Back

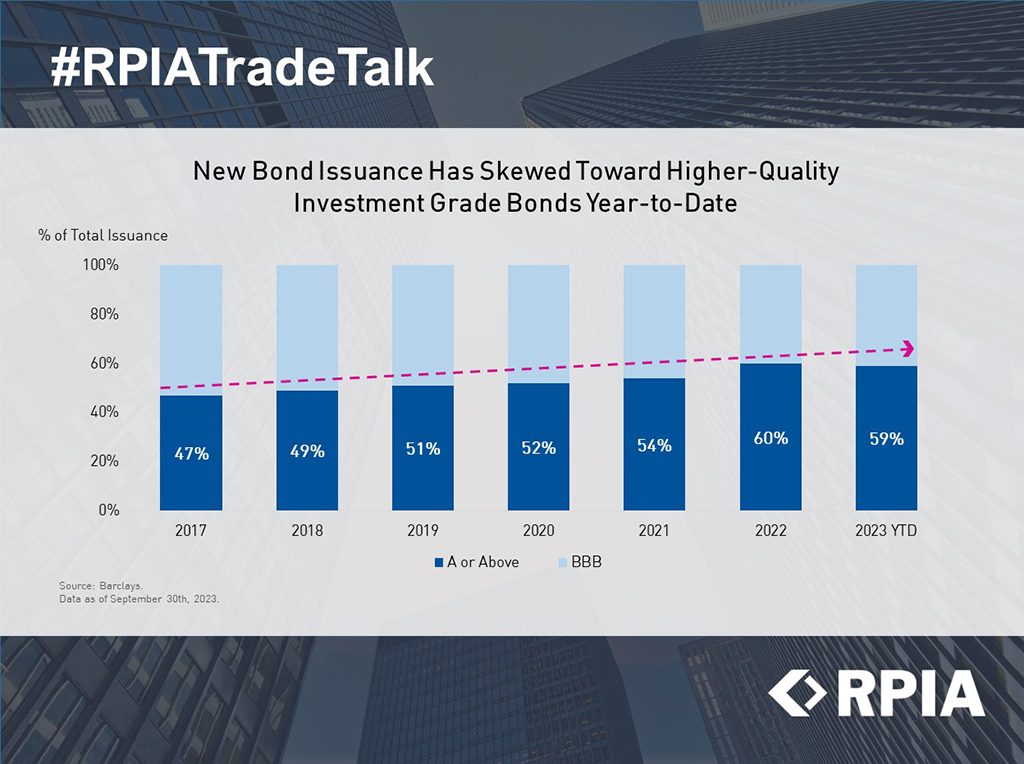

New Bond Issuance Has Skewed Toward Higher-Quality Investment Grade Bonds Year-to-Date

Corporate bonds have exhibited resiliency in 2023 by consistently surpassing earnings expectations and improving their financial leverage picture to contend with an unpredictable macroeconomic environment. Looking closer, we have seen a trend of higher quality bonds coming to market, with nearly 60% of US Investment Grade issuances year-to-date being from issuers rated A and above – much higher than the 7-year average of 53%. Many of these new issues have safer, shorter-term maturities, and many come from high-quality financials issuers with diversified businesses.

We remain biased toward Investment Grade securities in our portfolios and are finding value as an active participant in both the new issue and secondary market. Given the attractive relative fundamentals and technical backdrop in corporate bonds relative to other risk assets, we continue to feel excited about the total return opportunity in bonds today.