Celebrating 5 Years of Outstanding Returns

RP Alternative Global Bond Fund

All Weather Liquid Bond Strategy

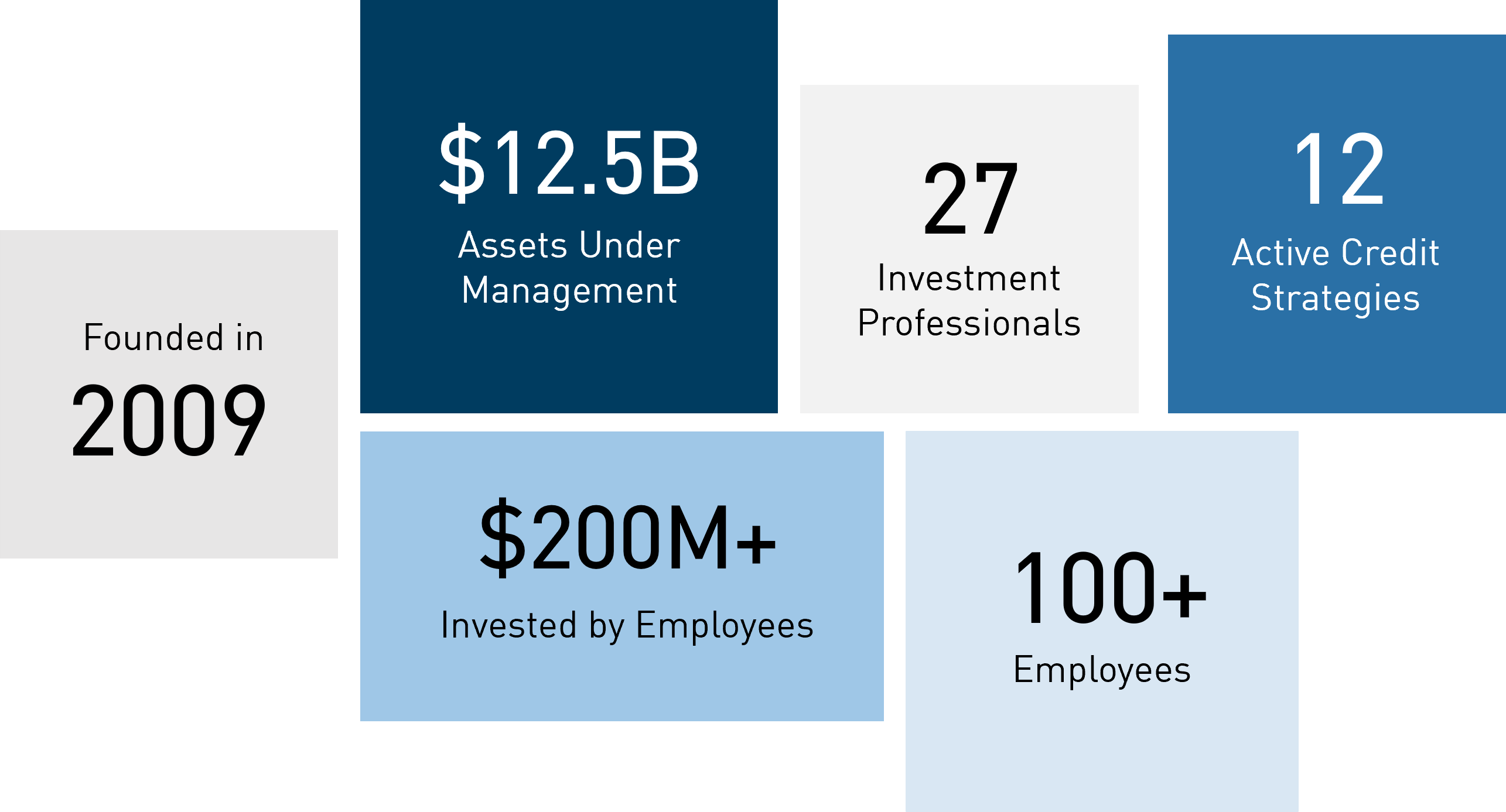

RP Alternative Global Bond Fund (“AGB”) is an alternative bond strategy that can generate attractive risk-adjusted returns and diversify a traditional portfolio while providing daily liquidity. The Fund invests primarily in investment grade securities of corporations and financial institutions in developed markets.

The Fund’s relentless focus and proven track record exploiting inefficiencies in developed bond markets can allow investors to:

- Enhance absolute and risk-adjusted returns

- Preserve capital during volatile interest rate periods

-

Diversify traditional bond risk factors and increase portfolio resiliency

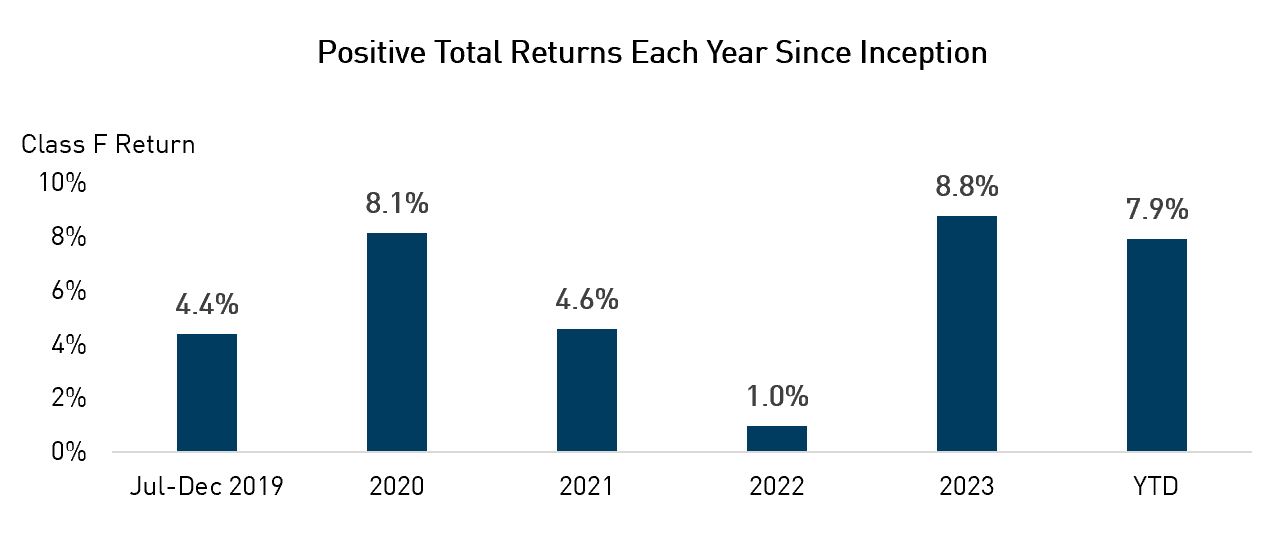

The performance is a testament to our active trading approach, which allows our team to capitalize on the idiosyncratic nature of credit, proving AGB's strength amid volatile market conditions.

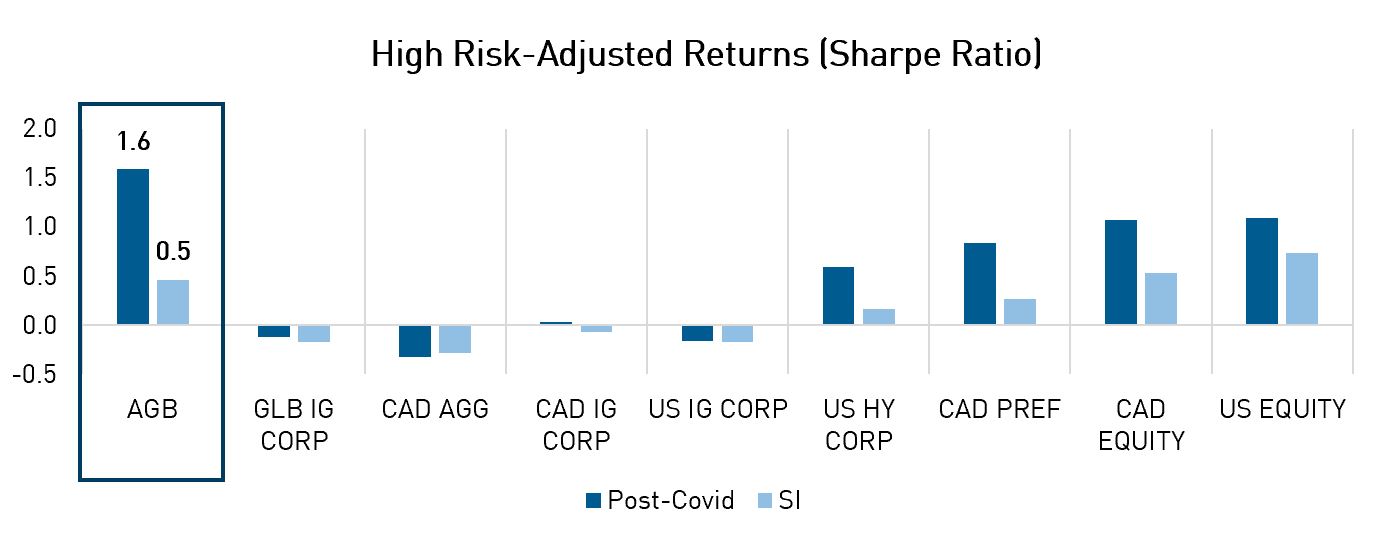

AGB has also outperformed traditional corporate bonds in a sophisticated, risk-adjusted manner by employing multiple layers of protection to the portfolio and tactically managing interest rate exposure.

Source: RPIA. Data as of September 20, 2024.

Source: RPIA, eVestment. Data as of August 31, 2024. Risk-free rate = FTSE Canada 91-Day TBill Index. Post-Covid = post March 2020. SI = July 2019.

Historical Fund Performance

| Fund Code: RPD210 | YTD | 1 YR | 2 YR | 3 YR | 5 YR | Since Inception |

|---|---|---|---|---|---|---|

| RP Alternative Global Bond Fund (Class F) | 7.9% | 14.0% | 9.3% | 5.7% | 6.6% | 6.7% |

| Bloomberg Global Corporate (CAD Hedged) | 4.7% | 11.0% | 6.5% | -1.5% | 0.8% | 1.2% |

| Peer Group Average* | 6.4% | 10.3% | 7.0% | 2.8% | 4.0% | 3.9% |

| # of Funds in Peer Group | 30 | 29 | 26 | 24 | 13 | 13 |

Source: RPIA, Bloomberg. Morningstar Direct. Data as of September 20, 2024. Returns greater than 1 YR are annualized. SI = July 19, 2019.

*Peer Group Average is internally calculated based on the daily liquid, Class F, Canadian dollar mutual funds within the Canada Fund Alternative Credit Focused category.

Less Coupon Clipping | Higher Activity

AGB has the potential to enhance traditional fixed income portfolios, but also serve as a low-volatility equity alternative for outcome-based conservative portfolios. It employs a highly active strategy that relies less on coupon clipping than traditional bond strategies and manages its exposure to interest rate volatility.

Less Sensitive to Interest Rates

AGB has a lower exposure to the uncertain path of interest rates than traditional bonds and is committed to a thoughtful relative value approach. We believe AGB is well-positioned to continue delivering positive risk-adjusted returns in various market environments moving forward.

Get in Touch With Us

You have selected {0} as your investor type. Is this correct?

Indices Used

Source: eVestment | CAD Aggregate: FTSE Canada Universe Bond | CAD IG Corporate: FTSE Canada All Corporate | Global IG Corporate: Bloomberg Global Aggregate Corporate Bond (CAD Hedged) | US IG Corporate: Bloomberg US Corporate Investment Grade (CAD Hedged) | US HY Corporate: Bloomberg US Corporate High Yield (CAD Hedged) | CAD Preferred: S&P/TSX Preferred Share | CAD Equity: S&P/TSX Composite | US Equity: S&P 500

RP AGB Inception = July 8, 2019.

Important Information

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the funds facts and simplified prospectus before investing. Indicated rates of return include changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information presented is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. Always consult with your registered investment advisor before making any investment decision.

Performance presented for RP Alternative Global Bond Fund is for Class F of the respective fund. Class F units do not include embedded sales commissions, which results in higher performance relative to Class A units of the fund. The benchmark performance comparisons presented are intended to illustrate the historical performance of the fund with that of the specified index or peer group benchmark over the indicated period. The comparison is for illustrative purposes only and does not imply future performance. There are various differences between the benchmarks and the fund that could affect the performance and risk characteristics of each, including but limited to investment objectives, composition, sector, geographic and currency exposure, as well as the impact of fees and expenses on the performance of the fund vs that of an index or peer group. The Sharpe Ratio is a widely used method to measure the risk-adjusted returns of an investment, and is defined as the difference between the returns of the investment (i.e. the fund) and a risk-free return, divided by the standard deviation of the fund’s returns. A higher ratio means a higher risk-adjusted return. The ratio can serve as a useful tool for comparing investment returns that account for the historical risk or volatility associated with the investment.