Overview

For the past two years, the unprecedented speed of rate hikes and tumbling bond valuations have caused investors to look for better options for cash and short-term fixed income. GICs have emerged as a “go-to” allocation as they offer attractive yields and, more importantly, capital preservation, especially important after 2022 when bonds experienced significant capital losses. Looking forward, as we go into an inflation-moderating environment, investors should consider looking beyond GICs and pivot back to bonds, which can be expected to outperform both in terms of all in yields and provide capital preservation and portfolio diversification.

5 Key Reasons to Redeploy Capital into Bonds

- Active bonds have greater return potential than GICs

- GICs bear potential reinvestment risk in a falling-rate environment

- Looking beyond the recency bias

- Tax efficiencies for non-registered accounts

- Superior liquidity of bonds

1. Active Bond Strategies Have Greater Return Potential Than GICs

As the market approaches the end of the Fed rate hike cycle, the potential opportunity cost of choosing GICs over short-dated bonds grows. This shift is driven by the expectation that bonds will stabilize and once again embrace their customary role of enhancing portfolio diversification, all the while delivering greater long-term returns compared to GICs. This expectation stems from the inverse relationship between bond yields and prices, which had led many bonds to trade at a discount during the rate-hike cycle, enabling bond investors to benefit from both coupon payments and capital appreciation from the pull-to-par effect.

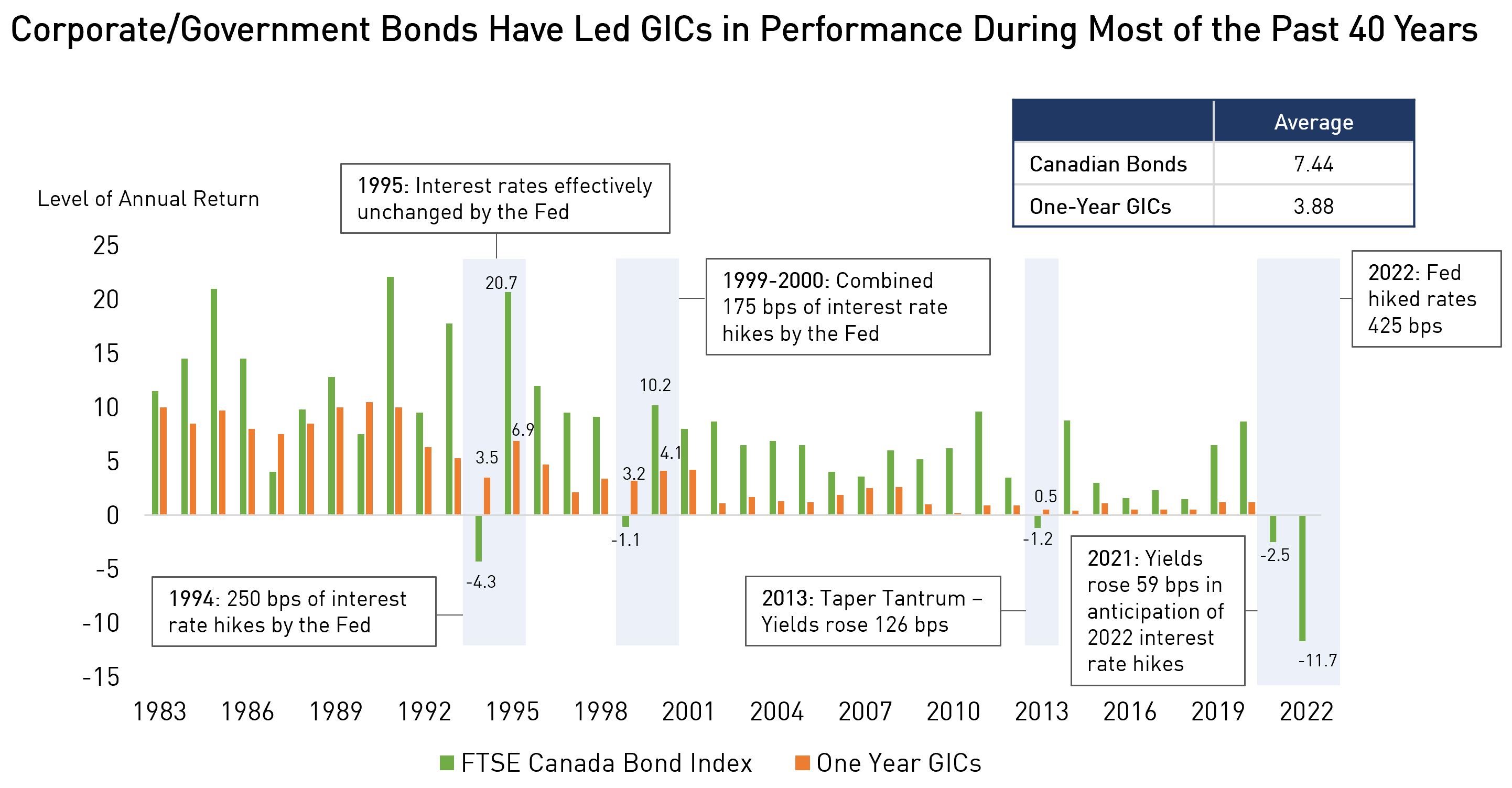

Over the past 40 years, bond returns have exceeded those of one-year GICs in 33 out of 40 years; in other words, 83% of the time. Historical data also demonstrates that following periods of interest rate hikes that led to losses, bond returns have experienced a recovery in subsequent years – most notably in 1995, 2000, and 2014, when the FTSE Canada Bond Index generated more than twice the return as one-year GICs.

Source: FTSE, Fidelity. Data as of December 31, 2022. One-year GICs performance is estimated using the GIC rate offered by major banks in the previous year-end.

2. GICs Bear Potential Reinvestment Risk in a Falling-Rate Environment

Reinvestment risk is the possibility of an overall lower rate of return if the cash flows from maturing GICs cannot be reinvested at the prevailing rate. As the market experiences faster-than-expected inflation cooling, we anticipate that declining interest rates can pose a risk for GIC investors, who may potentially face lower GIC yields when it is time to reinvest their cash flows.

Bond investors will not be facing the same reinvestment risk as GIC investors due to their differing maturity and interest payment profiles. GICs are fixed-term investments that typically have a short maturity, often one year. On the maturity date, the investor receives their initial principal along with the accumulated interest payments. In a falling rate environment, these investors face the risk of not being able to reinvest their matured cash flows in a return-advantageous manner.

Bonds, on the other hand, have varying maturities with regular coupon payments throughout their life. The continuous stream of coupon payments allows bondholders to gradually reinvest their funds, potentially mitigating the impact of reinvestment risk in a falling rate environment. Furthermore, as interest rates decline, bond prices tend to increase, creating the opportunity for capital appreciation if the investor decides to sell the bond.

3. Looking Past Recency Bias

Investors often exhibit a cognitive bias known as recency bias, which involves basing future expected performance on recent performance, whether positive or negative. In this context, investors may be expecting the negative returns in bonds and the current relative attractiveness of GICs to persist. However, it is important to note that such unconventional economic conditions characterized by high inflation and rapid rate hikes are unlikely to continue in the years to come. As central banks slow down quantitative tightening pressures, we believe markets may see bond returns outperform GICs once again.

4. Bonds Have Tax Efficiencies for Non-Registered Accounts

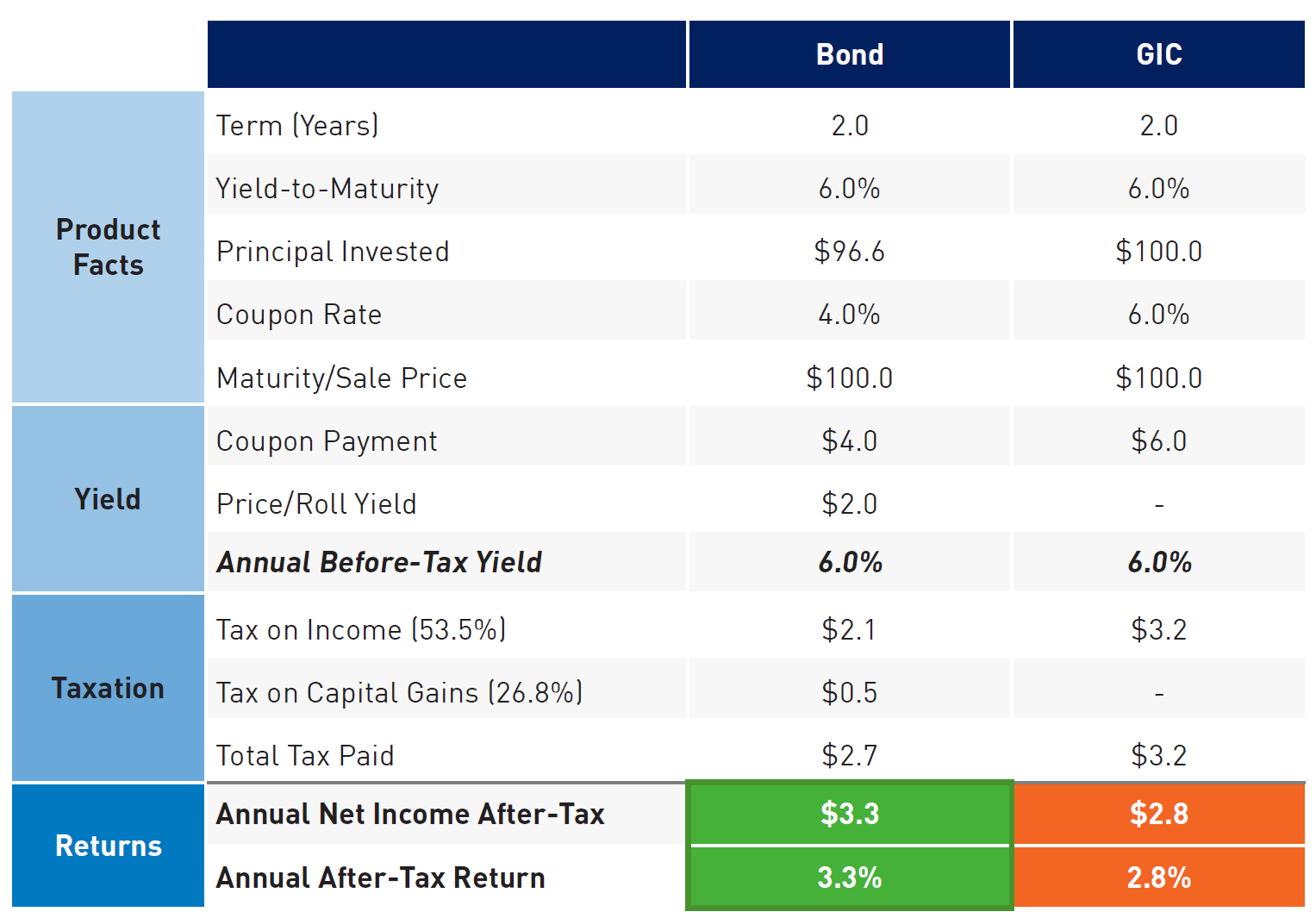

GIC returns are sourced 100% from coupon payments, which are taxed in non-registered accounts at the investor’s full marginal tax rate. Total returns for bonds include coupon payments as well as capital appreciation. The capital appreciation of the bond is taxed at only 50% of the investor’s marginal tax rate, which makes bonds a more tax-efficient investment for non-registered accounts. The sample comparison below illustrates the relative tax efficiency of bonds.

For illustrative purposes only.

5. Bonds are More Liquid than GICs

Locked-in GICs have significant penalties for early withdrawal, whereas actively managed corporate bonds can be withdrawn within two days of trading. Given the mixed macroeconomic data, markets will likely continue to be riddled with uncertainty. Investors may benefit from being able to quickly rebalance their portfolios using the funding from bond allocations, which would have been difficult had the capital been locked in non-redeemable GICs.

Closing Thoughts

Over the past two years, substantial rate hikes have led investors to favour GICs over bond portfolios due to declining bond valuations. GICs have served as a transitional asset allocation, offering higher yields against the backdrop of tumbling bond valuations. As inflation moderates, bond valuations are expected to stabilize and appreciate and reclaim their usual roles of portfolio diversification, capital preservation, and higher long-term returns.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.