The hedging program employed by our portfolios takes a holistic approach to managing risk. The goal of the program is not to remove risk completely since doing so would eliminate the opportunity to generate alpha. Instead, the goal is to first understand the varying risks in the portfolio with precision and then to sell or hedge away those risks for which we do not believe investors are being adequately compensated.

To do so, we continuously monitor and take inventory of the risk parameters in the portfolio. In its simplest form, this involves dissecting the portfolio into its component risk factors and comparing them to portfolio performance in the real world.

Once we understand the risks, the next step is to determine if our investors are being adequately compensated for the cost of bearing them. If we do not believe our portfolio risks are adequately compensated, we will seek to mitigate them. This may involve the use of various hedging instruments, or if we believe the cost of these hedges is prohibitive, may instead involve simply shrinking our portfolio, sticking with our core convictions, and prioritizing positions we believe have the best risk/return tradeoff.

For simplicity’s sake, we can bucket risk into explicit risks and tail risks.

Explicit Risks

Explicit risks, such as interest rate, credit, currency, geography, liquidity, etc., are risks we can “see” and quantify to a certain extent. You may visualize these risks as the tip of the iceberg that is visible above the surface of the water. These types of risks are addressed continuously through day-to-day risk management, which includes fundamental analysis and managing factors such as duration, currency, liquidity, exposure, and concentration.

For instance, to address company- or sector-specific risk, we can enter single-name short positions in vulnerable issuers to offset long exposure to stronger or improving borrowers in the same industry. To address interest rate risk within the portfolio, we can combine long corporate bond positions with short positions in government bonds to isolate the credit spread portion of the potential total return.

Tail Risks

Tail risks or black swan risks, on the other hand, are like the greater portion of the iceberg underneath the surface. They are unknown, unforeseen, or currently unquantifiable. This type of risk requires a different, more generalized, and usually more dynamic approach that is diversified across products and purposes. This overlay is constantly monitored and altered if necessary, depending on what we call the 3 Cs of Hedging: cost, correlation, and convexity.

- Cost: We can always gauge the cost of hedges, given both options and swaps are observable and tradable on a very large scale.

- Correlation: Based on principle assumptions, our risk team helps us continuously gauge, what we think, medium to long-term correlation is, depending on multiple scenarios.

- Convexity: A convex hedge means we are making more money when the market is down than we are losing when the market is equally up.

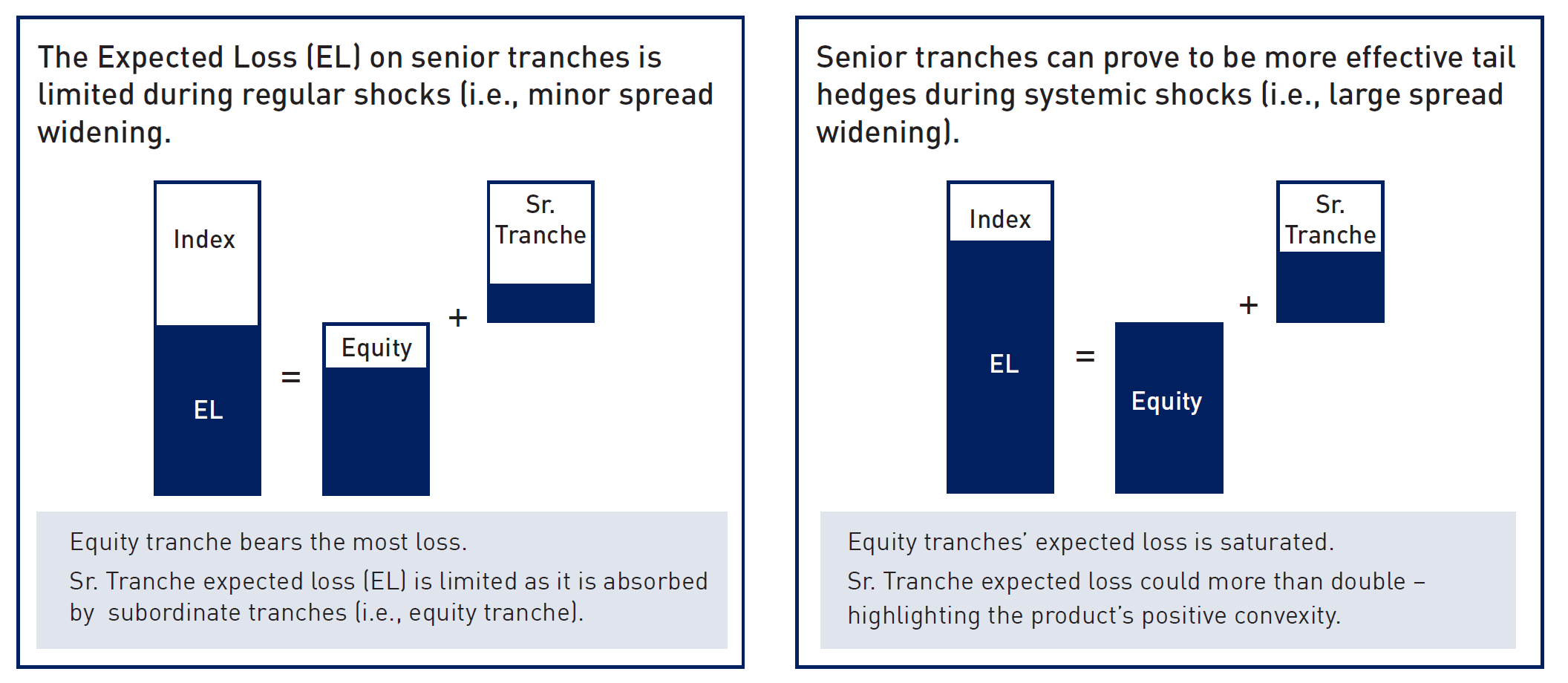

For illustrative purposes only. The expected credit risk of the index is distributed among all tranches (otherwise, arbitrage opportunities would exist). The implied correlation determines the expected loss allocation among tranches. Senior tranches may be more effective than Equity or Index protection per unit of premium spent for tail risk hedging.

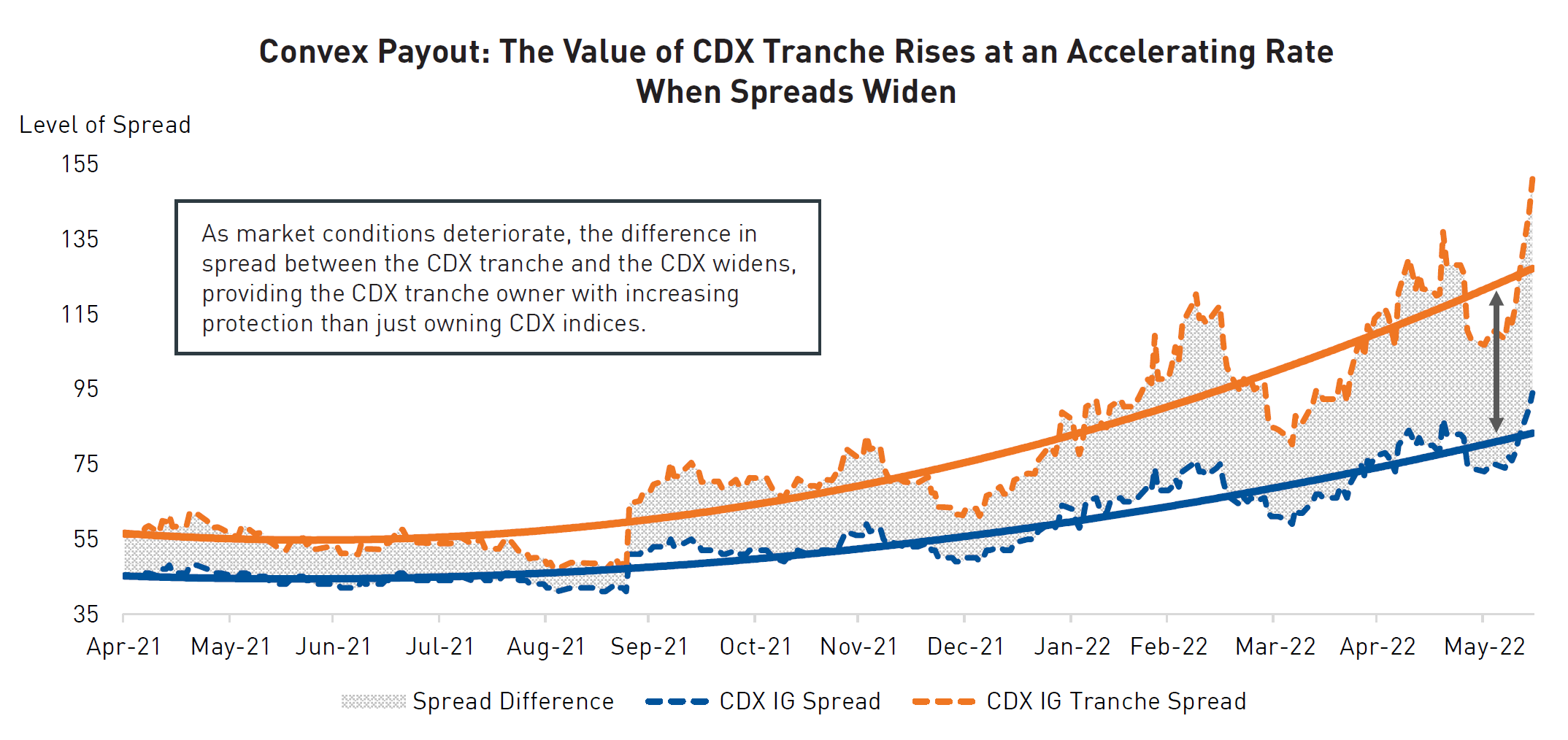

A credit default swap (CDS) provides investors with protection against losses in the event of a borrower’s default, effectively allowing an investor to profit if credit spreads widen. The CDX family of credit default swap indices are portfolios of credit default swaps and are among the most liquid credit products in the world. We used this type of hedge to protect against the market’s sharp sell-off through the end of 2021 and 2022.

Our strategy was to purchase protection on a carefully selected slice of the index, specifically, protection on losses of between 7% and 15% that would provide a convex payout in the event of substantial deterioration in credit spreads. If market conditions deteriorate and spreads widen, the value of our CDX tranche rises at an accelerating rate. In other words, the more spreads widen, the more protection the tranche provides – that is convexity at work.

Source: RPIA, Bloomberg, JPMorgan. Data as of June 14th, 2022.

Source: RPIA, Bloomberg, JPMorgan. Data as of June 14th, 2022.

Final Thoughts

The increased usage and popularity of corporate credit by Canadian investors over the past decade has prompted more asset managers to offer products in this space. But similar to other asset classes, not all managers employ the same style or take the same approach to generating returns.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.