Key Points

- Hybrid and Additional Tier 1 (AT1) Capital are types of bonds typically issued by investment grade companies.

- These markets have grown due to unique characteristics that benefit both issuers and investors.

- We actively participate in these markets, taking advantage of opportunities in the secondary market, and have capitalized on recent new issue opportunities.

Capital Structure 101

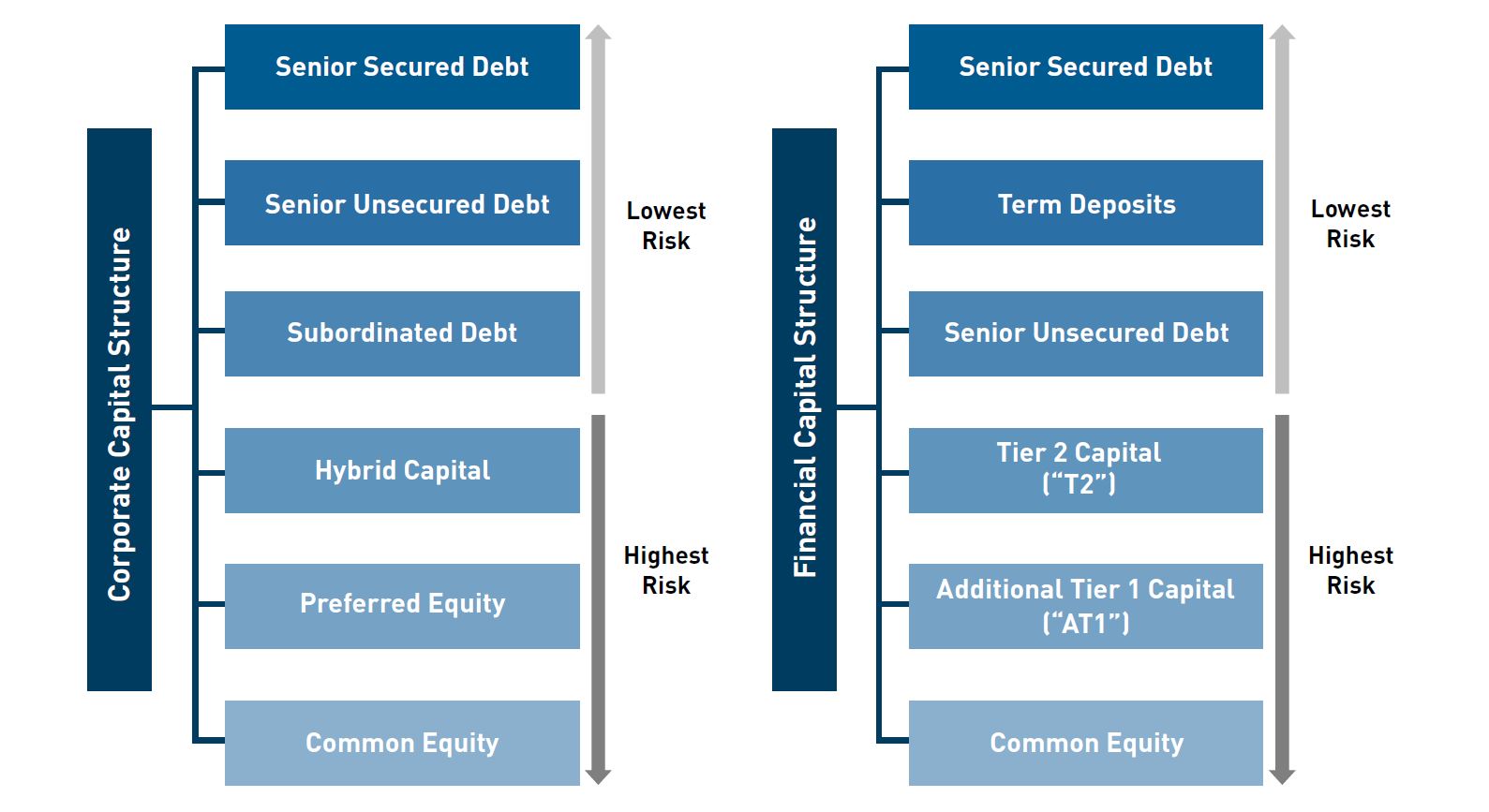

Non-financial companies (which we refer to as corporates) and financial companies fund themselves through debt or equity, and some use instruments that have features of both. Collectively, we refer to this as the company’s capital structure.

In the event of a bankruptcy, the holders of securities at the top of the capital structure get repaid first, while equity holders generally have the highest risk of receiving nothing. This is why securities higher in the stack are generally less risky and tend to offer less return potential, while securities lower in the capital structure provide more return and come with more potential risk.

For illustrative purposes only.

Investors are likely familiar with higher-quality segments (senior debt) as these are your traditional bonds, and lower-quality segments (preferred and common equity). As specialized bond managers, we often find value in the more niche areas of the market. More specifically, we have recently been taking advantage of the compelling opportunities in hybrids and AT1s.

Hybrids versus AT1s

Hybrids and AT1s can bear significant differences besides nomenclature, including loss absorption mechanisms, call features, coupon classifications, subordination ranks, etc. However, what’s important is why these securities are issued in the first place.

Non-financial firms issue hybrids as a strategic tool to balance leverage and credit ratings. Since hybrids receive a 50% equity classification from rating agencies but still carry debt-like characteristics (e.g., coupons are tax deductible), issuers can access capital at a lower cost than issuing equity, which helps strengthen their financial position without excessively diluting shareholders.

In contrast, financial firms issue AT1 securities, which are designed to meet regulatory capital requirements, enhance financial stability, and reduce the risk of taxpayer-funded bailouts. These capital requirements were introduced after the 2008 crisis to reinforce bank balance sheets.

Despite their differences, both are forms of subordinated capital that can present attractive opportunities for investors seeking higher yields, especially in a market where careful security selection and deep expertise around structure nuances can uncover mispriced value.

Taking Advantage of This Market

These securities offer three primary benefits for us as an investor:

Higher yields with only marginally more risk: They offer yields typically associated with high-yield bonds, yet they are generally issued by high-quality investment-grade companies. Although they are rated slightly below the issuer’s senior unsecured bonds and carry higher risk in the case of default, there are several safeguards that incentivize issuers to meet their obligations.

Mispriced opportunities: Our firm has extensive experience in this space, and we have worked closely with issuers of these securities for decades. We scrutinize covenants with heightened diligence when navigating lower tiers of the capital structure to ensure we are adequately compensated. Our process allows us to be active participants and capitalize on recent new issue opportunities.

- Growing market in North America: The US corporate hybrid issuance has hit all-time highs, and Canadian conglomerates like Rogers Communications have recently tapped the domestic and US hybrid markets with new issues. As choice grows, so does our ability to translate our research into real returns for investors.

Tying it Together - Recent Examples

Rogers has been a high-conviction holding across our portfolios at the senior security level (rated BBB-). We were eager to participate in both the CAD- and USD-denominated hybrids issued in February 2025. These BB rated securities offered a healthy yield pickup over senior bonds and a solid credit spread pickup over average BB rated bonds despite being issued by an investment grade company at the parent level.

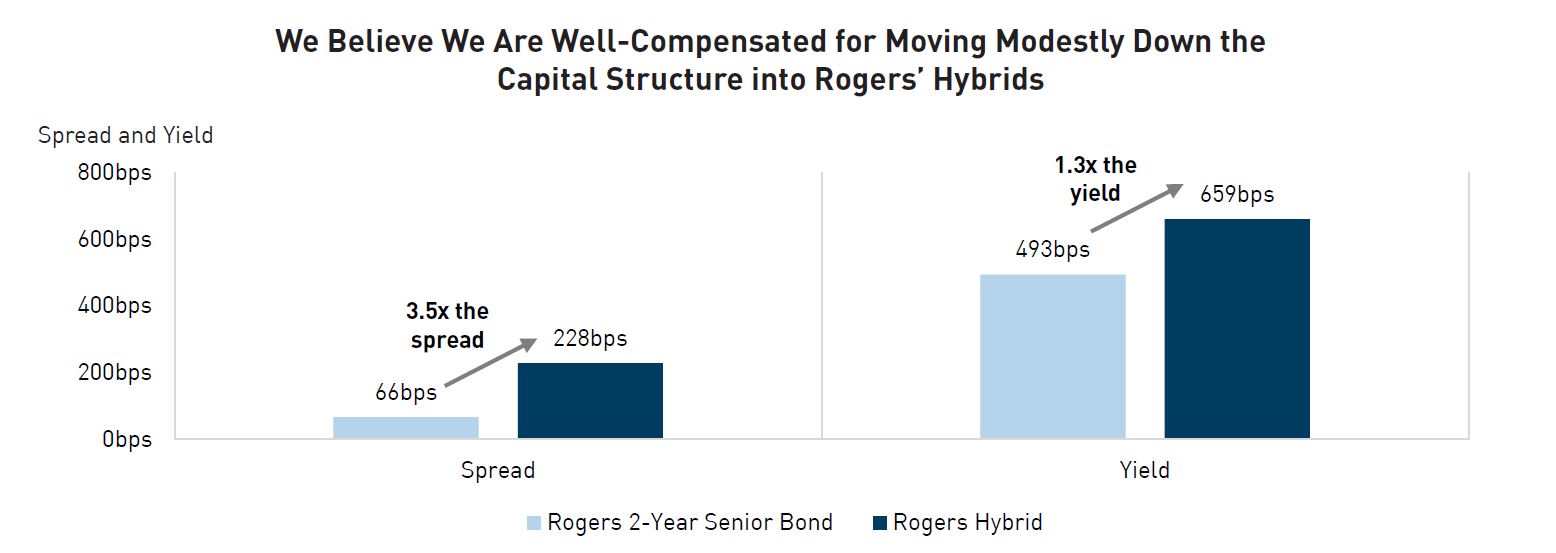

We were also active participants in the secondary hybrids market around the time of the new issue, particularly in the legacy USD-denominated hybrid callable in 2027. It is important to note that Rogers has strong structural incentives to call (repurchase) this security at the call date. At the time, it was trading at a discount to par and at approximately 3.5 times the spread of a similarly maturing 2-year senior note. We built a sizable position across our portfolios, given the high probability of the security being called in 2027 and its attractive 6.6% yield to call. While still a holding, we have realized some profits as the hybrid’s spread rallied significantly.

Source: Bloomberg. Data as of February 3, 2025. Rogers 2-Year Senior Bond = RCICN 3.2 2027-03-15. Rogers Hybrid = RCICN 5.25 2082-03-15. Spread is represented by the option-adjusted spread. Rogers 2-Year Senior Bond Yield is represented by the yield-to-worst. Rogers Hybrid Yield is represented by the yield-to-call.

Similarly, we began the year overweight European Yankee banks (European-domiciled banks that issue USD-denominated securities) based on supportive technicals and relative value dynamics. We expressed this view by identifying attractively priced AT1 capital from high-quality, predominantly global systematically important European banks. This positioning has performed well year-to-date, as Yankee bank spreads have compressed (outperformed) those of the Big Six US banks.

Given the uncertainty at hand, we are firm believers that this market environment requires a nimble approach that can actively capitalize on opportunities across the fixed income spectrum. Our expertise across the capital structure enables us to participate in securities and exploit new issue opportunities in an otherwise constrained credit market.

Please feel free to contact us if you would like to discuss these themes further or learn more about how we could help you meet your investment objectives.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice.

The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA.

The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.