Back

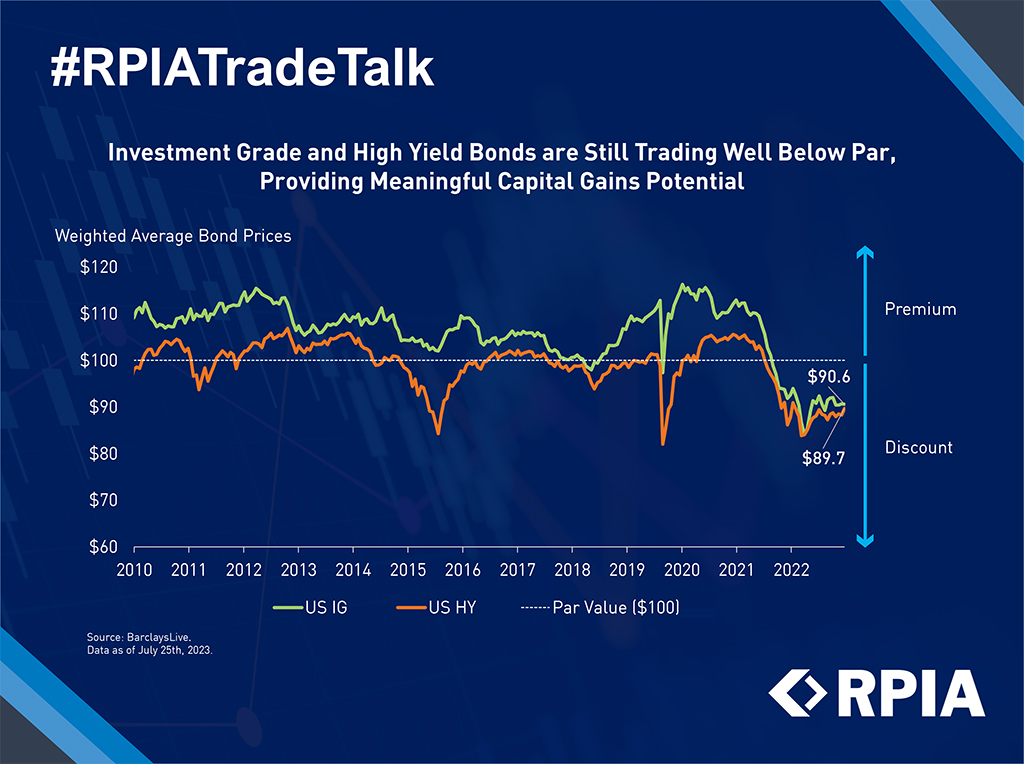

Investment Grade and High Yield Bonds are Still Trading Well Below Par

Over the past two years, rising interest rates have been a leading factor in lower bond prices; however, there is now a silver lining. US Investment Grade and High Yield bonds are now trading at approximately $90 on average - well below the $100 par value - the lowest level we have seen since the Great Financial Crisis.

Today’s entry point provides investors the chance for meaningful capital gains from the pull-to-par effect. Prior to this rising interest rate environment, the pull-to-par effect hindered after-tax bond returns as they often traded at a premium to par (trading at over $100). Purchasing bonds at attractive yields and a price discount can translate to attractive capital gains, which are taxed at a lower rate compared to coupon payments alone, notably improving after-tax returns for investors.