Back

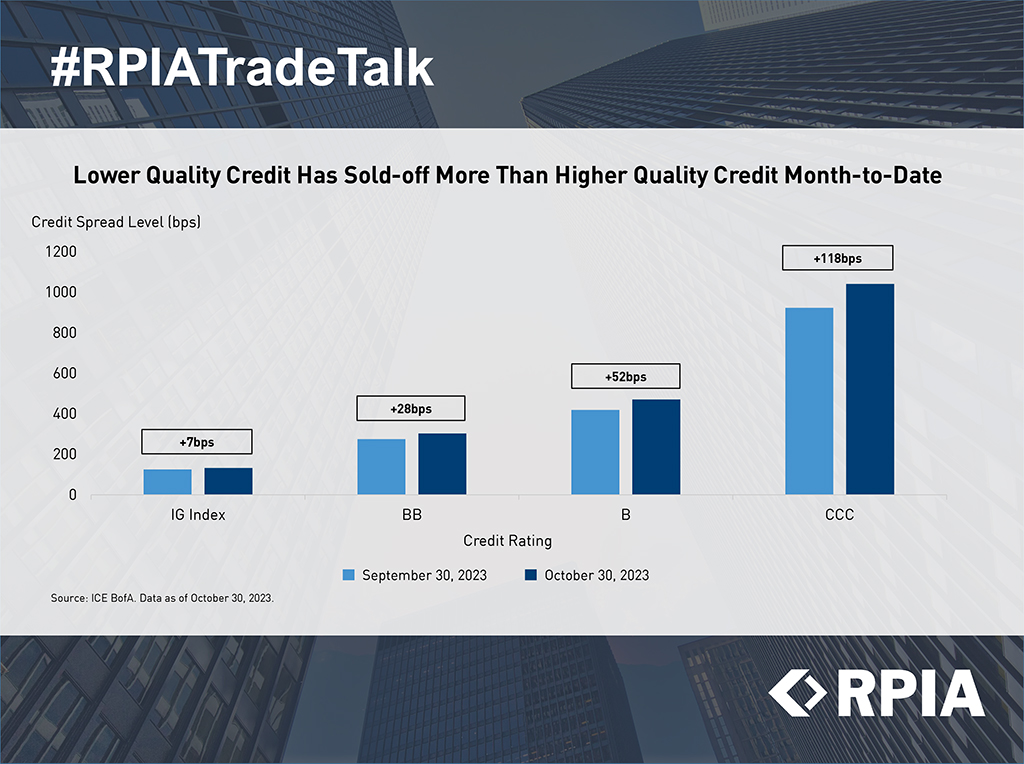

Lower Quality Credit Has Sold-Off More Than Higher Quality Credit Month-to-Date

The high yield market’s lower sensitivity to rising rates, supportive technical dynamics, and a stronger-than-expected economic backdrop have translated to strong returns in the first three quarters of 2023. But October saw that trend come to a halt as concerns began to materialize regarding the potential impact of a "higher-for-longer" cost of capital environment on lower-quality issuers.

In response, high yield credit spreads, particularly those of issuers in the lowest quality segment of the market, decompressed (widened more) relative to investment grade spreads. For example, spreads of issuers rated CCC or below widened (sold off) +118bps versus only +7bps for investment grade issuers.

While our portfolios remain heavily tilted toward investment grade issuers, this repricing is a welcomed event for active managers like ourselves. The selloff and increased dispersion in high yield credit presents new opportunities to extract value from higher-quality BB-rated issuers with solid fundamentals. Nonetheless, we remain cautious on high yield issuers as a whole and continue to skew our holdings toward investment grade credits that we believe can be resilient in a potential recessionary environment.