Back

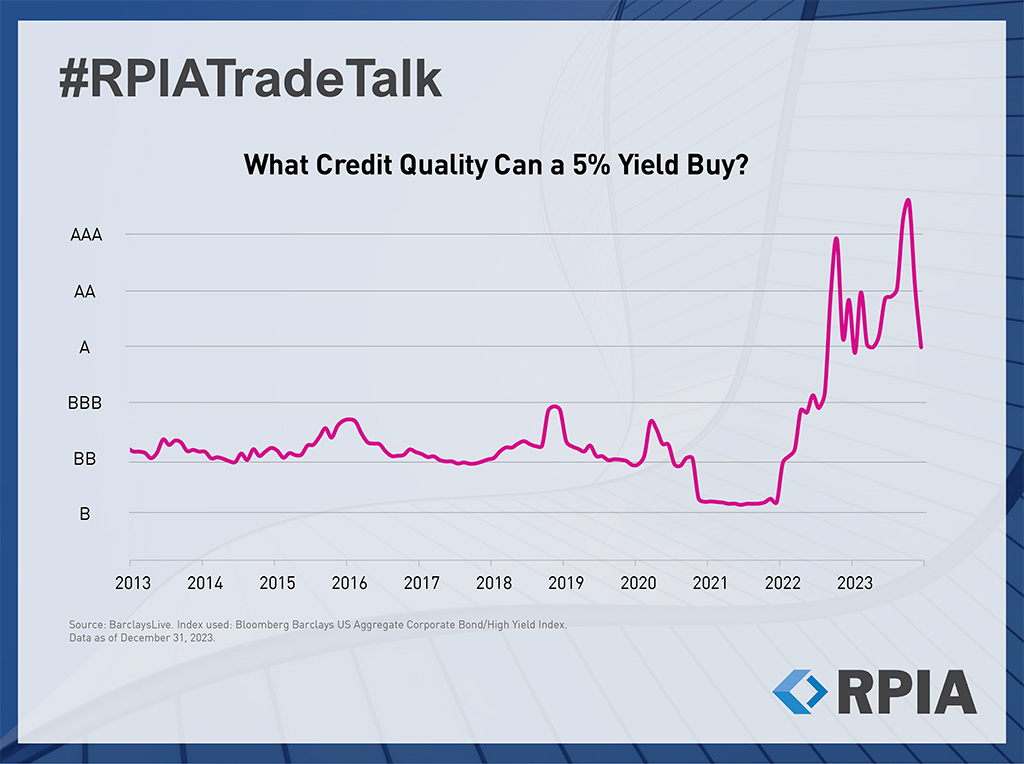

What Credit Quality Can a 5% Yield Buy?

We believe investors can now achieve attractive yields from liquid, high quality bonds. In the past, achieving a yield of 5% would require delving into the BB and even B-rated segments of the high yield market, introducing risks associated with lower-quality companies. For instance, B-rated bonds historically had default rates that could be as high as 14% during times of stress.

Today, investors can purchase A-rated securities to deliver a robust +5% yield and receive the protection of a high quality issuer. The long-term average default rate of A-rated securities is only 0.1%, and the highest default rate for A-rated securities in any given year only reached 0.4%.

We view this as an opportune time for investors to enhance portfolios through corporate fixed income that can provide higher returns for less risk than in the past.