Back

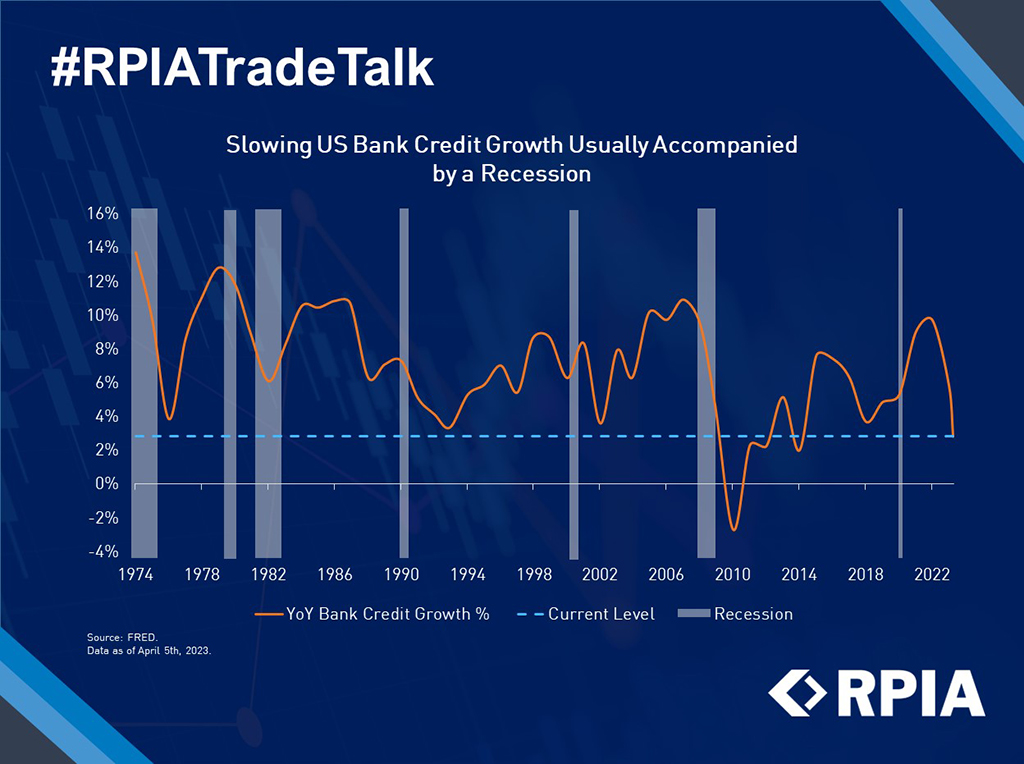

Slowing US Bank Credit Growth Usually Accompanied by a Recession

Rising interest rates and a slowing economy have led to notably lower loan growth in recent months. By raising the benchmark interest rate that banks use in lending money to each other, central banks have made consumer and business loans more expensive and harder to get. This trend accelerated in mid-March after Silicon Valley Bank and Signature Bank abruptly failed, which increased conservative lending practices by banks to avoid a similar fate and strengthen their balance sheets to weather future storms.

The effect on the real economy should be to lower demand for credit-financed goods and services, and in time, also lower inflation. The magnitude of the slowdown will ultimately determine the severity of a potential recession. In any case, we think investors should be flexible and ready to adapt in this rapidly changing investment environment.