Back

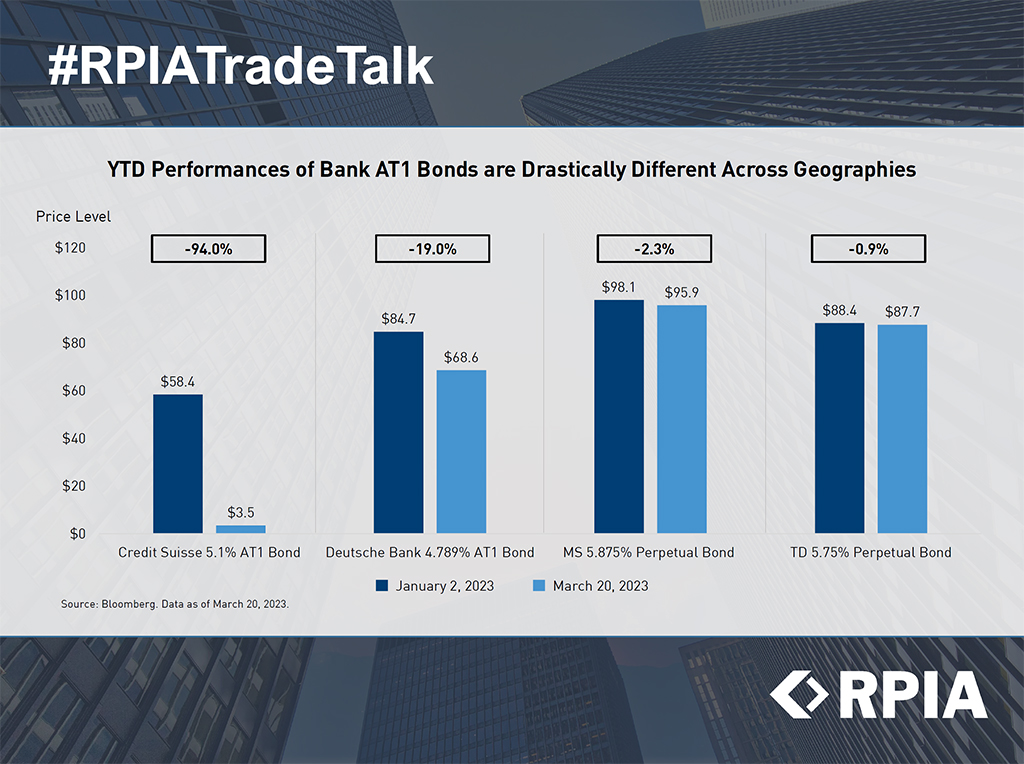

YTD Performance of Bank AT1 Bonds are Drastically Different Across Geographies

AT1 bonds have recently garnered a lot of attention following the emergency takeover of Credit Suisse by UBS over the weekend, which saw holders of these bond instruments effectively wiped out. AT1 bonds (also known as CoCos in Europe) are a form of junior (lower-priority) debt that can provide investors with higher yields than senior debt, but they also carry a much higher risk of permanently losing capital if a default occurs.

Investors should be aware that the risk and default treatment of AT1s can differ substantially across jurisdictions and require analysis of the terms on a case-by-case basis. For example, take a look at the profound price drop in European AT1’s last week relative to the much more resilient price moves of AT1s in Canada and US.