Back

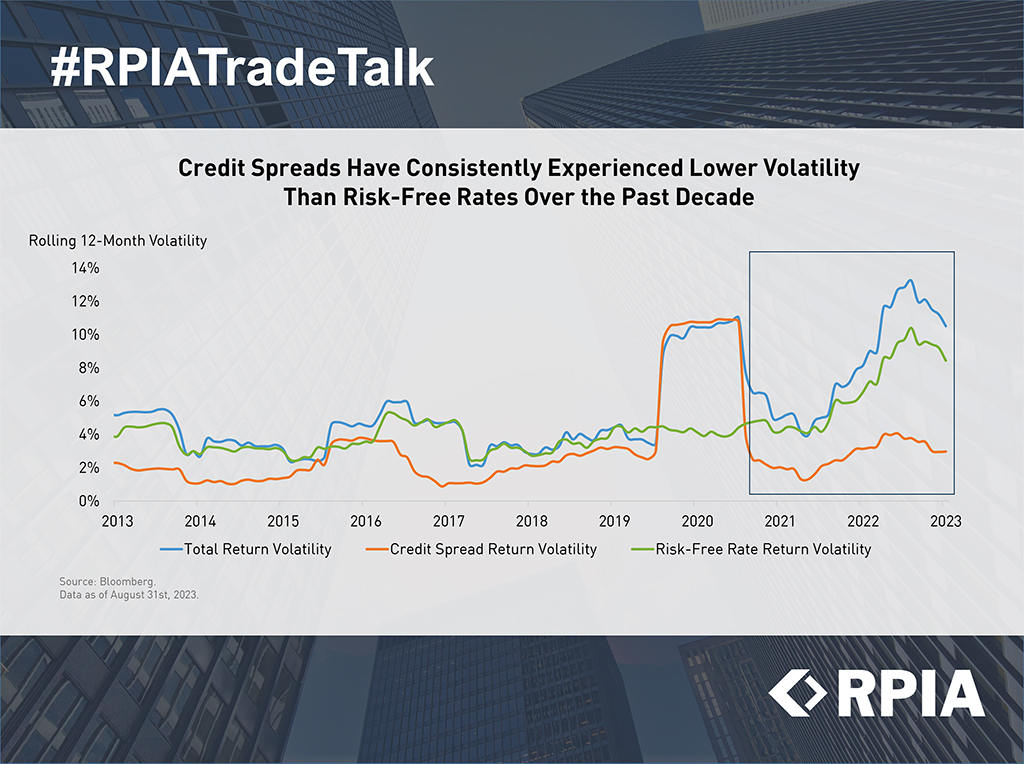

Credit Spreads Have Consistently Experienced Lower Volatility Than Risk-Free Rates Over the Past Decade

Perhaps surprising to most investors, the "risk-free" component has been more volatile than the credit spread component of corporate bonds over the past decade, with the exception of a few short-lived periods. While counterintuitive, the phenomenon can be especially true when inflation expectations are elevated and uncertain.

Many investors dismissed rates volatility when interest rates were falling pre-2022. However, today, with elevated inflation, higher rates, and an uncertain monetary backdrop, investors are exposed to the potential drawbacks of relying solely on interest rate exposure as the primary return driver for bond portfolios. In our role as an active bond manager who seeks to mitigate rates-related risks, we believe that shifting the focus to credit spread returns can be a prudent strategy to generate superior risk-adjusted returns.