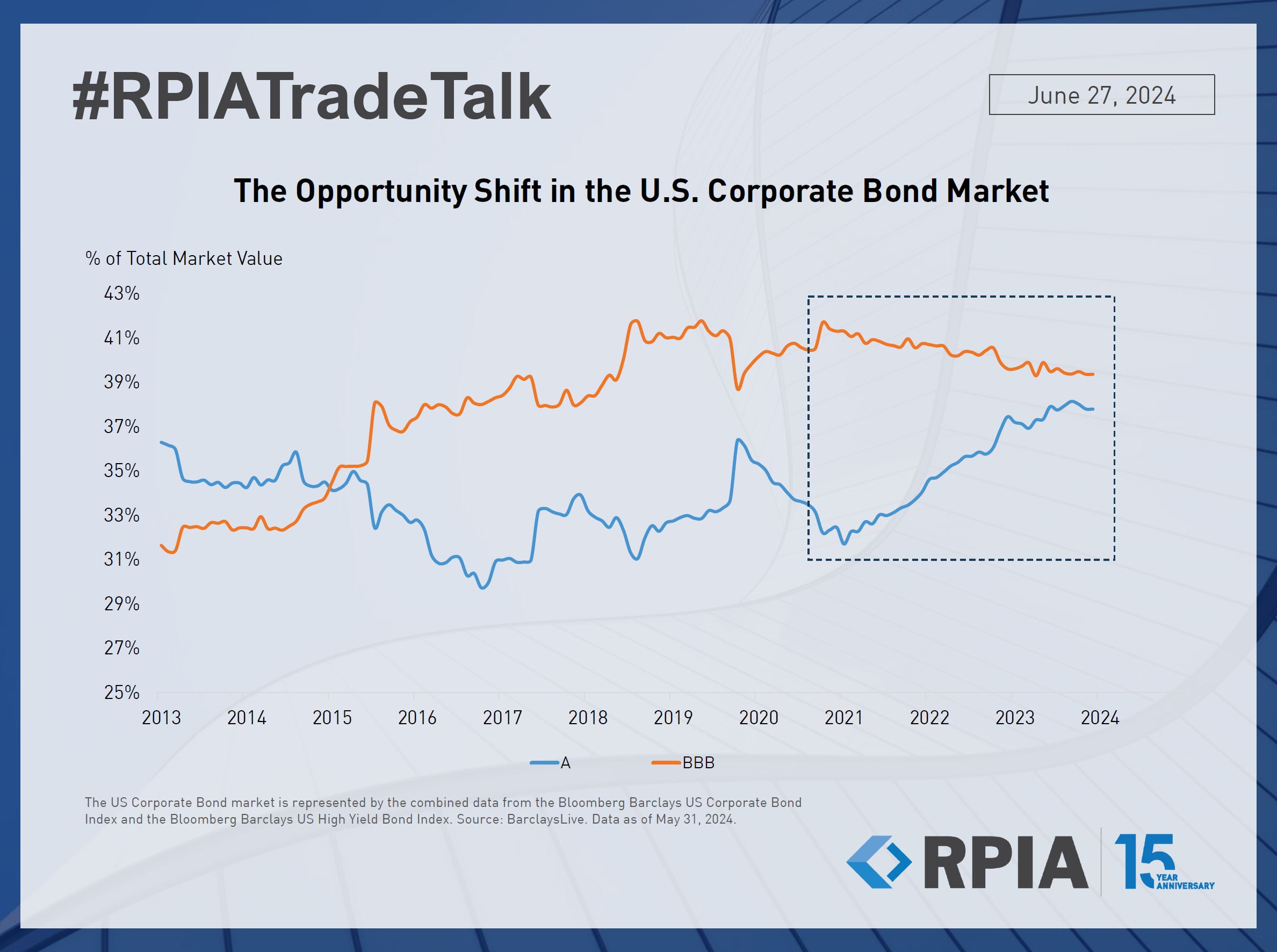

Since 2021, there has been a notable shift in the ratings composition of U.S. corporate bonds. Currently, BBB-rated bonds, which were once the dominant category, stand neck and neck with A-rated bonds, making up 39% and 38% of the index, respectively. This shift has been a result of increased high-quality issuance and favourable upgrades into the A-rated space. On the other hand, in the high yield world, BB-rated bonds have decreased from 10% of the index in 2021 to less than 8% today.

In response to this shift, we have been employing our tactical investment approach and credit selection expertise to actively seek out alpha generating opportunities. In our view, the new makeup of the bond market's credit quality distribution enables us to capture relative value by meticulously monitoring the market across the A/BBB/BB spectrum.