Back

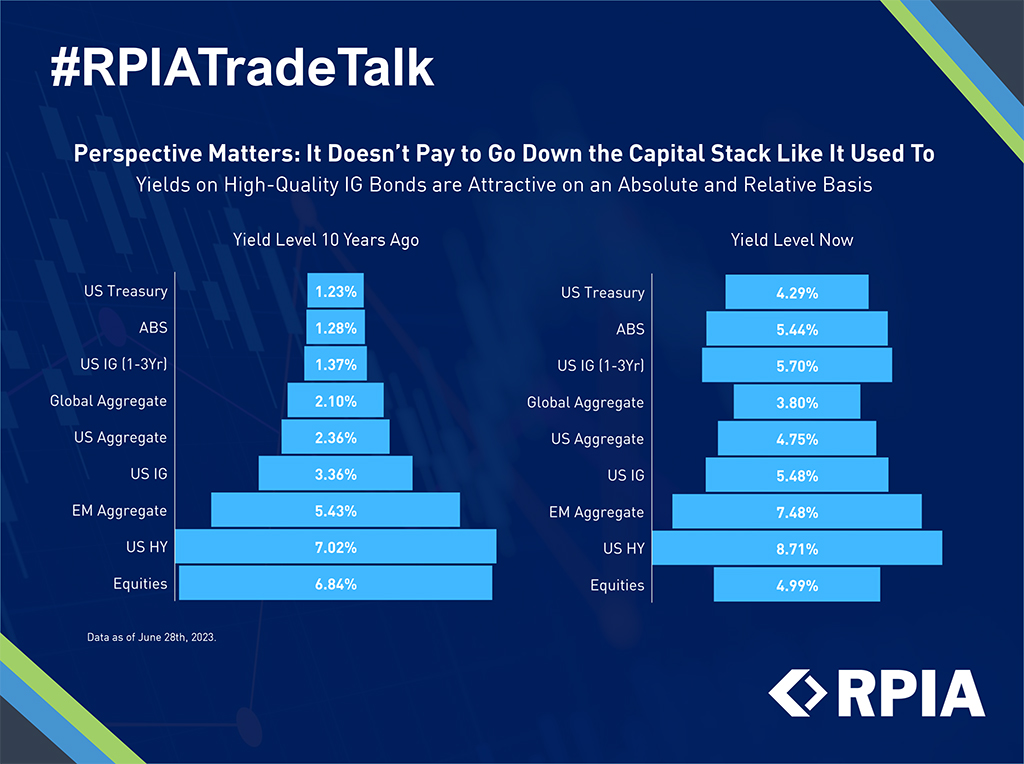

Perspective Matters: It Doesn’t Pay to Go Down the Capital Stack Like It Used To

With drastic shifts in the macro-environment and global monetary policy, the fixed income investing landscape has changed significantly. Historically, to earn a decent yield, a manager would need to go down the capital stack to lower-quality bonds or equities, which carry exponentially higher risk. We believe that need has now diminished as safer assets like short-term investment grade credit offer yields above 5.5%, placing these yields at par with, if not higher than, those generated by equities.

In addition to the baseline yield, a skilled active manager has the ability to generate additional alpha through active trading and credit selection. We believe this presents a great opportunity for investors to rethink their asset mixes and potentially generate the same level of yield with much less risk in their portfolios.