Back

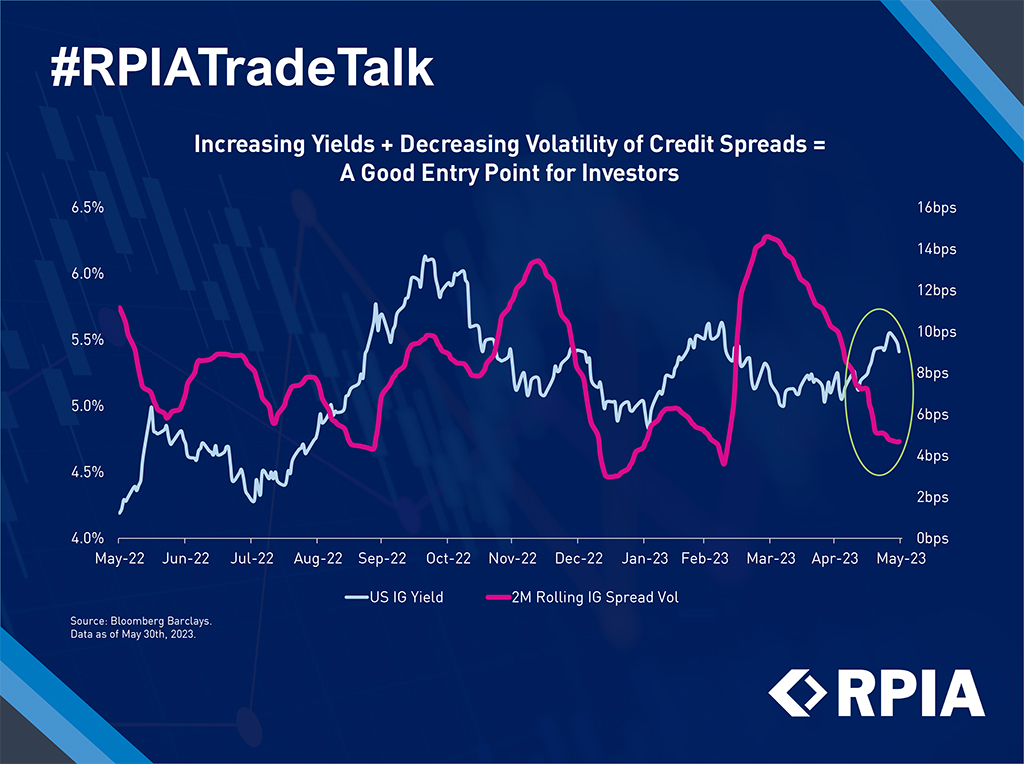

Increasing Yields + Decreasing Volatility of Credit Spreads = A Good Entry Point for Investors

Over the last 12 months, we have seen all-in yields of US Investment Grade Bonds increase by ~1% and now offer over 5.4%. At the same time, 2-month credit spread volatility, a useful indicator of credit risk, has experienced a significant decline of almost 70% since peaking in March.

We believe this reset of higher yields and lower volatility is a great opportunity to rotate into corporate bonds, and an ideal time for active managers that focus on credit selection, to generate returns in excess of the market.