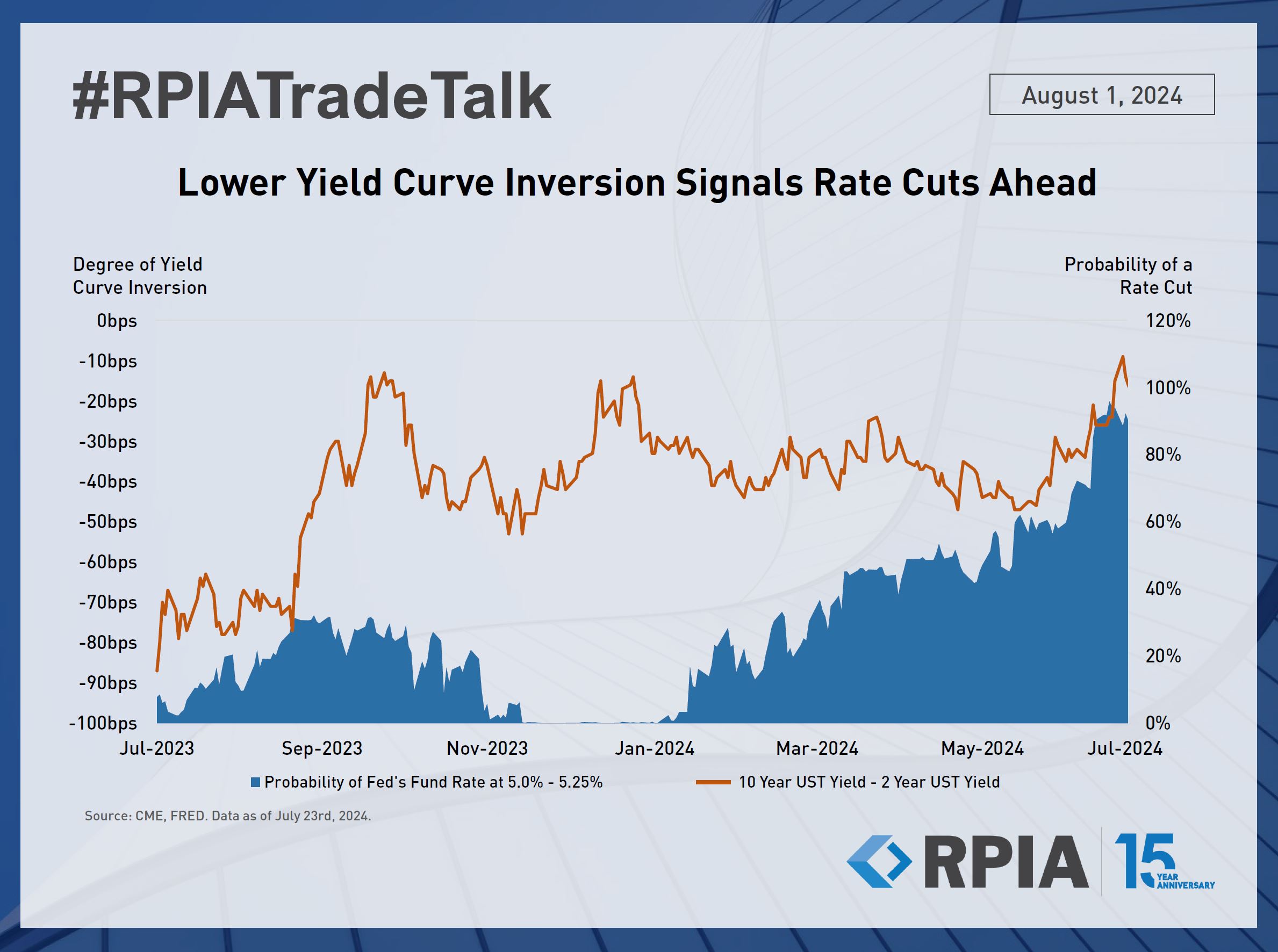

As expected, the Fed held rates steady at 5.25-5.50%. However, the Fed’s statement and Chair Powell’s speech struck a dovish tone. While Powell did not explicitly disclose the Committee's path, he acknowledged that cooling inflation and a more balanced labour market may soon call for a less restrictive monetary policy. As a result, the market has placed a 100% probability of a September rate cut.

In response, the U.S. treasury yield curve has further normalized, with short-term rates moving notably lower relative to longer-term rates. The spread between the 2-year and 10-year Treasury yields is now sitting at -20 basis points, significantly less inverted than the -100 basis points spread seen a year ago. This process has also been driven by the potential impact of tariffs, structurally higher inflation, fiscal deficits, and other factors that have put pressure on long-end yields. Given the increasing likelihood of a steeper yield curve, we continue to prefer shorter-term securities for interest rate exposure.