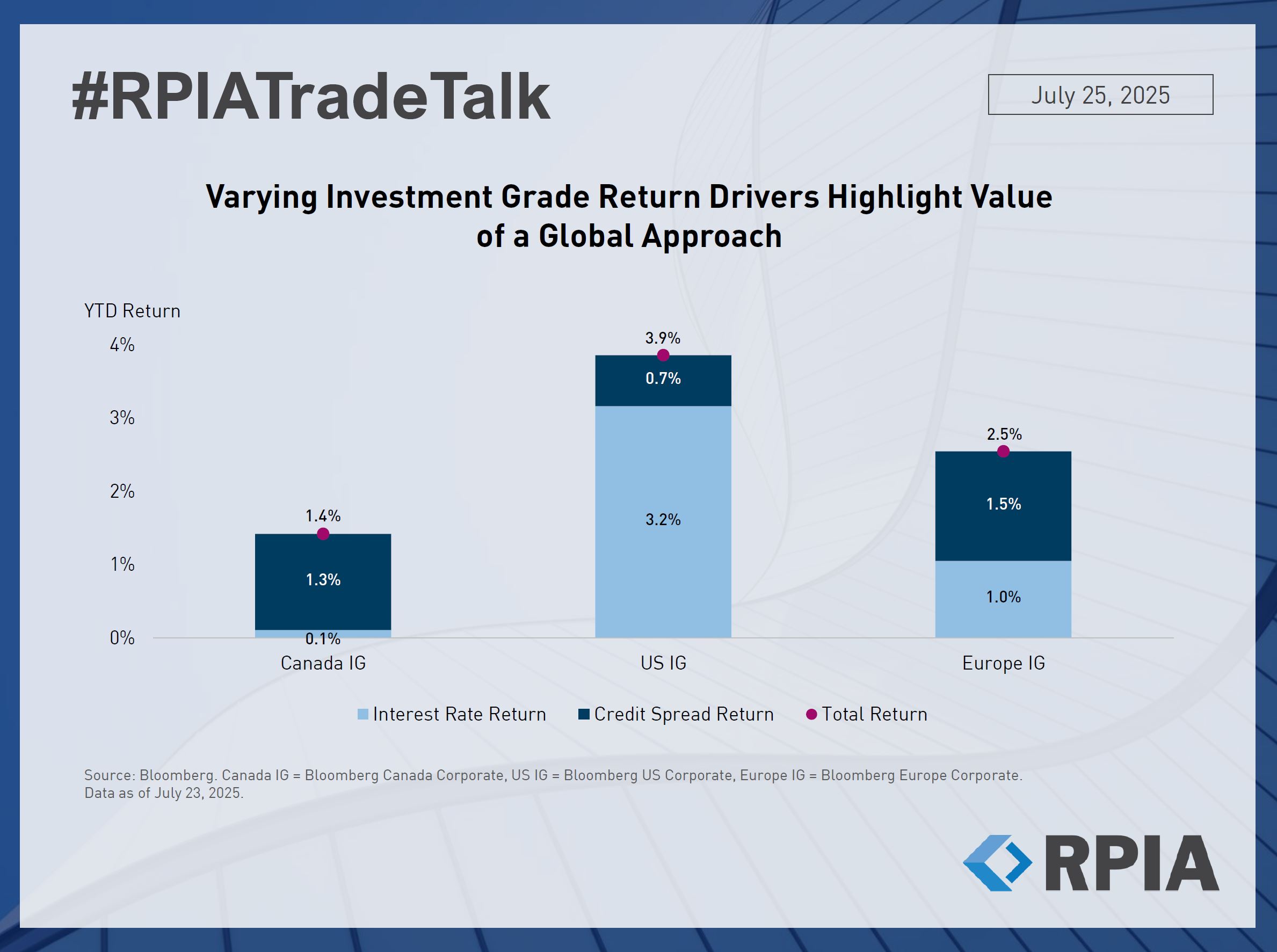

So far this year, the composition of total returns from investment grade (IG) credit has varied meaningfully across geographies. Canadian IG has delivered a modest 1.4% total return, driven almost entirely by tighter credit spreads (dark blue shaded bar), with minimal contribution from interest rates (light blue shaded bar). In contrast, US IG has generated nearly a 4% total return, with the lion’s share (3.2%) coming from lower bond yields – highlighting the notable outperformance of US rates relative to Canadian rates. Meanwhile, European IG returns of 2.5% have been more balanced, with both spreads and rates contributing somewhat evenly.