Back

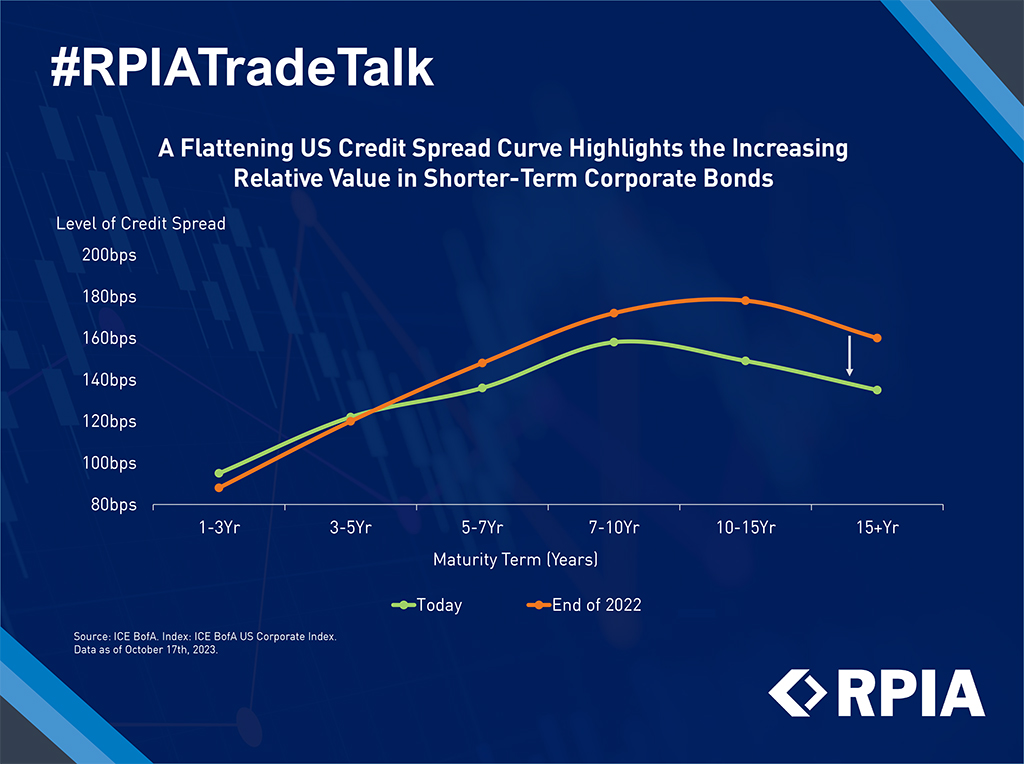

A Flattening US Credit Spread Curve Highlights the Increasing Relative Value in Shorter-Term Corporate Bonds

The US corporate credit curve has been flattening recently, which means the credit spread of longer-dated corporate bonds (10yr+ terms) has decreased by more than those with shorter maturities. This is in stark contrast to the closely followed risk-free government yield curve, which has been steepening in recent weeks.

There is a myriad of reasons for this phenomenon, but simple supply and demand dynamics are likely the main culprit. Higher risk-free rates can lead to muted long-end bond issuance as issuers try to avoid locking in high borrowing costs for long periods. Additionally, large indiscriminate buyers such as insurance companies and pensions are relying more on long-end credits now to meet their obligations instead of relying on riskier assets.

In light of this trend, we believe there is increasing relative value appeal in shorter-term corporate bonds (<= 5 years), and we have taken this opportunity to adjust our portfolios to favour the shorter end of the maturity spectrum.