The U.S. exceptionalism narrative and FOMO-driven sentiment have propelled U.S. equities to new heights, with the S&P 500 reaching an impressive 47 record highs in 2024. Notably, 25% of these all-time highs occurred during the post-election rally following the Republican sweep, which heightened concerns over stretched equity valuations.

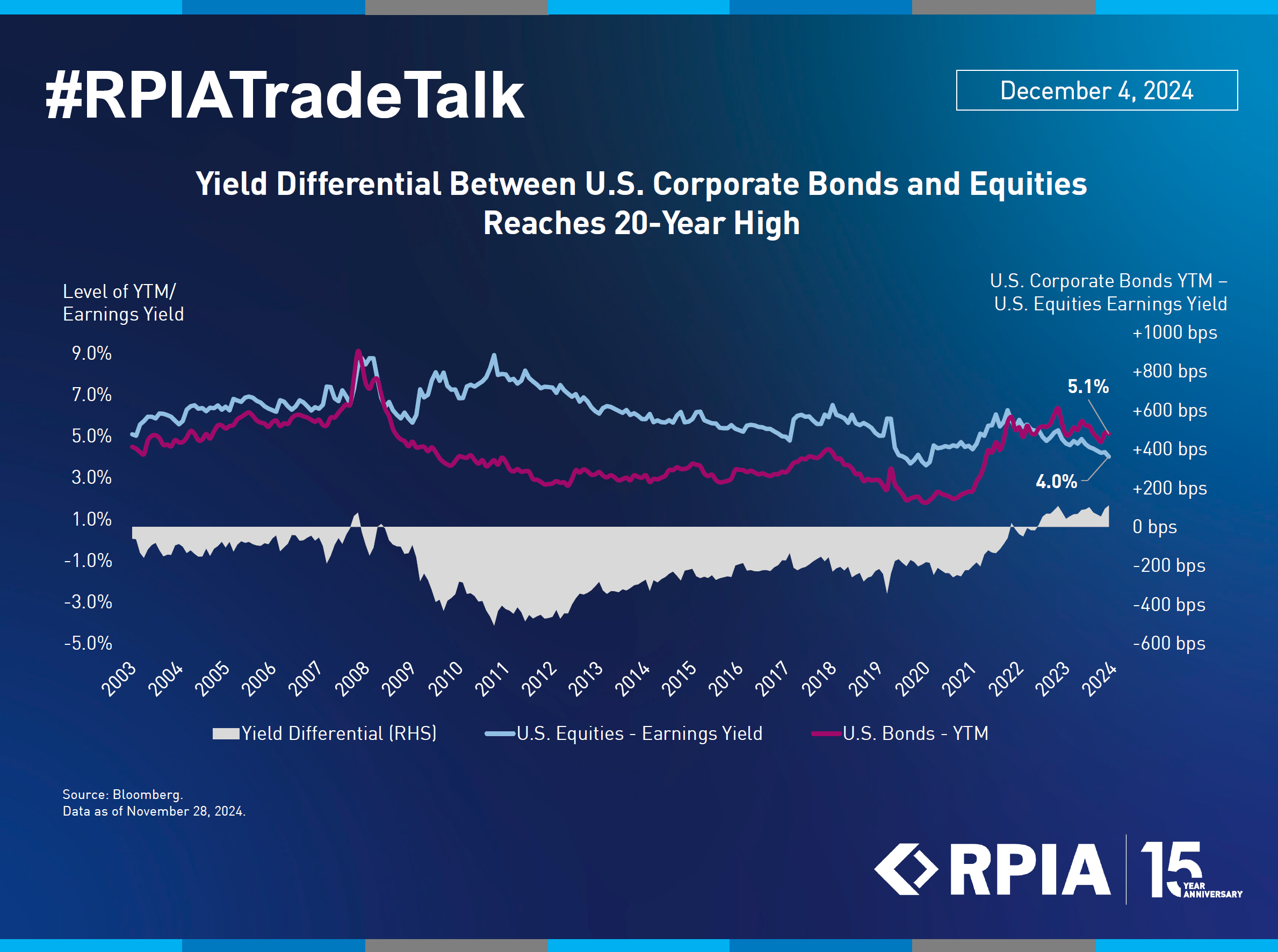

For instance, the S&P 500’s forward earnings yield (the inverse of the commonly referred to P/E ratio) currently stands at 4%, an extremely low level that implies investors are receiving limited earnings per invested dollar. Meanwhile, bond yields remain elevated at over 5%. This divergence has pushed the yield differential between bonds and equity earnings to 110 basis points – the widest gap in two decades.

Given the current valuation backdrop and the likelihood of persistent market volatility, we believe moving up the capital structure into bonds could enable investors to earn more attractive compensation per unit of risk.