Back

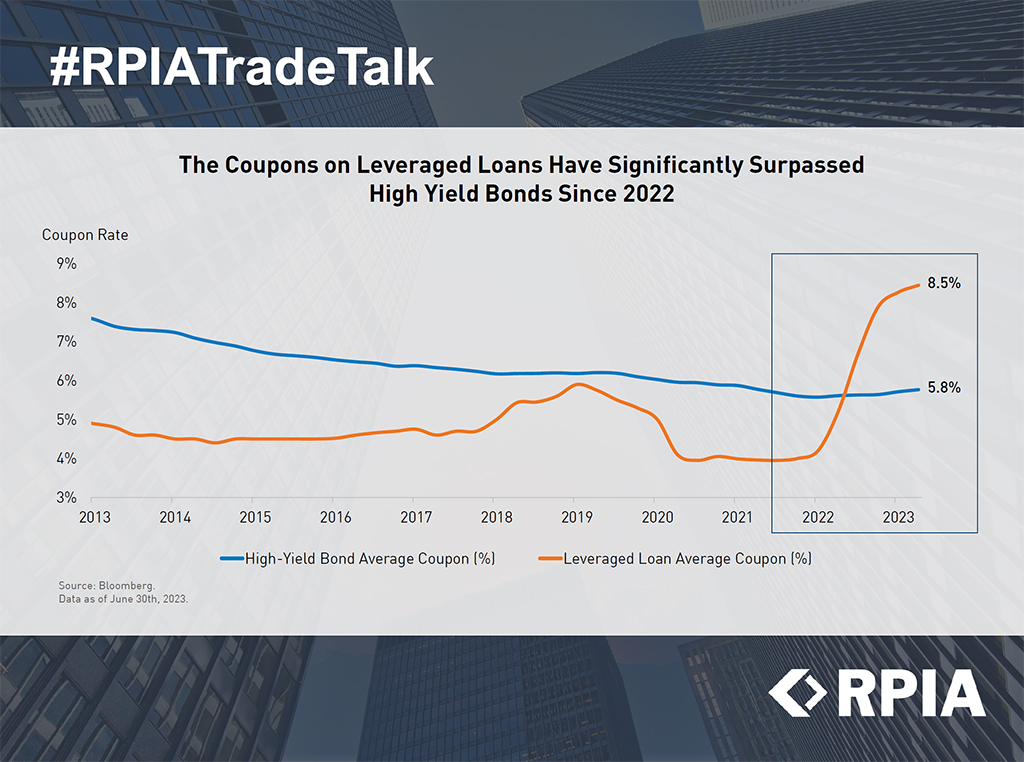

The Coupons on Leveraged Loans Have Significantly Surpassed High Yield Bonds Since 2022

The leveraged loans market is experiencing ongoing challenges due to stricter lending standards and a notable decline in loan quality. In under a year, numerous leveraged loan issuers have seen their coupon payments double, reaching the highest point in 15 years. Additionally, many of these loan issuers have a floating rate loan-only structure, which exposes them significantly to rising interest rates. This could lead to a surge in loan defaults in the foreseeable future as coupon payments stay elevated.

In contrast, high-yield issuers are faring much better with healthier balance sheets and limited vulnerability to rising rates. This illustrates that despite high-yield bonds being traditionally less secured than loans, they can now offer a higher degree of safety and potentially better risk-adjusted returns. As a result, we believe this economic cycle would impact high-yield bonds less than loans, and remain cautious yet optimistic about the high-yield space.