Back

Improving Market Sentiment Has Helped Moderate Rates Volatility

and Credit Spreads

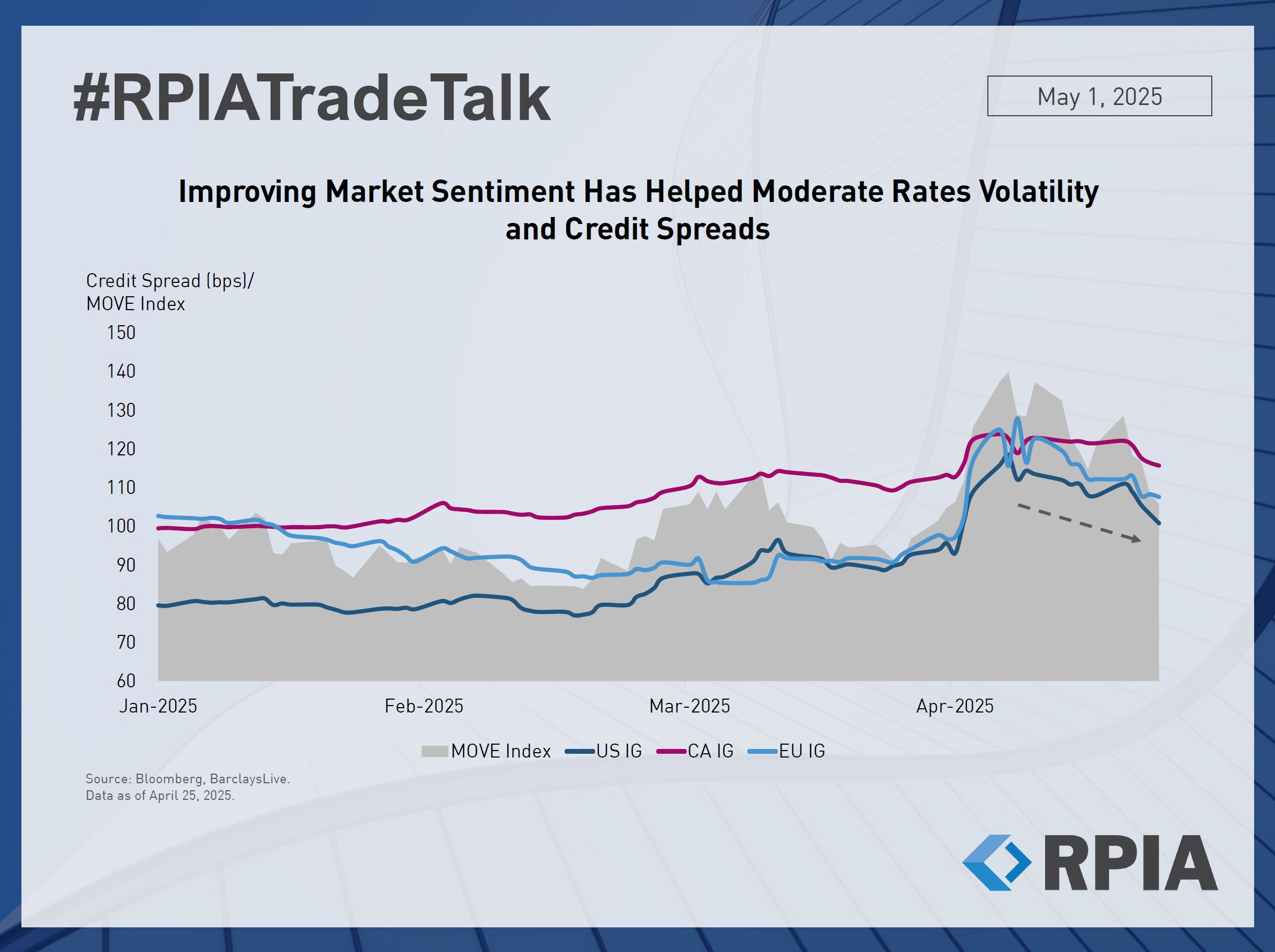

Market sentiment has continued to improve following the 90-day pause on reciprocal tariffs, with President Trump’s recent rhetoric toward China (and Fed Chair Powell) appearing much less combative. The relatively softer tone has specifically helped ease uncertainty around rates in the bond market.

The MOVE index, a key indicator of treasuries rate volatility, fell 25% during the past two weeks, now back to pre-Liberation Day levels. Credit spreads responded in a similar fashion. Investment grade credit spreads retraced across markets due to improved sentiment - although Canadian spreads tightened to a lesser extent due to the recent increase in supply.

Given the ongoing geopolitical uncertainty and the heightened risk of an economic slowdown, we believe credit spreads currently offer fair value - but not great - and may remain volatile. As such, we continue to position cautiously in credit, maintaining downside protection across our portfolios and waiting for more attractive levels of spread before adding meaningful credit exposure.