There is no denying that the income is back in fixed income. Accordingly, investors may feel compelled to lock in attractive bond yields by overweighting portfolios to government bonds and money market securities. However, we believe the still uncertain market backdrop calls for a more balanced approach when constructing a bond portfolio.

Low unemployment, a surprisingly strong labour market, and other sticky inflation components may require a “higher for longer” interest rate environment than previously expected. This ongoing uncertainty has led to wild swings in risk-free rates over the past two years and continues to challenge traditional bond strategies’ ability to provide the consistent returns investors grew accustomed to during the previous 40-year bull market.

We argue that investors should not simply accept undue amounts of volatility in their bond portfolios or revert to old habits by relying solely on coupon clipping and falling interest rates for capital appreciation. Instead, we believe that investors can consider using a long-term strategic corporate bond (credit) sleeve within their portfolio to help:

- Reduce volatility

- Enhance returns

- Embed diversification moving forward

Understanding the Risk Factors of Corporate Bonds

The key drivers of corporate bond returns (and risk) include interest rates, credit risk, and liquidity factors. Investors require an all-in yield that sufficiently compensates them for taking on these risks.

- Interest Rate (Duration) Risk is driven by changes in the risk-free rate, which is measured by the yield of a risk-free government bond with the same maturity as a corporate bond.

- Credit Risk is measured by the bond’s credit spread, which is the yield premium over the benchmark risk-free rate that investors require to compensate them for the risk of the issuer not paying back the promised coupons or principal.

- Liquidity Risk is much more difficult to measure, and for simplicity, we will assume that it is largely encompassed within the two factors above from a pricing perspective.

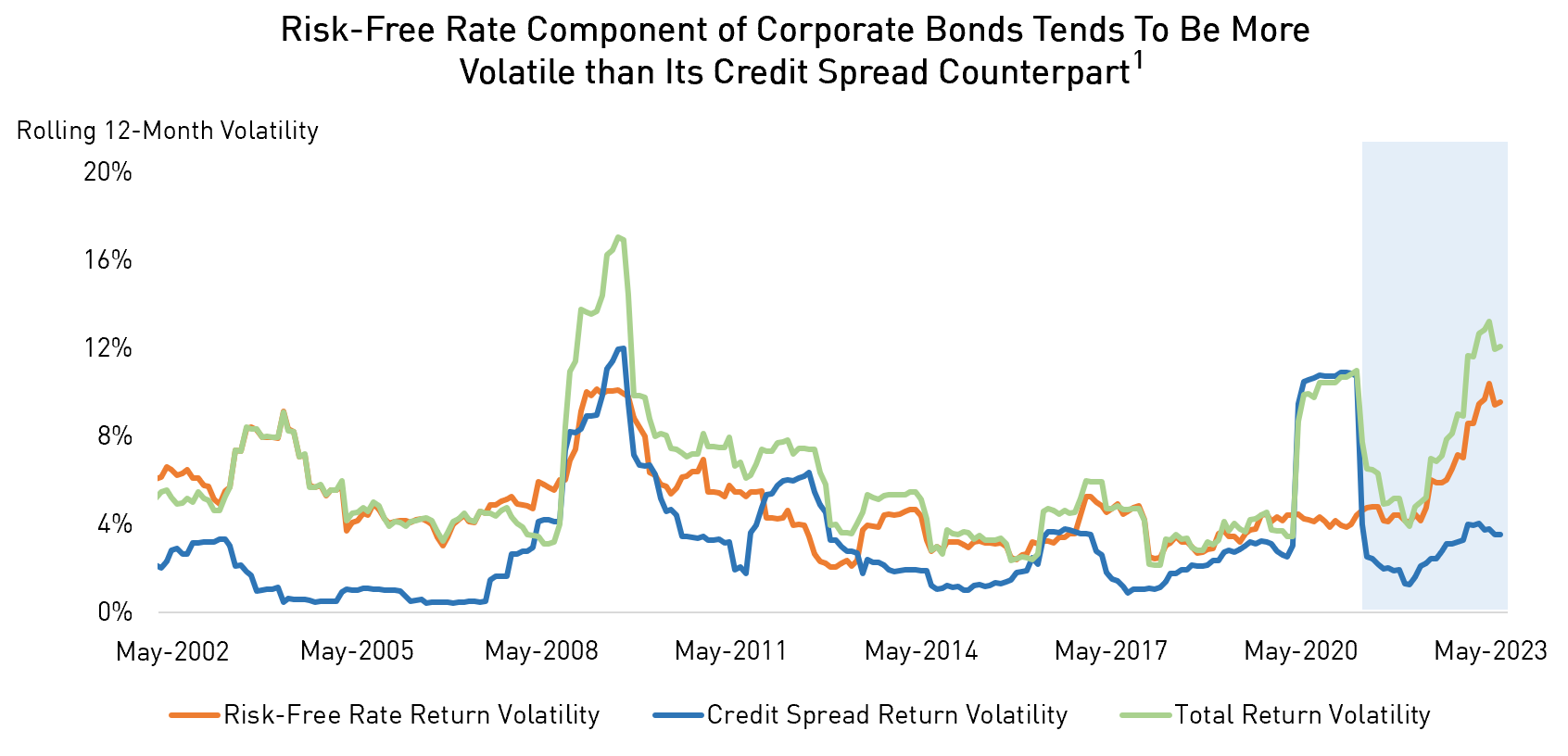

Perhaps unexpectedly to most investors, the “risk-free” component has been notably more volatile than the credit spread portion of a corporate bond over the past 20 years, except during a handful of short-lived periods. While this phenomenon is slightly counterintuitive, it can be especially true during an elevated and uncertain period for inflation expectations.

Source: Bloomberg. Data as of May 31st, 2023.

Enhancing and Diversifying the Return Drivers of Bonds

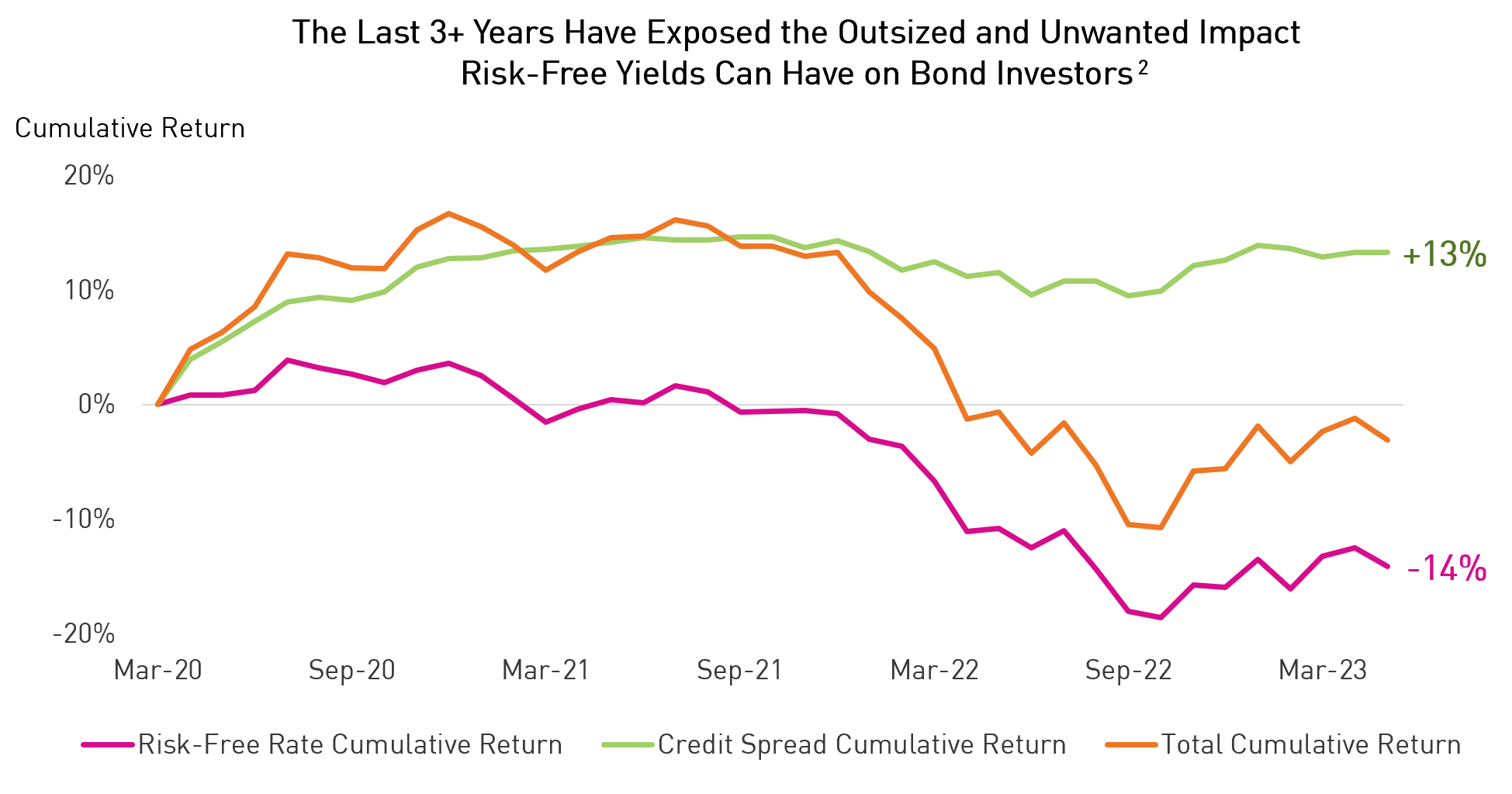

Many investors dismissed the elevated volatility of interest rates for decades, which was understandable considering the predominant trend of falling rates acted as a tailwind for returns. However, elevated inflation, higher rates, and an uncertain monetary backdrop have exposed the potential pitfalls of relying solely on interest rate exposure as a primary return driver of bond portfolios.

Bond managers with the capability of actively managing and minimizing returns from undue interest rate risk (pink line) and prioritizing returns from changes in credit spreads (green line) have provided significant outperformance relative to traditional fixed income allocations over the past three years.

Source: Bloomberg. Data as of May 31st, 2023.

To clarify, we are not advocating for eliminating interest rate risk (duration) in a portfolio. Duration has an essential role as a yield generator and a hedge against a traditional slowing in the economy. However, it is important to note that many investors’ traditional bond and equity portfolios already carry outsized amounts of interest rate exposure, particularly when you include their personal residences.

Predicting the future path of interest rates is a difficult task, to say the least – even the policymakers responsible for setting the course of yields have struggled mightily with this task. Consequently, traditional bond strategies that rely on interest rates as their primary return generator may not play the diversifier role that investors expect. In contrast, a credit-focused strategy has provided diversification and can continue to do so.

Final Thoughts

We believe an active manager with a proven track record of credit expertise can help investors reduce their reliance on volatile interest rate exposure. Furthermore, utilizing a corporate credit sleeve in a fixed income allocation can introduce a more measurable source of risk (credit spread exposure), a more repeatable source of alpha generation, and a truer form of diversification.

Please feel free to contact us if you would like to learn more about how actively managed credit strategies can complement your investment portfolios.

1 For illustrative purposes only. Return Volatility is calculated using monthly returns during the period ranging from 05/2002 to 05/2023. Risk-Free Rate Return Volatility = 12-month rolling volatility of the monthly Duration-Neutral Treasury component of the Bloomberg Global Aggregate Corporate Bond Index. Credit Spread Return Volatility = 12-month rolling volatility of the monthly Excess Returns component of the Bloomberg Global Aggregate Corporate Bond Index.

2 For illustrative purposes only. Cumulative Return calculated using monthly returns during the period ranging from 04/2020 to 05/2023. Risk-Free Rate Cumulative Return = cumulative return of the Duration-Neutral Treasury component of the Bloomberg Global Aggregate Corporate Bond Index. Credit Spread Cumulative Return = cumulative monthly return of the monthly Excess Returns component of the Bloomberg Global Aggregate Corporate Bond Index.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation. RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated. “Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.