Back

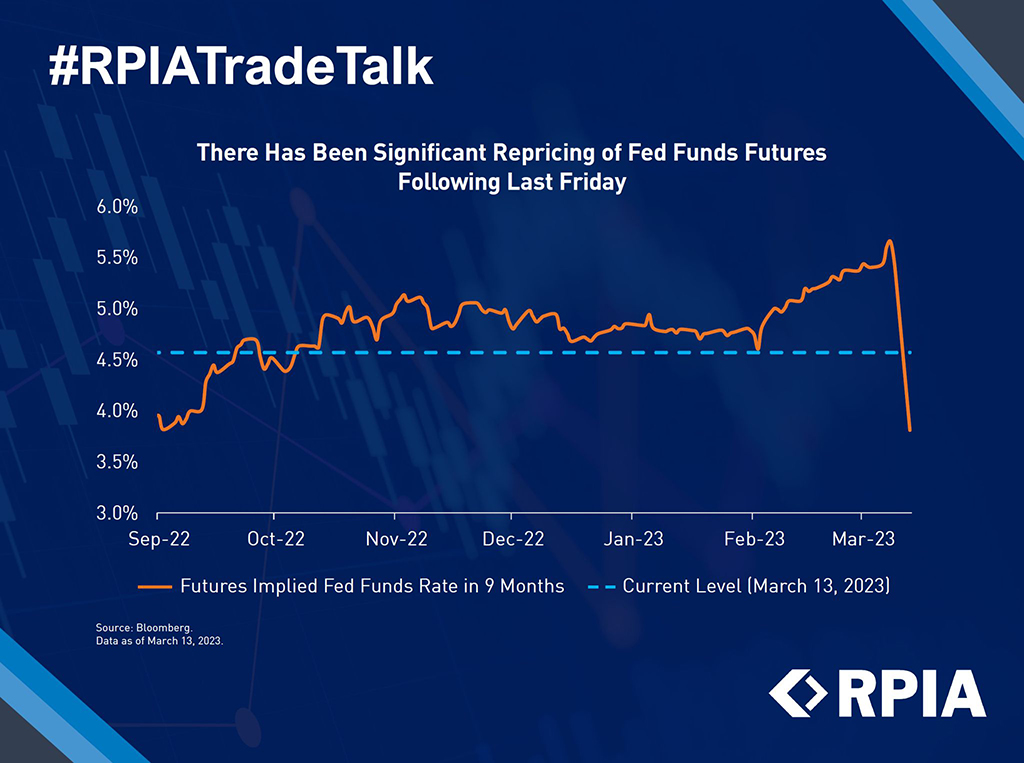

There Has Been Significant Reprising of Fed Funds Futures Following Last Friday

The implosion of Silicon Valley Bank further confused bond markets and increased the uncertainty around the path of interest rate hikes. The market reversed course from last week and is now pricing in a high probability for a 0.25% hike (previously expecting a 0.5% hike). Subsequently, the Fed Funds Terminal Rate dropped more than 120bps over the weekend to 3.8% on Monday, a velocity not seen since March 2020.

At this juncture, we are looking to actively increase our downside protection broadly, while also picking up opportunities that have risen from this unprecedented volatility. Liquidity continues to be paramount in our selection process as we navigate these choppy credit markets.