Markets Were a Rollercoaster in Q3

Markets entered Q3 positively, with risk assets performing well in July and corporate bonds up anywhere between 3-6% across Canada, the US, and Europe. Equities initially also rallied sharply on the back of favourable technical analysis and, ironically, troubling economic data and corporate earnings commentary. The "bad news is good news" adage was back in play as some speculated that signs of an impending recession could lead central banks to slow or pause their tightening cycles. This belief loosened financial conditions and challenged whether central banks are committed to taming inflation at all costs.

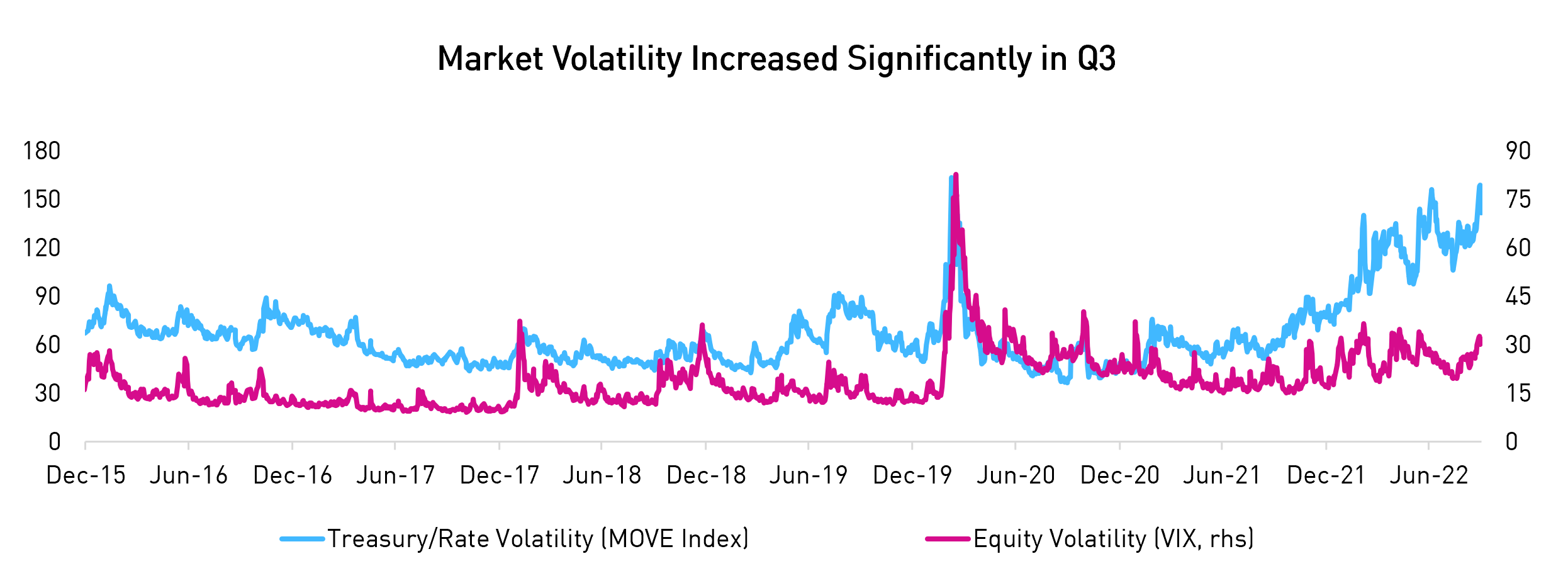

Unfortunately, this rally was short-lived. Increasingly sticky inflation reignited hawkish central bank rhetoric, which intensified due to geopolitical developments that whipsawed bond yields higher. In contrast, bond and equity prices moved lower in a highly correlated manner. The volatility of public assets continued to be extremely high, as seen in Figure 1. Toward the end of the quarter, volatility was exacerbated by unexpected fiscal stimulus in the UK, which sent UK government bond yields soaring, prompting intervention by the Bank of England.

Figure 1. Source: CBOE, ICE BoA

Volatility Across Markets Providing Opportunities

We believe the uncertain backdrop warrants defensiveness and caution in the short term, being prudent and using hedging tools to protect the downside. However, there is a silver lining - or three.

- The running yield of fixed income portfolios has increased significantly

- Dislocations across corporate bond markets have become more pronounced

-

Security selection opportunities are better than they have been in some time

After a decade of fixed income offering investors only a modest return, today, even high-quality Investment Grade ("IG") portfolios provide investors with an attractive running yield. For example, the Canadian IG Bond Index today offers investors a yield higher than the dividend yield on the TSX (5.1% versus 3.4%). In other words, investors can now earn a higher running yield from fixed income, despite being higher in the capital structure, with more downside protection from a pull-to-par. For more conservative investors, it is possible to earn 5% or more from even a very short-duration IG bond fund.1

With broad market volatility, the divergences across industries, sectors, and countries have picked up tremendously. This environment allows our portfolios to add attractive positions from both a relative and fundamental value basis. We believe the Canadian economy is more fragile than the US economy, with a higher sensitivity to an economic slowdown due to higher debt levels and housing market considerations. In response, we have increased allocations to US credits that we believe offer more liquidity and better fundamentals. From a sectoral perspective, we prefer US banks and telcos (particularly companies with near-term de-leveraging potential), and we dislike low-margin, inflation-sensitive, and highly consumer-dependent sectors.

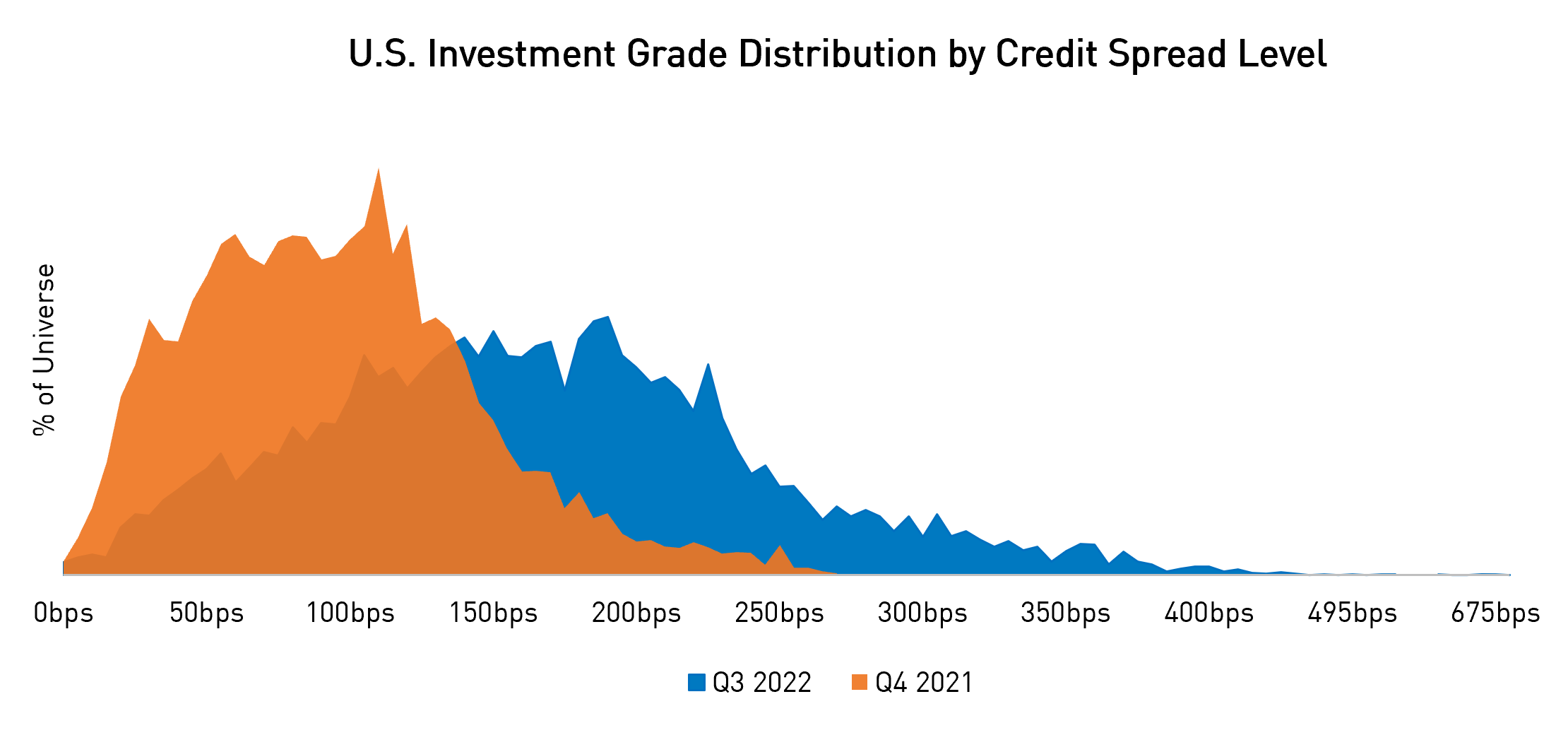

Even within specific geographical credit markets, the opportunities from security selection have improved considerably since the start of the year. Figure 2 shows the credit spread range of securities in the US IG index at the end of Q3 compared to the beginning of the year. A much wider dispersion in security valuations (as seen in blue) means many more opportunities for security selection to benefit our investors.

Figure 2. Source: Bloomberg. Data as of Sept. 29th, 2022. Index = Bloomberg US Corporate Total Return Index.

Long-Short Credit Strategies are Well-Suited for This Environment

Our long-short credit strategies can hedge and mitigate sharp moves from broad changes in rates and credit spreads, which has been the downfall of most traditional bond strategies during this period. Simultaneously, our highly active nature allows us to be tactical and gain returns from the opportunities we see in credit markets. We believe that these strategies can deliver diversification and positive returns to investors in this challenging environment. Please do not hesitate to get in touch with our team if you want to discuss how long-short credit strategies could benefit your portfolio.

1 As of Sept. 30th, 2022, RP Fixed Income Plus (a long-only short-term investment-grade mandate) has a duration of 1.5 years while yielding 5.7%. The same metrics one year ago were at 0.9 years and 1.2%.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should

not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing

it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated,

the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully

offered and to investors who qualify under the applicable regulation. RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. “Forward-Looking” statements

are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future

events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.