Back

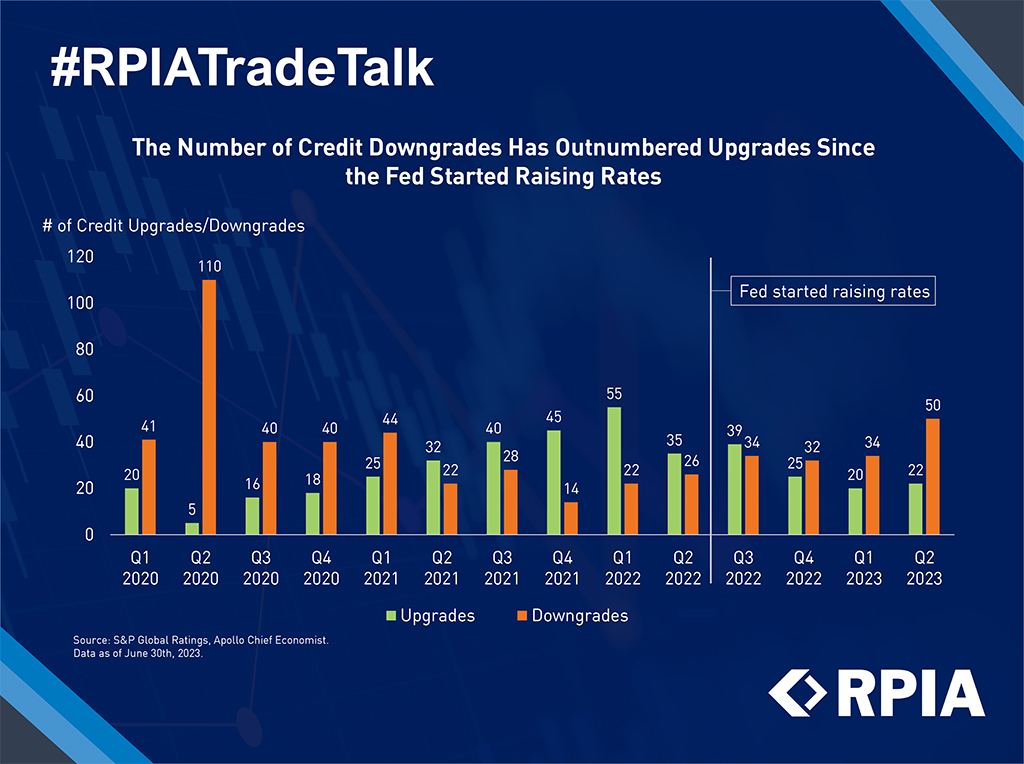

The Number of Credit Downgrades Has Outnumbered Upgrades Since the Fed Started Raising Rates

Throughout the post-COVID recovery, the number of credit rating upgrades outpaced the number of rating downgrades as companies’ balance sheets improved alongside the economy. However, this dynamic began to reverse as rating agencies began downgrading more vulnerable companies when the Federal Reserve embarked on its historic rate hiking cycle.

During the second quarter, the U.S. market experienced more than 2x the number of credit rating downgrades relative to upgrades (50 vs. 22), a level not seen since 2020. Although the restrictive policy is beginning to create cracks in the market, it has also prompted us to maintain our strategic positioning by focusing on higher-quality credits with robust fundamentals.