Executive Summary

- Positive performance continued in May as markets looked past short-term pain to the gradual re-opening of the economy.

- The Federal Reserve made its debut in the market buying a mix of mostly investment grade and some high yield ETFs.

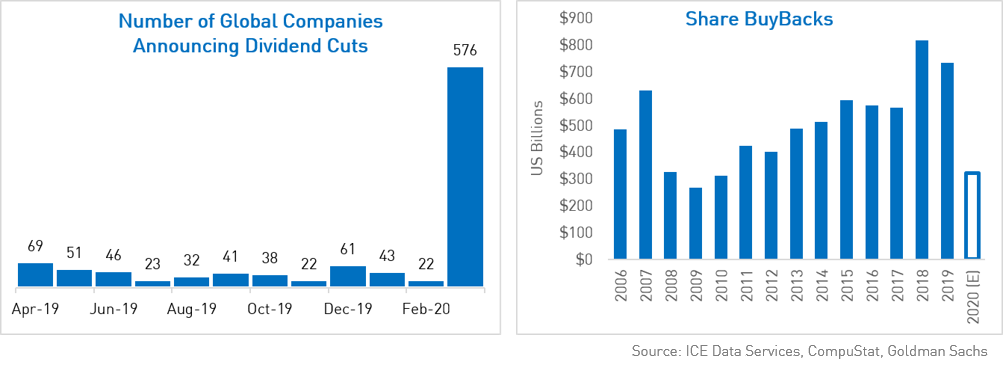

- While there are many roads an investor can take on the path to recovery, we continue to think a Federal Reserve backstop, income and further spread compression make credit an ideal asset class versus equities which face dividend cuts and the cancellation

of stock buybacks.

Markets extended their positive performance into the month of May as participants looked past near-term pain towards the possibility of a sustained recovery. With U.S. unemployment hitting 14.7% in April (the highest level in post-war history), the personal savings rate hitting 33% and consumer activity at all-time lows, we got a clearer sense of how hard hit the consumer and small businesses were. However, markets remain forward looking with an eye towards a steady re-opening of economies, progress on the vaccine-front and the eventual unleashing of pent-up demand as people return to work and spending. Even a re-escalation of US-China trade tensions could not push this market off the recovery path.

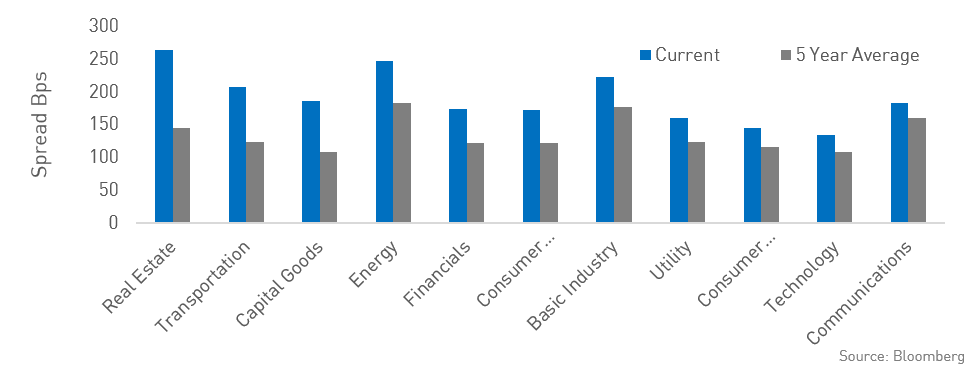

Within corporate bonds we saw investment grade credit spreads continue to retrace from the wides experienced in March. The Federal Reserve (“Fed”) began its buying programs via ETF purchases which helped underpin spreads in both investment grade and high yield markets. As of May 19th the Fed had bought $1.3B in ETFs, 83% of which were investment grade and the remainder high yield. However, the size of the buying is relatively limited (up to 20% of AUM), and while helpful, we continue to believe that the Primary and Secondary facilities used to buy company specific bonds will also be effective tools in the Fed’s toolkit if needed. The debate continues over whether the Fed will actually have to use these facilities or whether they have already been effective in calming markets without full scale adoption. Case in point, investment grade spreads in the U.S. are now sitting within or slightly tight of levels that we would view as reflective of a “normal” recession (in the 200 to 250 bps range). We have also seen a wide range of companies be able to access the primary credit markets in recent weeks, which relieves the pressure from the Fed near-term.

Given how far spreads have retraced from their peaks (from the peak of 373 bps reached on March 23rd to end the month at 171 bps), many investors may be wondering how much more room there is for returns in risk assets such as equities and corporate bonds. In the case of equities we agree that the current outperformance may stall as equity markets have performed tremendously well despite Q1 2020 earnings contracting roughly 13 to 14% from Q1 of 2019. The near-term outlooks is also dismal with Q2 2020 estimates expecting a 40% or more fall year-over-year. Equity valuations may be hard to justify against this type of earnings recession with a cyclically adjusted P/E ratio that is in the 93rd percentile on a valuation basis going back to 1881.

However, credit is a different story and one that we think continues to be a good risk-reward proposition for investors trying to decide which road to take towards recovery because of the dramatic retracement we experienced in April and May. Unlike equities, bondholders sit higher in the capital structure and benefit from this seniority in terms of safety of capital in the longer term. This is unlike the equity path where companies have been forced to drastically cut or eliminate dividend and share buyback programs to preserve cash (a large driver of equity returns over the last decade). Thus, on a risk-adjusted basis corporate bonds continue to look favourable to equities with the upside from possible spread compression replacing the “buyback boost” that has been reduced/removed from the equity market and a stable source of income that is also being eroded from equities thanks to dividend cuts.

Solely from a risk perspective, the Fed stands ready as a lender of last resort, placing a theoretical limit on how wide spreads can move going forward, even in some of the more bearish scenarios we can conceive of. The Fed can still intervene on many levels, including adding liquidity back into markets via its secondary buying program (purchasing of company-specific bonds already issued in the market) or by funding issuers who cannot easily raise capital through the normal processes in the primary market. In our view, the probability of a repeat of the liquidity crisis we experienced in March has been greatly reduced by the Fed’s actions and commitment to credit markets.

However, even credit’s path to recovery will not be a straight and easy one and your implementation should reflect this. The COVID-19 crisis has created high levels of dispersion and clear winners and losers unlike past recessions. This means a passive approach could expose investors to unintended risks and exposure to sectors which will see structural headwinds for the long term. Consider that while Financials, Energy and Consumer Discretionary issuers saw earnings decline in the most recent period sectors such as Consumer Staples, Utilities, Health Care and Information Technology actually posted decent earnings growth thanks to their valuable positions within the new “work-from-home economy.”

In addition, many investment grade credits are still on negative watch by the rating agencies ($600B+ of BBBs for example) which means the credit market you buy today may look very different tomorrow. We continue to see “cheap” valuations in short-dated BBB bonds in the US and in select BB and Crossover issuers. Meanwhile, higher-rated AA, A and longer duration investment grade bonds are beginning to look less attractive as they have retraced a large portion of the weakness experienced in March. So, while we believe credit is an opportune way to play the path to recovery, we also believe the active management premium is higher than it has ever been.

For our portfolios this translates into a highly selective approach to investing capital as a necessary ingredient for success. Case in point, the top contributors for our strategies in May continued to be more concentrated than usual in certain sectors, all of which we think were well positioned to thrive in the challenged environment. This includes Communications (Charter Communication), Financials (Goldman Sachs, Wells Fargo), Healthcare (Perrigo, Abbvie) and Media (ViacomCBS, Telus).

Outside of investment grade, we continue to find very selective opportunities in high yield, focused on businesses that are being hurt by the high yield label despite their fundamental strength (CenturyLink) and also those that have been hard hit by the current economic shutdown and who need to “bridge the gap” between the current period and eventual re-opening (Six Flags). This need has resulted in issuing highly collateralized bonds which still offer yields well above what these issuers would have normally paid for such highly secured issuance. This collateral security translates into downside protection – even in worst case scenarios (such as a second wave of global shutdowns) these bonds will benefit from collateralization and high recovery rates, even if the company itself goes into default (which is not our base case scenario). We continue to look across the globe for these types of relative value opportunities, creating risk-reward profiles that we believe will be the best roads to take as we move towards recovery.