Key Takeaways

- P&C firms face more complex investment decisions than most institutions due to regulatory capital guidelines, but now must re-evaluate their investment playbook in the context of today’s market volatility and weaker macroeconomic outlook.

- Based on the three P&C investment dimensions: return, risk, and capital charge, we believe P&C insurers can benefit from the relative opportunity in high-quality Active Credit, providing a better risk-reward profile.

The "Reach for Yield" Era is Over

Property and Casualty (P&C) insurance firms have unique requirements when it comes to investing. They want to generate a reasonable return on the pool of premiums collected from their clients but without taking undue risk. Furthermore, P&C insurers face more complex investment decisions than many other institutions, due to the strict regulatory capital guidelines (Minimum Capital Test or MCT) imposed by the Office of the Superintendent of Financial Institutions (OFSI). Given the nature and term of P&C liabilities, the regulator presides over a framework that incentivizes P&C firms to lean toward high-quality short- and medium-term fixed income investments.

Over the previous decade or so, investors found themselves in an environment of low and stable interest rates and an improving economy. P&C firms, like many other types of investors, took more risk in their fixed income portfolios in a search for additional yield. At one end of the spectrum, this was manifested by firms substituting government bonds with corporate bonds or Core Plus strategies. For more aggressive firms, this often took the form of allocating to high yield bonds, preferred shares, or equities.

Today’s market environment, with a weaker macroeconomic outlook and more volatility, looks completely different to even 18 months ago. Investors face new challenges as central banks aim to tame inflation without causing too much economic damage. We believe the investment playbook that worked over the last decade or so (“the reach for yield”) won’t best serve investors in the period ahead. It’s time to take a fresh look at the investment landscape.

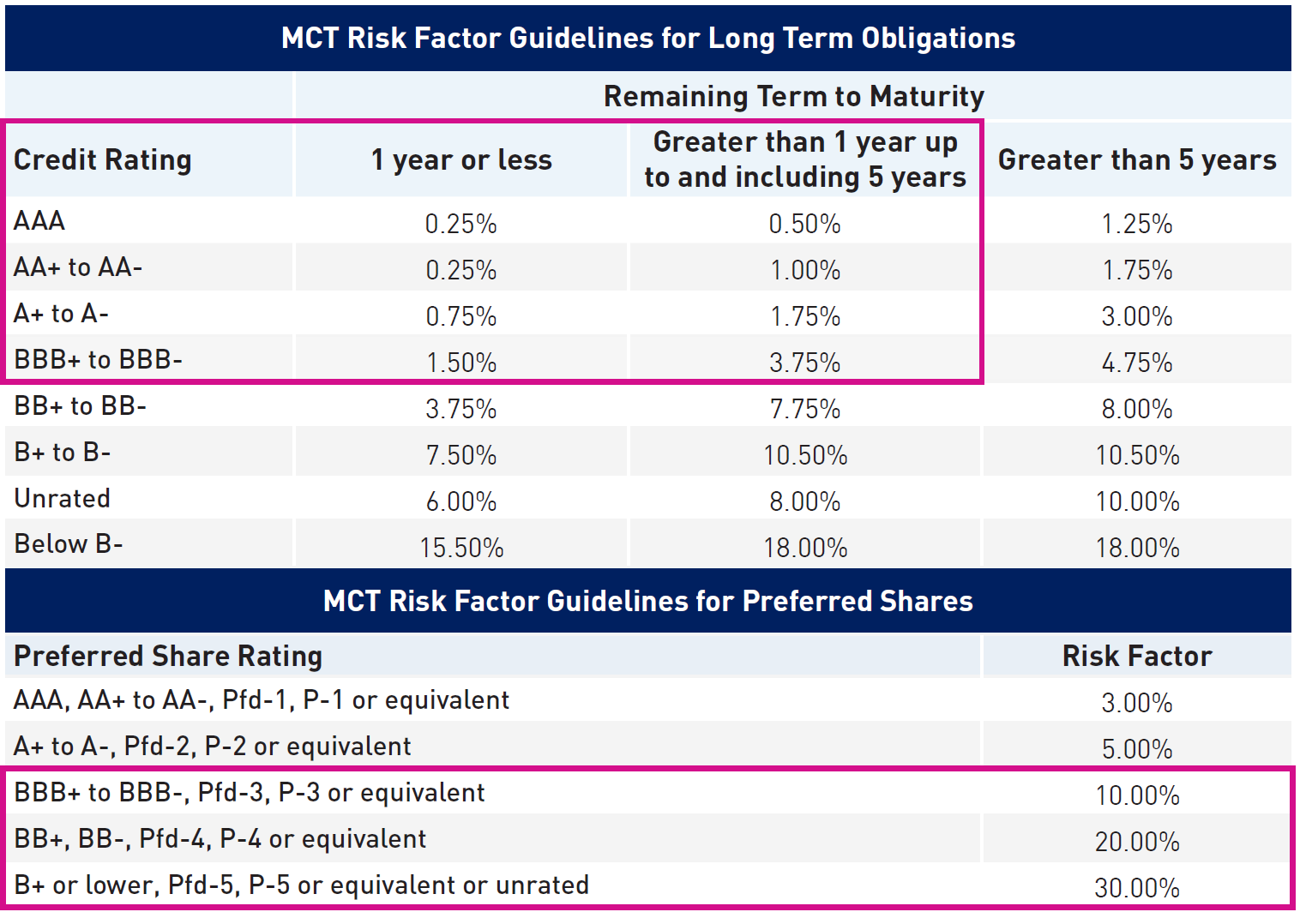

The Charge on Credit Risk

From a Credit Risk perspective, OSFI “charges” P&C firms (by imposing a capital charge) based on the credit rating and remaining term to maturity of bonds, making shorter-dated investment grade securities more attractive to insurers.

Source: OFSI.

Too Much Risk, Not Enough Reward

When thinking about their target asset mix, we believe P&C firms generally perform “traditional” risk-return analysis alongside considerations of capital regulations to form their optimal mix. This is where there’s good news for P&C firms.

The dramatic increase in yields over the last year or so means the attractiveness of high-quality fixed income has increased significantly. There is no longer any need to reach for yield as it is readily available without needing to add additional risk to the portfolio. Moreover, we believe the outlook for high yield bonds, preferred shares, and equities has deteriorated over the last year, with more macroeconomic concerns on the horizon without the cushion of attractive valuations. For these reasons, we believe the optimal portfolio for P&C firms today should contain more high-quality fixed income compared to a year or two ago.

The Return Potential in Active Credit

We believe that P&C firms looking to increase their allocation to high quality fixed income should focus their attention on investment grade corporate bonds. Compared to other asset classes, Active Credit is relatively “cheap” for P&C insurers to hold, especially when factoring in the capital charge. Today’s volatile market environment is challenging enough for many investors just using traditional risk-return analysis, and adding this capital treatment layer further complicates how efficiently a P&C investor can allocate to different asset classes.

Within fixed income, focusing on investment grade-only markets can help minimize that capital drag. Over the medium- to long-term, corporate bonds can provide investors with increased yield and return with only a modest increase in risk1. Credit spreads today are slightly “cheaper” compared to the 10-year average in both the US and Canada.

When actively managed strategies are used in conjunction with the extra yield from assuming some credit risk, additional returns are possible. These returns typically come from security selection and tactically adjusting the positioning of the portfolio over time. An experienced active credit manager, like RPIA, can realize the return potential in this asset class through expertise in effectively managing risks and volatility and experience successfully navigating many different market conditions over the years.

Optimizing Your Asset Allocation Mix

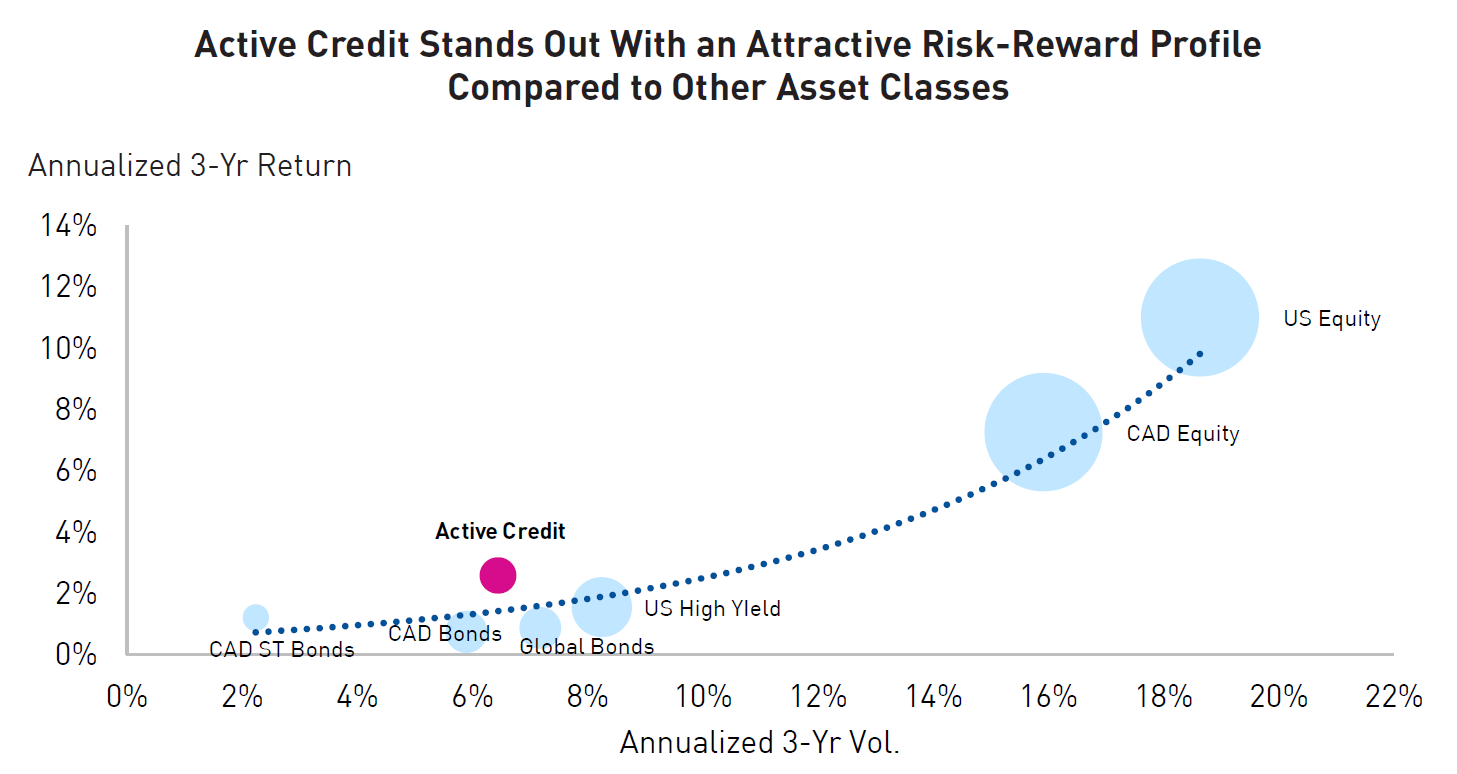

In the following chart, we plot the efficient frontier faced by P&C firms, comparing asset classes based on the three P&C investment dimensions: return, volatility (risk), and capital charge.

- Return from the asset class (along the y-axis)

- Volatility or risk of the asset class (along the x-axis)

- Relative amount of set-aside Capital required for owning that asset class (size of each bubble)

The chart highlights that more return typically comes with more risk and a higher capital charge.

Source: RPIA, Bloomberg, FTSE TMX Debt Capital Markets, OFSI 2023. Capital treatment based on 2023 MCT Guidelines credit risk factors. Interest rate risk factors assume 2-yr duration for liabilities and include the 1.25% MCT interest rate shock. See disclaimer for more information. All data is as of May 31, 2023.

When combining normal risk measures with MCT-specific considerations, we see a powerful case for active credit, and we believe now is the ideal time and market environment to allocate to fixed income. The above chart aptly illustrates how Active Credit can provide returns without taking on too much risk, all while being MCT-efficient.

As P&C insurers face headwinds on both a risk and regulatory front, we believe there are opportunities to optimize their fixed income allocation while still maintaining MCT efficiency. An experienced active credit manager has the ability to manage both duration risk and credit risk while being opportunistic in security selection within the high-quality investment grade universe for a better risk-reward profile.

1 The historic average cumulative default rate for 1-yr investment grade corporate bonds in North America has been 0.09%. Source: S&P Global Ratings Research, S&P Global Market Intelligence CreditPro. Data from 1981-2020.

Important Information

All analysis is based on Office of the Superintendent of Financial Institutions (“OSFI”) – 2023 ‘Minimum Capital Test for Federally Regulated Property and Casualty Insurance Companies’ Guideline. Relative capital impact of each asset class is based on prescribed credit, equity and interest rate risk factors within the guidelines applied across constituents of each index. All data is as of May 31, 2023.

The indices and funds used to represent each asset class are listed below:

- Active Credit: RP Strategic Income Plus Fund

- CAD ST Bonds: FTSE TMX Canada Short Term Bond Index

- CAD Bonds: FTSE TMX Canada Universe Bond Index

- Global Bonds: Bloomberg Barclays Global Aggregate Index

- US High Yield: Bloomberg Barclays U.S. High Yield Index

- CAD Equity: S&P/TSX Composite Index

- US Equity: S&P 500 Index

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation. RPIA managed strategies and funds carry the risk of financial loss. Performance is not guaranteed and past performance may not be repeated.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.