Back

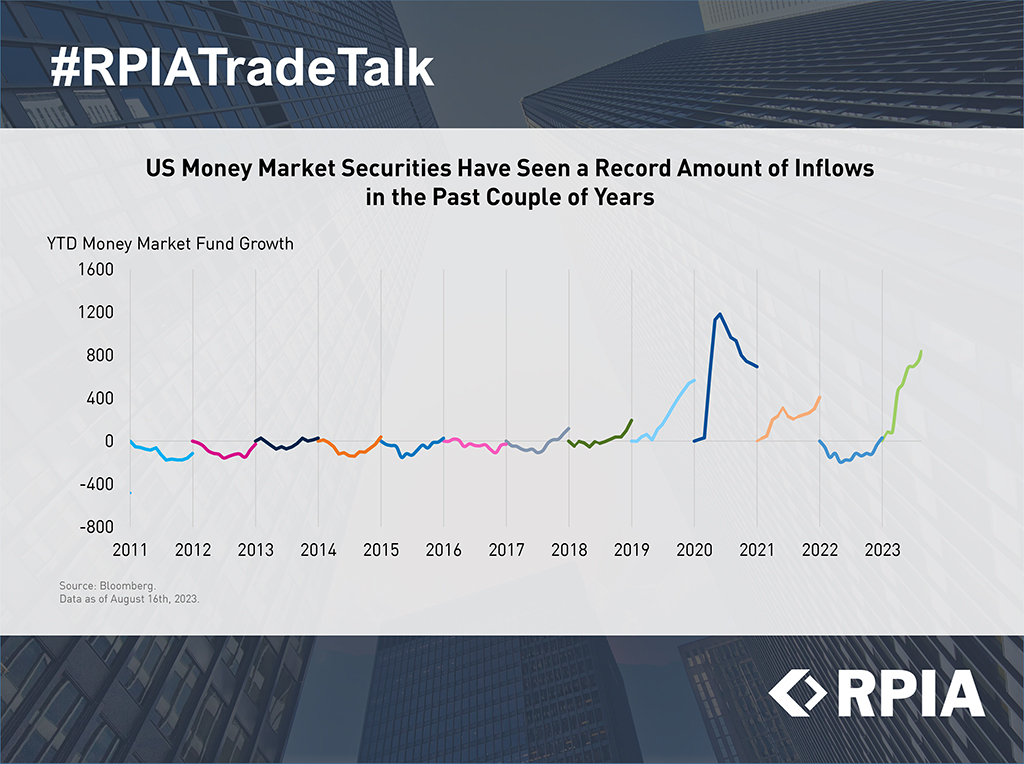

US Money Market Securities Have Seen a Record Amount of Inflows in the Past Couple of Years

The rise in interest rates has spurred strong demand this year for U.S. money market securities from investors looking for a short-term hiding spot. Year to date, U.S. money market instruments saw over $800 billion of inflows, making it the largest annual inflow in the last decade, with the exclusion of a panic-filled flight to safety in 2020. As a result, the total amount of capital parked in the asset class now exceeds a whopping $5.5 trillion.

We believe that a substantial amount of this sidelined capital could find its way back into bonds if short-term rates begin to decrease and investors seek to lock in higher yields for longer using fixed bonds. This scenario could represent a strong technical tailwind for corporate bonds, particularly the debt of issuers with a strong fundamental profile and attractive but safe coupons.