During July, central banks around the world continued to tighten monetary policy in an effort to slow rampant inflation. The U.S. Federal Reserve (the “Fed”), for example, has lifted the upper bound of the Fed Funds Rate from 0.25% to 2.50% for a whopping 225bps of tightening in only 133 days, and the Bank of Canada surprised the market by raising its Overnight Target Rate 100bps on July 13, also to 2.50%.1

Decoding the Fed's Message

In his most recent press conference, Fed Chair Jerome Powell stated that he believes the current policy rate range of 2.25% to 2.50% may be close to neutral, meaning that it could support full employment and stable prices in the long term. However, he also acknowledged that the current rate is not high enough to rein in inflation at the current levels.3

He emphasized that the Fed expects further rate hikes to be necessary – driving the policy rate into restrictive territory – before financial conditions will be tight enough to recalibrate demand and supply and subdue inflation. Nonetheless, many market participants initially felt that his less specific forward guidance and pledge to be more data-driven when determining future hike decisions meant he was softening his aggressive tone relative to previous meetings.

However, that opinion changed shortly after the press conference when several Fed speakers took to the press to re-emphasize their commitment to fighting inflation – and rates rose in response. But more importantly for credit investors, the volatility in spreads has declined, and the new-issue market has reopened in many cases.

A Convergence in Actual and Expected Rates

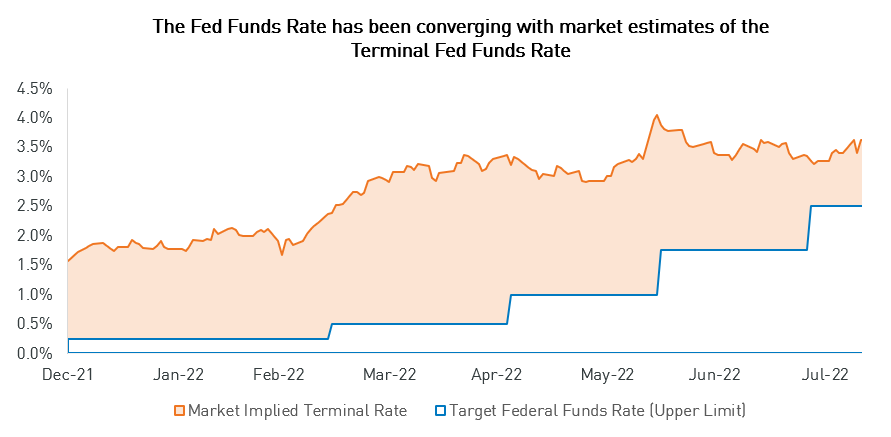

While more rate hikes are undoubtedly in store, market participants have at times questioned the Fed’s capacity to hike rates in the face of a slowing economy. In support of this view, Q2’s GDP came in at -0.9%, following Q1’s GDP print of -1.6%, meaning we are clearly seeing signs of slowing growth in some segments of the economy.4 Additionally, implied measures of the terminal Fed Funds Rate – the rate expected to be reached at the end of this hiking cycle – have retraced from recent highs.

Furthermore, we believe that the Fed’s strategy to front-load hikes is seemingly moving us closer to the end of this cycle faster than initially expected (the front-loading strategy is also operative at other central banks in other areas, including Canada and Europe). This phenomenon can be depicted by the convergence between the implied terminal rate and the Fed’s policy rate.

Source: Morgan Stanely TERM Index, Federal Reserve. Data as of Aug. 11th, 2022.

At the time of preparation, terminal rate estimates sit at ~3.6%, which is down notably from the estimated terminal rate high of 4.1% in mid-June.

Declining Chance of Higher Inflation and Reduced Tail Risk

The continued convergence and the eventual end of this hiking cycle, along with a decrease in commodity and gasoline prices and a better-than-feared earnings season, have given some market participants hope that the stagflationary worst-case scenario may be off the table.

Excess liquidity within the system is draining at a measured pace as hoped, and the Fed’s reduction of its balance sheet through quantitative tightening has not yet led to any severe negative surprises. The rising cost of capital seems to be moderating demand somewhat, even if the Consumer Price Index (“CPI”) has not reflected it quite yet – but CPI itself may be a lagging indicator. In contrast, although some components of inflation, such as shelter and healthcare costs, remain stubbornly high, some market-based inflation measures and components, such as break-even rates and commodity and energy prices, have moderated over the past couple of months.

With inflation potentially cresting, the labour market may again be in the limelight. After adding 528,000 jobs in July, which doubled market estimates, the U.S. labour market has recouped the number of jobs lost in the depths of the pandemic.5 We acknowledge that a persistently robust labour market could pose a potential risk if it makes inflation stickier than hoped and forces the Fed to hike rates past current expectations.

A Clearer Picture Ahead for Fixed Income Investors

We believe this convergence of the current Fed Funds Rate and the implied terminal rate may be a promising sign for fixed income investors. While daily rates volatility may persist, the reset in fixed income valuations could provide investors with attractive entry points and some protection from any further unexpected rise in rates.

Despite the recent rally in corporate credit, the U.S. investment grade and high yield indices are still yielding 4.5% and 7.4%, respectively, ~214bps and ~301bps more attractive relative to the start of the year.6 Current overall yields may provide opportunity even considering the uncertain macroeconomic outlook. While overall spread levels would likely widen if the major economies were too substantially slow, the current level of risk-free yields may provide some insulation in that eventuality. On the other hand, should economies re-accelerate, current all-in yield levels provide significantly more current income than before the hiking cycle’s onset.

In either case, dispersion among sectors and issuers is providing excellent opportunities for highly active traders to create returns as volatility subsides. This is why we believe that active credit selection will be essential to generate alpha in the coming months. Currently, we prefer investment grade credits, especially those with low duration profiles considering the relatively low amount of compensation the yield and spread curves provide for the greater risk of buying longer-dated bonds.

One area of the bond market that we believe provides opportunity is the primary issue market. For instance, U.S. banks have come to market with sizeable new debt deals post-Q2 earnings. We participated in a 3-year, A rated Bank of America new issue that came to market with a spread of ~160bps and a coupon of 4.8%. We believed this deal offered meaningful relative value (~89bps worth) compared to bonds with similar maturities and ratings.7 This holding has already realized ~16bps of tightening in just over two weeks.8

We believe that this healthier backdrop and the existing yield and capital appreciation opportunities can give investors opportunities that didn’t exist at the beginning of 2022. While we remain data-dependent, we recognize that tail risks appear to be waning, enabling us to grow more comfortable and strategically add credit risk upon weakness.

1 Source: Federal Reserve, Bank of Canada. Data as of Jul. 29th, 2022.

2 Source: Federal Reserve Bank of San Francisco,Goldman Sachs U.S. Financial Conditions Index.

3 Source: Transcript of Chair Jerome Powell’s Press Conference.July 27, 2022.

4 Source: Bureau of Economic Analysis. Data as of Jun. 30th, 2022.

5 Source: Bureau of Labor Statistics. Data as of Jul. 31st, 2022.

6 Source: ICE BofAML. Data as of Aug. 8th, 2022. Indices referenced: ICE BofA U.S. Corporate Index and ICE BofA U.S. High Yield Index.

7 Source: Bloomberg, ICE BofAML. Data as of Jul. 19th, 2022. The credit spread of the 3-year Bank of America bond (BAC 4.83% 07/26c25) is compared to the G-Spread of the ICE BofA 1-3 Year A U.S. Corporate and Yankee Index to highlight its relative cheapness.

8 Source: RPIA. Data as of Aug. 5th, 2022.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should

not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing

it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated,

the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully

offered and to investors who qualify under the applicable regulation. RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. “Forward-Looking” statements

are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future

events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.