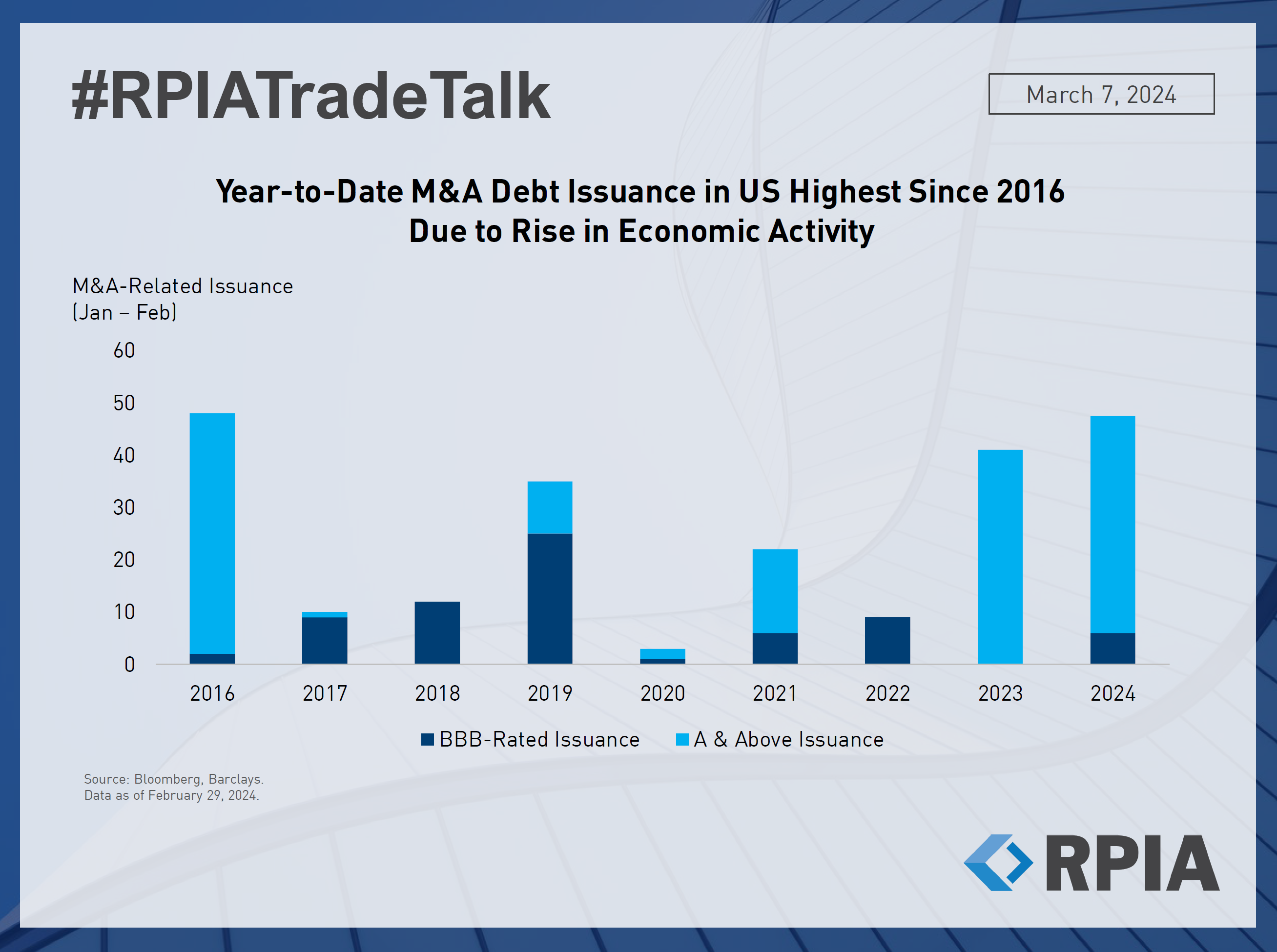

During the first two months of this year, the primary market was extremely active, marking a record high with the total year-to-date supply of debt reaching $350 billion. A significant portion of this new issuance is dedicated to financing mergers and acquisitions within the U.S., with most of the newly issued debt coming from high-quality, A-rated companies. This trend, combined with the likelihood of a smooth economic transition and looser monetary policies, indicates a resurgence in business activity from companies that were focused on conservatively shoring up their balance sheets throughout 2023 in anticipation of recession concerns.

This robust issuance data may lead to more investor pushback and, thus, more favorable concessions in oversupplied sectors such as technology, pharmaceuticals, and Business Development Companies (BDCs). Consequently, we will likely see more opportunities to redeploy capital and upgrade/optimize the portfolios by participating in these new issues.