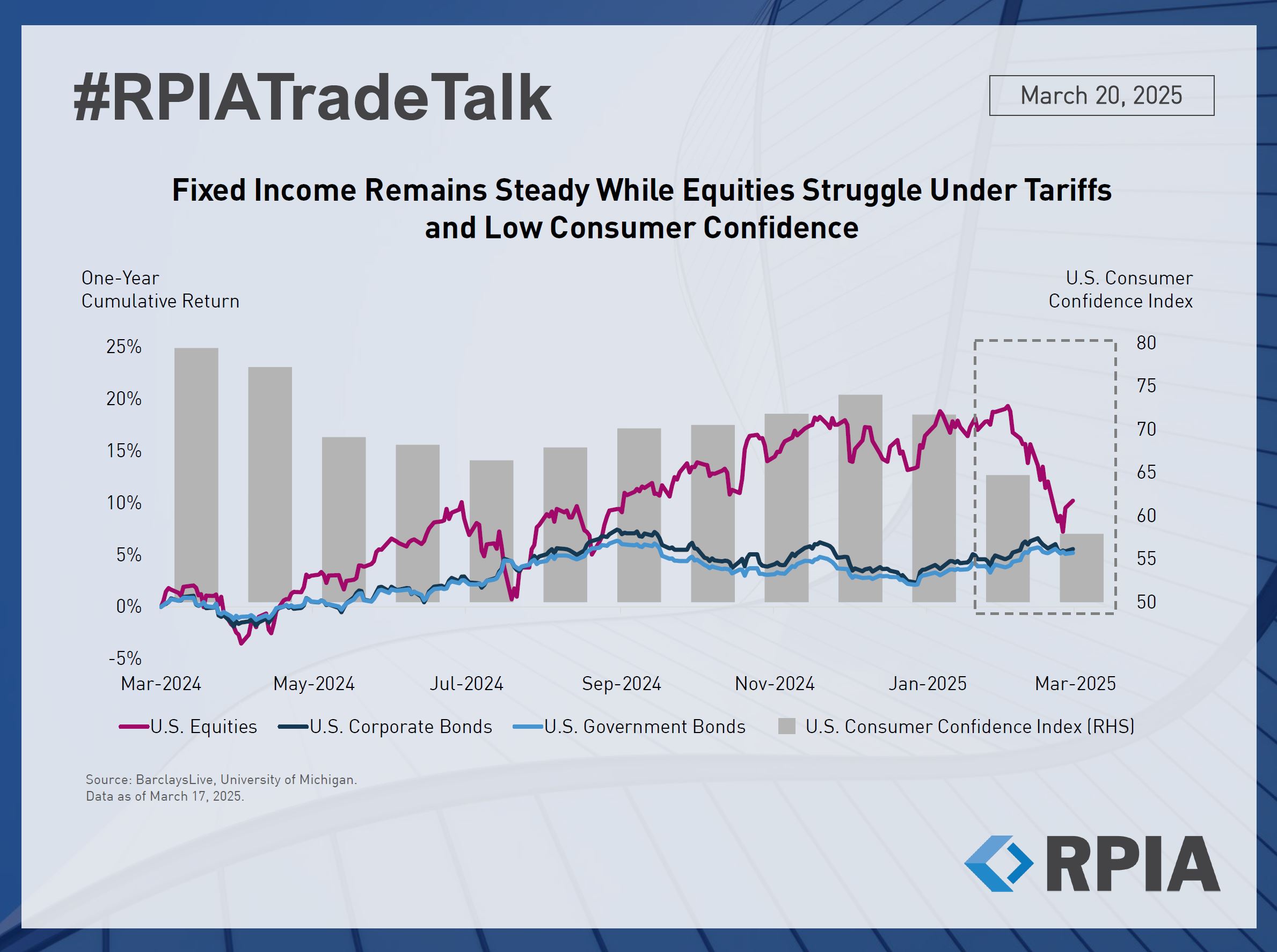

As trade war and inflation concerns continue to rise, U.S. market sentiment has turned increasingly cautious. The University of Michigan Consumer Sentiment Index, a key measure of U.S. consumer confidence, plunged to 57.9 in March 2025, the lowest level since November 2022. Likewise, equities are also struggling, with the S&P 500 down ~10% from its February peak, erasing all post-election gains. In contrast, fixed income has remained resilient. Government bonds have held up well as yields declined amid rising economic uncertainty, and corporate credit continues to be supported by attractive yields and strong investor demand.

There’s no doubt the market ahead will be marked by volatility across asset classes as headline risks continue to unfold. We believe this is a time to be prudent. That said, as increased volatility produces greater dispersion, we remain tactical to capitalize on relative value opportunities as they arise in the evolving market landscape.