Back

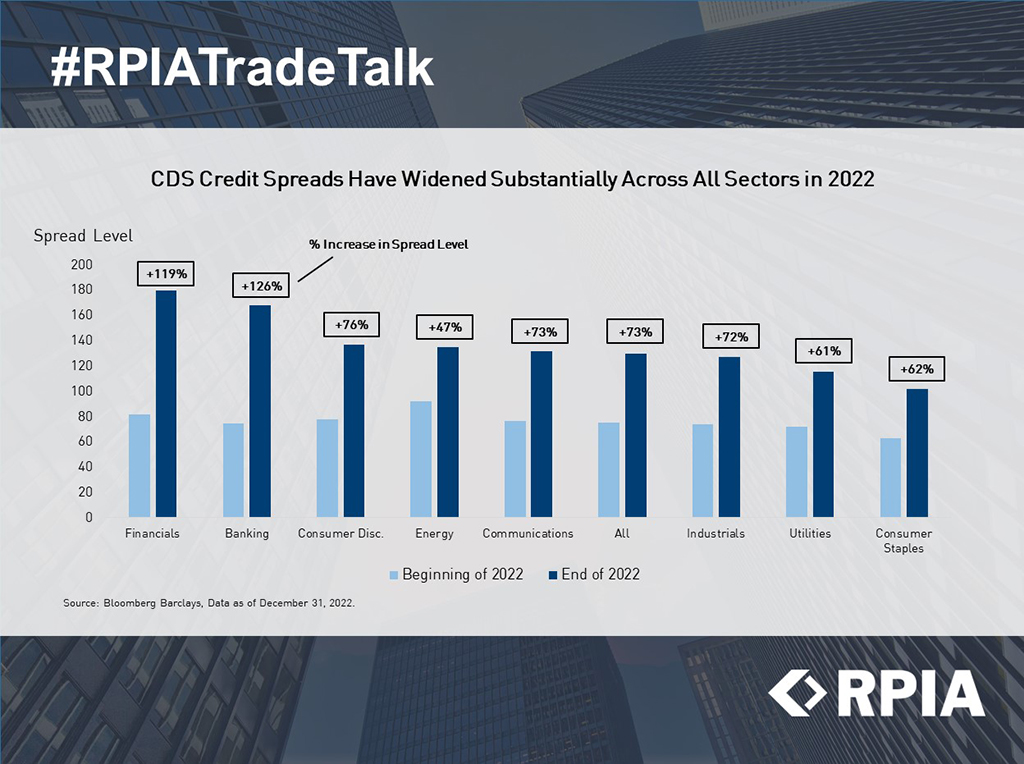

CDS Credit Spreads Have Widened Substantially Across All Sectors in 2022

2022 saw credit spreads widen across sectors and contribute notably to the 73% spread increase on the 5-year corporate bond. However, the move wider was not uniform across sectors - financials and the banking sector saw large moves, while utilities and consumer staples were less effected. Although we expect to see weakening corporate profits and fundamentals moving forward, we do not see evidence of poor corporate credit underwriting and excessive risk-taking.

Additionally, many corporate issuers took advantage of lower funding costs in March 2020 to refinance maturing debt issues, making them well-positioned for this upcoming year. We believe this market environment can provide us with opportunities to generate additional returns in excess of the starting yield of our portfolios, while aiming to stay reasonably well-insulated from default risk despite the deteriorating economic picture.