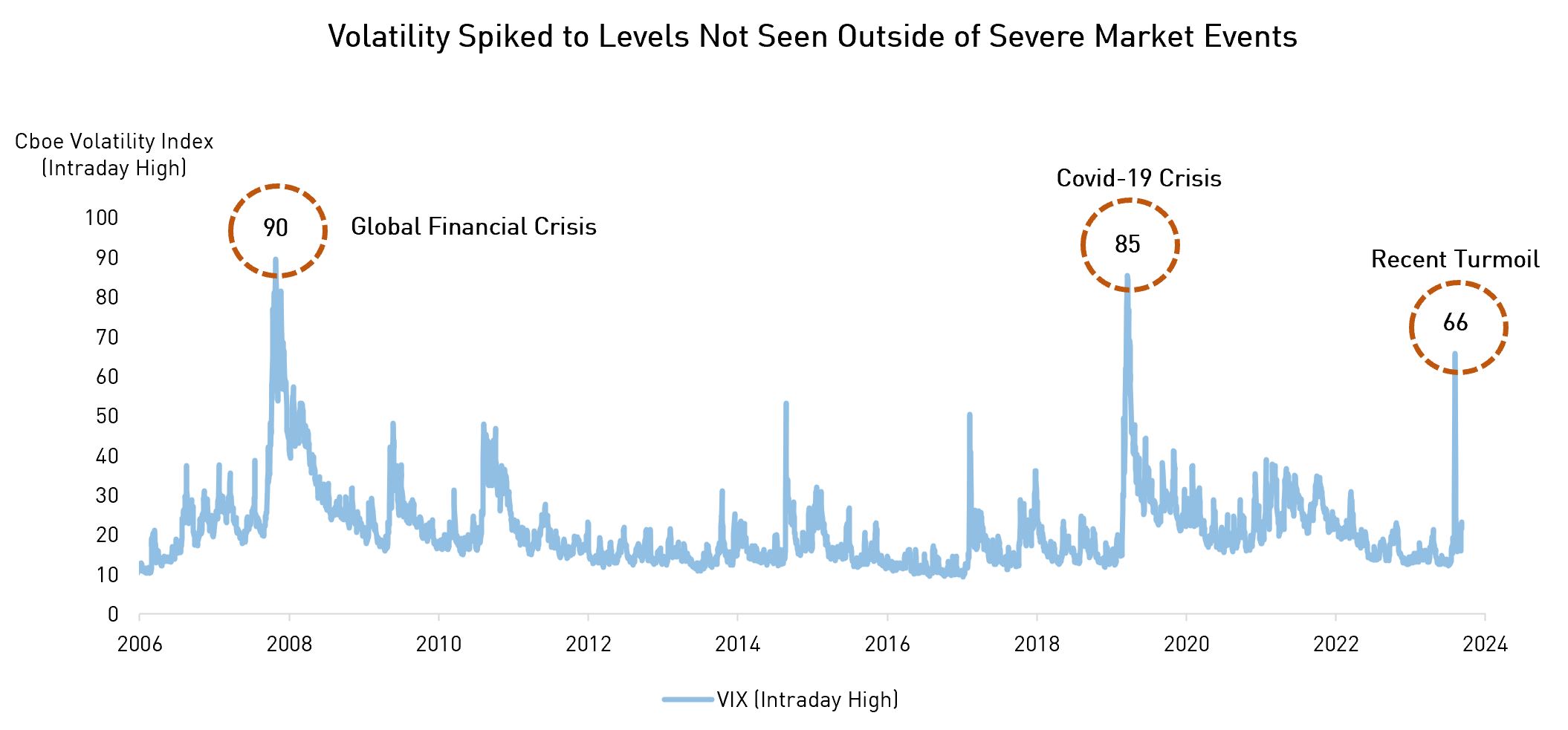

August started with a major bout of volatility caused by several macro and technical developments, with the initial unwind of the now infamous Japanese Yen carry trade perhaps being the most impactful. The VIX, an index that measures the volatility of the S&P 500 index, reflected the market panic by spiking to levels not seen outside of the COVID-19 crisis and the Great Financial Crisis.

Source: Cboe Exchange, Inc. Data as of September 5, 2024.

While markets recovered quickly, we expect them to experience more bouts of volatility between now and the end of the year as analysts continue to pore over every job number and inflation estimate to divine the likely policy response of central banks. Of course, we also have a pivotal US presidential election to look forward to.

Overall, we think conservative positioning is warranted, given the uncertain backdrop and the broadly speaking “average” valuation levels for risky assets. Accordingly, we have been adding to downside hedges in the portfolios that have the flexibility to do so. September also tends to be a heavy month for corporate bond supply, so having less exposure at this juncture means more room to add attractively priced new issues in the primary market. For now, we believe “less is more,” and our portfolios are focused on shorter-dated, higher-rated, more liquid issuers versus the start of the summer.

Dispersion in credit spreads can present opportunities for active managers

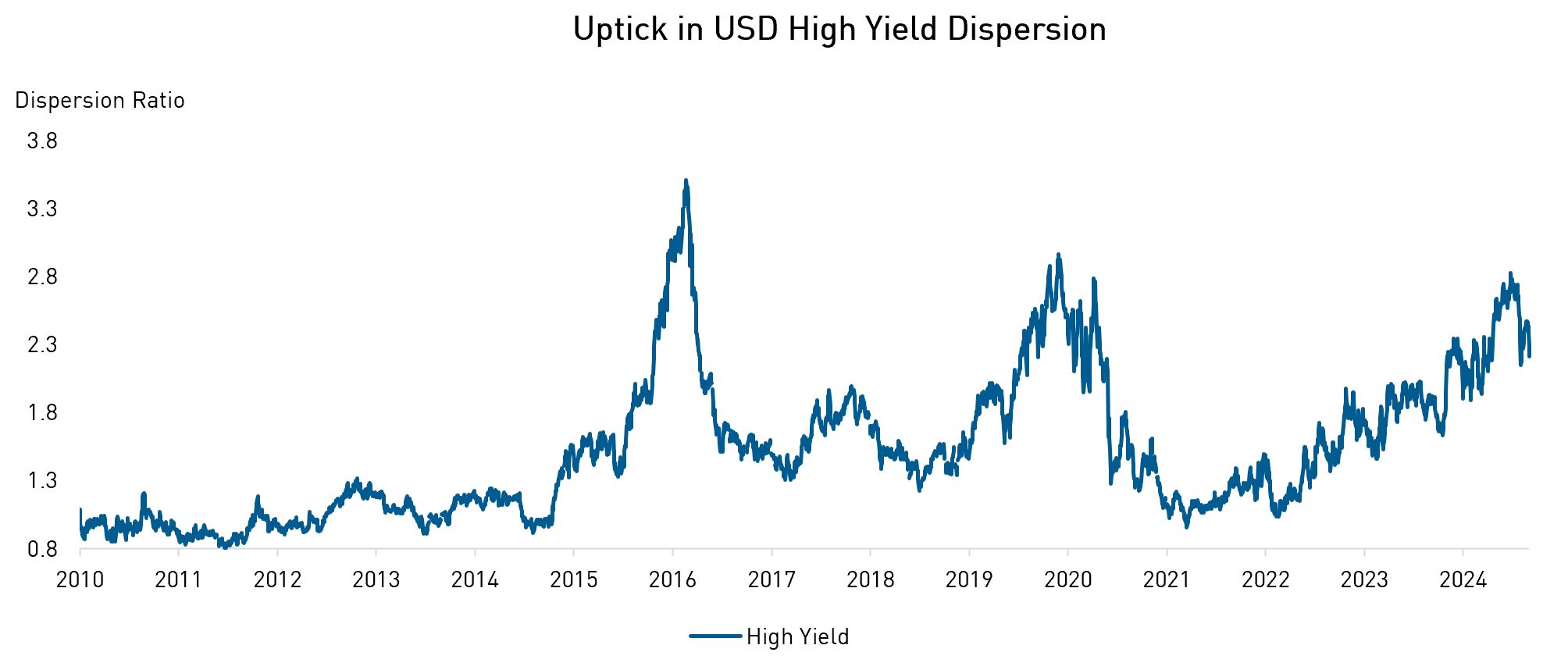

As an active and value-focused manager, the average level of credit spreads is less important to us than the dispersion between credit spreads across different issuers and markets. This year, there has been an uptick in the dispersion of credit spreads, particularly within the high yield market. In general, greater dispersion means more relative value opportunities.

Spread dispersion is the inter-decile range divided by the median across the bond index constituents.

Source: iBoxx, Goldman Sachs Global Investment Research. Data as of September 5, 2024.

As noted above, we are positioned conservatively, given our expectation of more volatility to come. However, we are constantly shifting the composition of our portfolios to capture the opportunities we’re seeing from elevated dispersion in the market. For instance, our most flexible strategy, RP Select Opportunities, began the year with only 12% below investment grade exposure, while today, roughly 46% of the portfolio is rated BB or B. The higher yielding exposures that we have are in specific situations where we believe the compensation is adequate for the risk. We are also utilizing dislocations between qualities to embed targeted single-name short positions in issuers that are more vulnerable to an economic slowdown. Simply put, more dispersion means more opportunities to add value from active management, which we believe should result in greater excess returns for our clients.

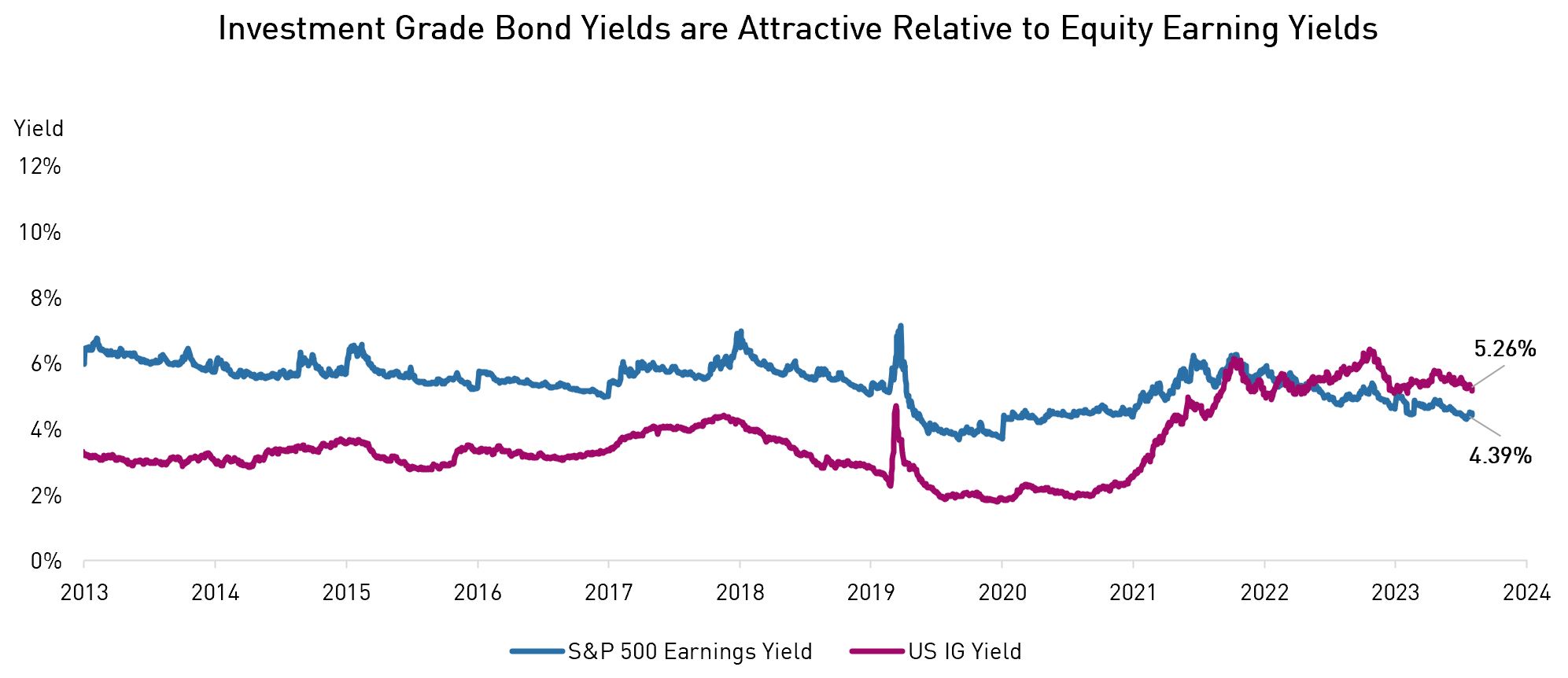

Credit can play an important role in investor portfolios

Finally, we still think investors should be asking themselves if they have sufficient exposure to credit in their portfolios at this time. We believe credit is best thought of as “equity-lite” – in other words, when you invest in credit, you can still expect to earn excess returns, but without the potential downside of equity investing. Currently, the yield of the US IG bond index exceeds the expected earnings yield of the S&P 500. This is a divergence from the usual relationship where equities tend to offer a premium for the greater risk the investor assumes.

Source: Bloomberg, ICEBofAML. Data as of July 31, 2024.

Given the run equities have had and the propensity for volatility in the coming months, we believe some investors should consider replacing some equity exposure with more defensive credit exposure. The “cost” of doing this in terms of foregone returns may very well be lower than it has been in some time. Once again, we reaffirm our belief that corporate credit in developed markets will be among the best risk-return opportunities in the coming quarters.

Please feel free to contact us if you would like to discuss these themes further or learn more about how we could help you meet your investment objectives.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice.

The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA.

The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.